In the summertime of 2021, the Chinese language authorities banned Bitcoin (BTC) mining and cited the everyday considerations of dangerous environmental results and cash laundering. Now, the Chinese language authorities is working towards establishing its personal digital yuan forex. This raises the query as as to whether the unique reasoning was merely a Computer virus.

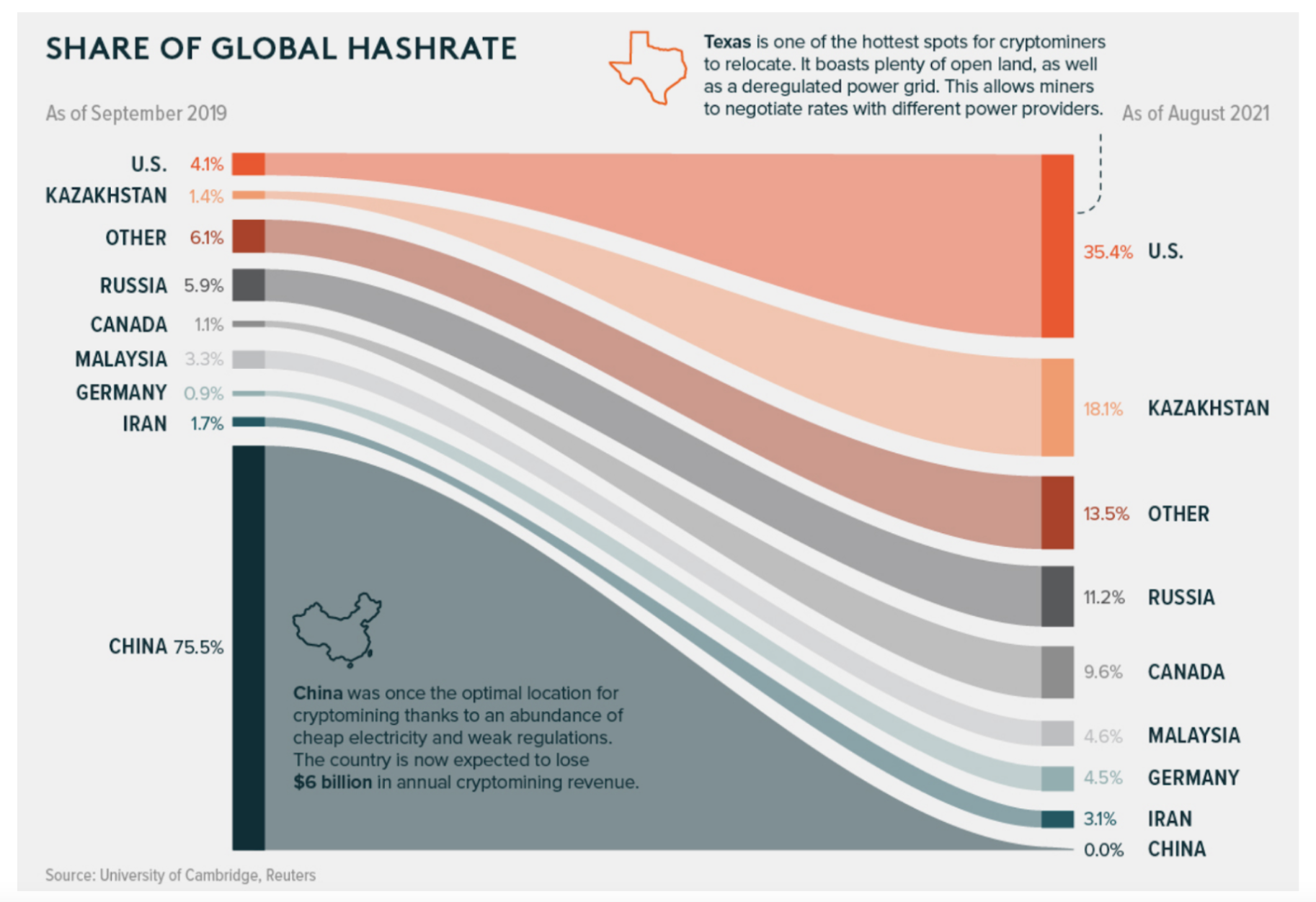

This ban might simply have been an enormous blow to Bitcoin’s momentum. In any case, near 75% of all Bitcoin mining had been performed in China by late 2019, based on Cambridge Different Finance Benchmarks. If the community teetered underneath the burden of China’s nationwide ban, different governments might need begun to suppose that Bitcoin may very well be defeated in spite of everything.

China’s ban was Bitcoin’s stress take a look at

For a short interval, the ban labored as supposed — by the top of June 2021, the Bitcoin community’s hash price had dropped to 57.47 exahashes per second (EH/s), down by a number of multiples. Nonetheless, the hash price rebounded to 193.64 EH/s by December 2021 and by February 2022, it reached an all-time excessive of 248.11 EH/s.

All the ordeal was a take a look at that Bitcoin handed with flying colours: Banning Bitcoin mining proved as efficient because the Prohibition period was at killing consuming tradition in the US.

In early 2022, the plain rationalization for the hash price restoration was that miners who had arrange store in China had merely fled to the Western Hemisphere. There was loads of proof that appeared to help this speculation — primarily that the US’ share of the worldwide hash price exploded from 4.1% in late 2019 to 35.4% in August 2021.

The ban created a decentralized black market

Nonetheless, the so-called “nice migration” might not have been the one unintended consequence of China’s ban. As of Might 2022, miners in China accounted for 22% of the worldwide hash price — a determine that’s not as dominant as earlier than, however no small slice of the pie, both.

Because the Cambridge Centre for Different Finance stories:

“It’s possible {that a} non-trivial share of Chinese language miners shortly tailored to the brand new circumstances and continued working covertly whereas hiding their tracks utilizing overseas proxy providers to deflect consideration and scrutiny.”

Certainly, it’s possible that there’s now a large black market of Bitcoin mining in China.

Strive as they could, one of the crucial authoritarian regimes on the planet can not stop its residents from mining Bitcoin. In financial phrases, the potential advantages to the China-based miners outweigh the prices related to getting caught red-handed.

Regardless of the priority and skepticism that “consultants” broadcast about Bitcoin, miners in China worth the exercise a lot that they’re prepared to danger breaking the regulation to get their arms on the long run world reserve asset.

Worldwide competitors for miners rises

Regardless of China’s black market surge, there isn’t any doubt that the US’ financial system benefited from China’s ban. Simply outdoors Kearney, Nebraska, an organization referred to as Compute North runs one of many United States’ largest information facilities for cryptocurrency mining. Across the time of China’s ban, the corporate obtained a deluge of calls from operations that have been attempting to maneuver their mining tools from China into the US.

Compute North welcomed its new companions with open arms. “We doubled in dimension,” said their lead technician. “We have been busy nonstop for the entire summer time. […] And there’s simply persevering with increasingly more demand on a regular basis.”

Different cities, resembling Rockdale, Texas, and Massena, New York, are additionally witnessing progress of their cryptocurrency mining ecosystems.

All of this migration might trigger a vicious cycle for China and a virtuous cycle for the US, which signifies that all kinds of different Bitcoin-related alternatives shift from China to the US as nicely. Lamont Black, finance professor at DePaul College, believes that the latest inflow of Bitcoin mining into America might bolster the nation’s broader blockchain financial system.

And that logic works each methods — to the extent that Bitcoin miners are leaving China, then ancillary Bitcoin actions will journey together with them.

Though fleeing miners thought of nations apart from the US, evidently miners want America due to its comparatively sturdy respect for property rights. One miner migrating from China stated, “Possibly the governments [of countries such as Russia or Kazakhstan] aren’t solely shutting down the operation, however additionally they take […] all of your machines. You may lose all the pieces, so the US is a secure alternative.”

The takeaway for world governments

This black market phenomenon ought to be a lesson to Western politicians: If the Chinese language authorities can’t ban Bitcoin mining out of existence, neither are you able to.

As the US forges forward in finding out the regulatory implications of the trade, conventional monetary establishments are carefully monitoring its actions. Retail and institutional buyers are additionally paying shut consideration to the market swings as they battle inflation at dwelling. At this level, attempting to place the toothpaste again within the tube is nothing however a waste of power. Bitcoin mining isn’t going away.

The US and different world leaders should study from the errors of others in order that they don’t should repeat them. China wasted its efforts in order that others don’t should.

Disclaimer. Cointelegraph doesn’t endorse any content material of product on this web page. Whereas we intention at offering you all essential info that we might receive, readers ought to do their very own analysis earlier than taking any actions associated to the corporate and carry full accountability for his or her selections, nor this text could be thought of as an funding recommendation.

William Szamosszegi is the CEO and founding father of Sazmining, the world’s first clear power Bitcoin mining platform for retail clients. He’s additionally the host of the Sazmining podcast and as a Bitcoin evangelist, Will is dedicated to enhancing humanity’s relationship with time, cash and power. Will is the recipient of Bucknell’s enterprise grant, a finalist in SXSW’s Digital Entrepreneurship Match, a Forbes Fellow and an everyday speaker at Bitcoin mining conferences.