Bitcoin (BTC) heads into the primary week of September on a rocky street downhill after United States markets’ Jackson Gap rout.

After the U.S. Federal Reserve strengthened hawkish feedback on the inflation outlook, threat belongings bought off throughout the board, and crypto remains to be reeling from the aftermath.

A reasonably nonvolatile weekend did little to enhance the temper, and BTC value motion has returned to give attention to areas under $20,000.

In so doing, a number of weeks of upside have successfully disappeared, and in flip, merchants and analysts count on a retest of the macro lows seen in June this yr.

Whereas all is now quiet concerning the Fed till the September fee hike resolution, there may be nonetheless loads of room for upset as geopolitical uncertainty and inflation persist, the latter nonetheless growing in Europe.

Nevertheless, as of final week, Bitcoin seems basically resilient as a community, with on-chain knowledge telling a distinct story to cost charts.

Cointelegraph takes a take a look at 5 components to think about when questioning the place BTC/USD could head within the coming days.

Spot value triggers $18,000 goal

Information from Cointelegraph Markets Professional and TradingView confirms no surprises for guessing what occurred to BTC/USD into the most recent weekly shut.

After a relatively uneventful weekend buying and selling interval, the pair bought off significantly on the finish of Aug. 28, ensuing within the lowest weekly shut since early July.

A $2,000 purple weekly candle thus sealed a depressing August for the bulls, this following an preliminary $3,000 of losses the week prior.

With days till the month-to-month candle completes, the temper amongst analysts was understandably lower than optimistic within the quick time period.

“Hoping we are able to see a restoration this week however the best way equities closed Friday does not look so sizzling,” dealer Josh Rager summarized to Twitter followers in a part of a weekend replace.

Standard buying and selling account Il Capo of Crypto nonetheless eyed the likelihood for a short squeeze to the upside earlier than continuation of the downtrend.

Noting destructive funding charges implying derivatives market bias in direction of straight losses, he predicted that $23,000 may reappear first.

“Rather more folks anticipating 19k than these anticipating 23k. Funding says all of it. Additionally, there’s loads of juicy liquidity above 21k. Squeeze these shorts,” he tweeted.

Responding, dealer Mark Cullen noted that merchants had been “including extra BTC shorts within the space between 20.1 and 20.3k.”

“There’s a good inefficiency above there and one other at round 20.9-21.1k. If it could break up it is prone to be a quick transfer larger,” he added.

Amid varied requires $17,000 or decrease, technical analyst Gert van Lagen gave a $17,500 ground goal for the every day chart.

$BTC[1D]

White C-wave situation I confirmed final Monday performed out like clockwork. Double check of inexperienced field on every day.

C-wave seems last, time to bounce

Invalidation: 17.5k#BullMarket #Bitcoin https://t.co/acs6bFEl66 pic.twitter.com/DkhXmp3GDc

— Gert van Lagen (@GertvanLagen) August 28, 2022

In a barely much less cautious outlook, TMV Crypto, in the meantime, flagged $18,400 as a high-timeframe space of curiosity.

Merchants put together for additional U.S. shares declines

Final week’s bombshell of a speech by Fed Chair Jerome Powell despatched shockwaves by threat belongings worldwide.

In response to one tally, Powell’s eight-minute tackle wiped over $2 trillion from international shares, together with $1.25 trillion within the U.S. alone.

#Fed‘s Powell has destroyed ~$2tn in international inventory market cap together with his 8-minute “Till the Job Is Finished” Jackson Gap speech, makes $4.2bn loss per second. pic.twitter.com/05YE5yG693

— Holger Zschaepitz (@Schuldensuehner) August 28, 2022

“Sooner or later, because the stance of financial coverage tightens additional, it probably will change into applicable to sluggish the tempo of will increase,” Powell said:

“Restoring value stability will probably require sustaining a restrictive coverage stance for a while. The historic document cautions strongly towards prematurely loosening coverage.”

Bitcoin and altcoins alike felt the squeeze, with Aug. 29 set to be one thing of a make or break Wall Road buying and selling session.

Speaking on Bloomberg Tv, Paul Christopher, head of worldwide market technique at Wells Fargo Funding Institute, warned that U.S. shares would fall additional, with the S&P 500 due for a visit under 4,000 subsequent.

On the flipside, crypto-focused Recreation of Trades argued that peak inflation from July had already signaled a macro low in shares.

As soon as once more the height in inflation has referred to as the underside is shares for now.

Let’s watch to see if this continues to play out. pic.twitter.com/HE2KfrjMVL

— Recreation of Trades (@GameofTrades_) August 28, 2022

Flagging cumulative knowledge for the S&P, Recreation of Trades continued to argue that every one was in reality not as dangerous because it appeared.

“SP500 is displaying A LOT of underlying power,” accompanying feedback from the weekend read:

“The cumulative advance/decline line speaks to the underlying power out there, which many buyers are failing to note. Regardless of the SP500 being double digits away from the ATH, the indicator has entered new highs.”

Even a drop to three,900, one other perception stated, would protect a “bullish formation.”

U.S. greenback targets September 2002 ranges

A key accompaniment to upheaval in equities stays the power of the U.S. greenback this week.

At the time of writing on Aug. 29, those highs are still playing out, DXY having hit 109.47 in its highest spike since September 2002.

“If the dollar keeps going, it’s going to really break things. It has literally done parabolic,” Raoul Pal, founder of Global Macro Investor, responded, warning that there was “actually nothing till 120” by way of resistance on the DXY chart.

Cointelegraph contributor Michaël van de Poppe was equally alarmed, together with DXY as an element making a “second of fact for the whole crypto market.”

Second of fact arising for the whole #crypto market.

Dealing with one other check of the 200-Week MA, which in the end may result in a HL and retest.

Sentiment is on an final low.$DXY must reverse or prime out quickly, although. pic.twitter.com/qlvutKi9QG

— Michaël van de Poppe (@CryptoMichNL) August 29, 2022

The greenback’s surge likewise spelled ache for main fiat currencies, notably the euro, which swiftly headed again under parity with the dollar into Aug. 29.

The European Central Financial institution, together with the Financial institution of Japan, has been reluctant to instigate the identical invoice of fee hikes because the Fed, resulting in inflation persevering with to climb over the summer season.

MVRV-Z rating retreats into the inexperienced

Heading again into its “purchase” zone is a basic Bitcoin power indicator which has caught macro bottoms all through Bitcoin’s lifespan.

The MVRV-Z rating indicator, which started to prepare analysts for a value backside in July, is now falling once more, hitting its lowest in a month.

MVRV-Z makes use of market cap and realized value to find out how shut BTC/USD is to its “honest worth.”

As Cointelegraph reported, realized price — the average at which the BTC supply last moved — now sits at around $21,600, data from on-chain analytics firm Glassnode confirmed.

“Excessive concern” makes a comeback

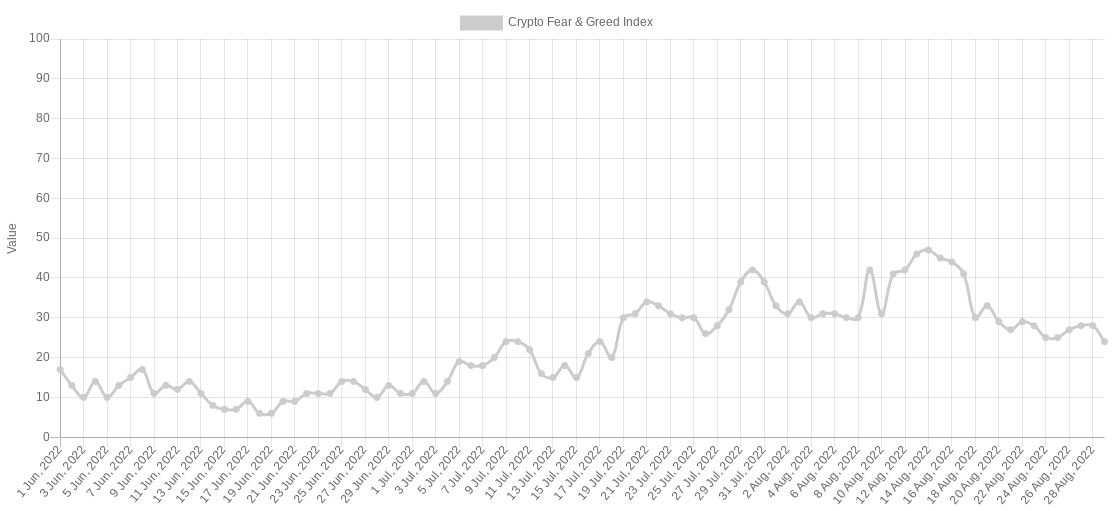

Maybe unsurprisingly, Bitcoin heading again under $20,000 has precipitated its key market sentiment gauge to return to its most bearish class.

Associated: Bitcoin mining issue set for 8-month document beneficial properties regardless of BTC value dip

As of Aug. 29, the Crypto Fear & Greed Index is again in “excessive concern” territory at 24/100.

Having reached as excessive as 47/100 in the course of the reduction rally, the Index now resides within the bracket which has characterised a number of months of 2022.

This yr even noticed its longest-ever spell in “excessive concern,” together with lows of simply 6/100 as an total market sentiment rating.

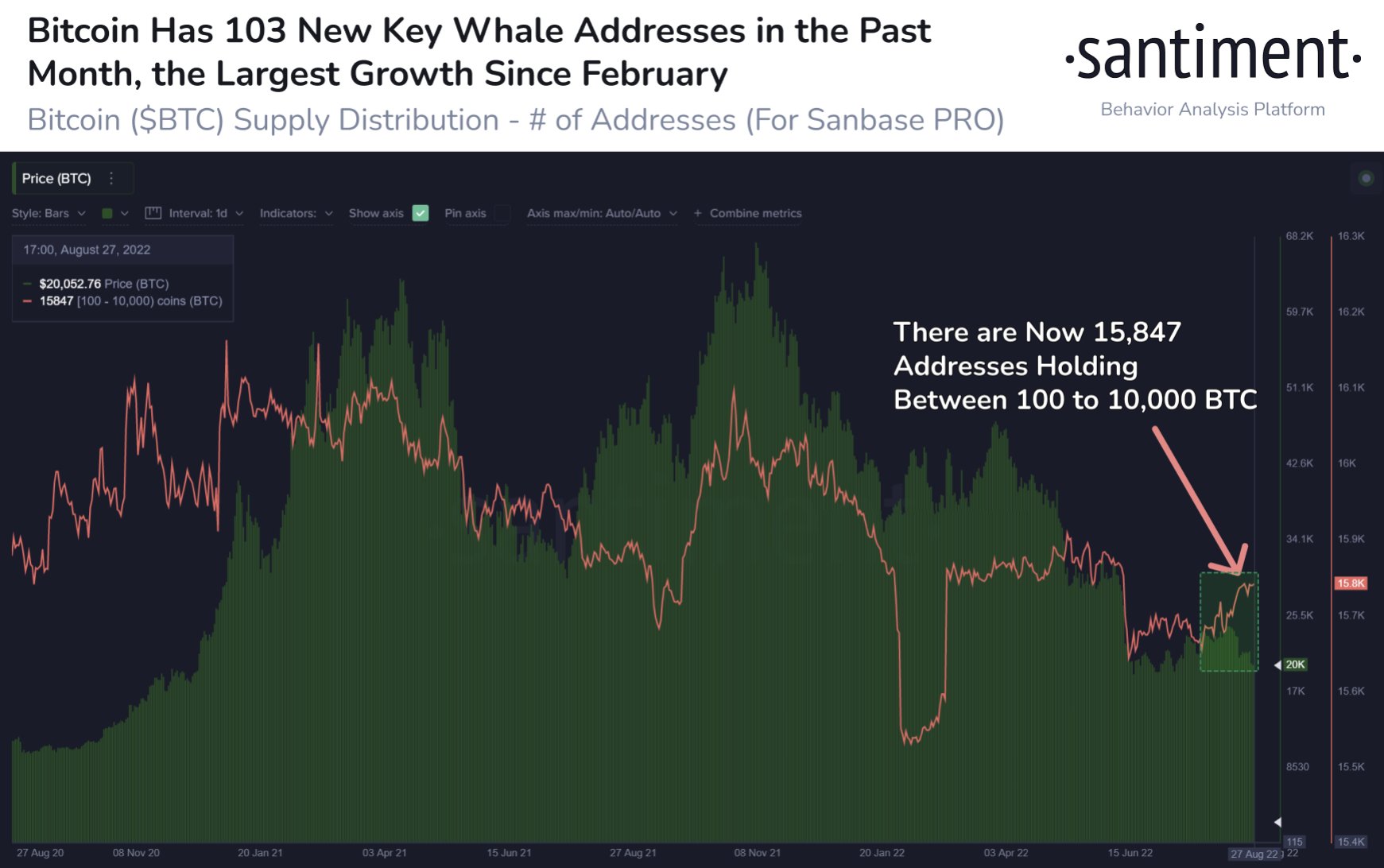

Analyzing the temper throughout buyers, nonetheless, on-chain analysis agency Santiment famous that large-volume buyers had been including to their holdings quite than divesting.

“As Bitcoin has danced round $20,000 this weekend, a optimistic signal is the expansion within the quantity of key whale addresses,” it commented on a chart for August:

“There is a correlation between $BTC’s value & the quantity of addresses holding 100 to 10k $BTC, and so they’re up 103 previously 30 days.”

Nonetheless, others felt that there was nonetheless some solution to go earlier than a real macro turning level was reached in crypto demand.

“The true generational entry isn’t just when individuals are afraid to purchase, however after they’re too broke to purchase,” on-chain analytics agency Materials Indicators acknowledged:

“Not there but.”

The views and opinions expressed listed here are solely these of the writer and don’t essentially replicate the views of Cointelegraph.com. Each funding and buying and selling transfer includes threat, you need to conduct your personal analysis when making a choice.