OpenSea, the world’s largest nonfungible token (NFT) market, has witnessed a considerable drop in each day volumes as fears a few potential market bubble develop.

OpenSea quantity plummets to yearly lows

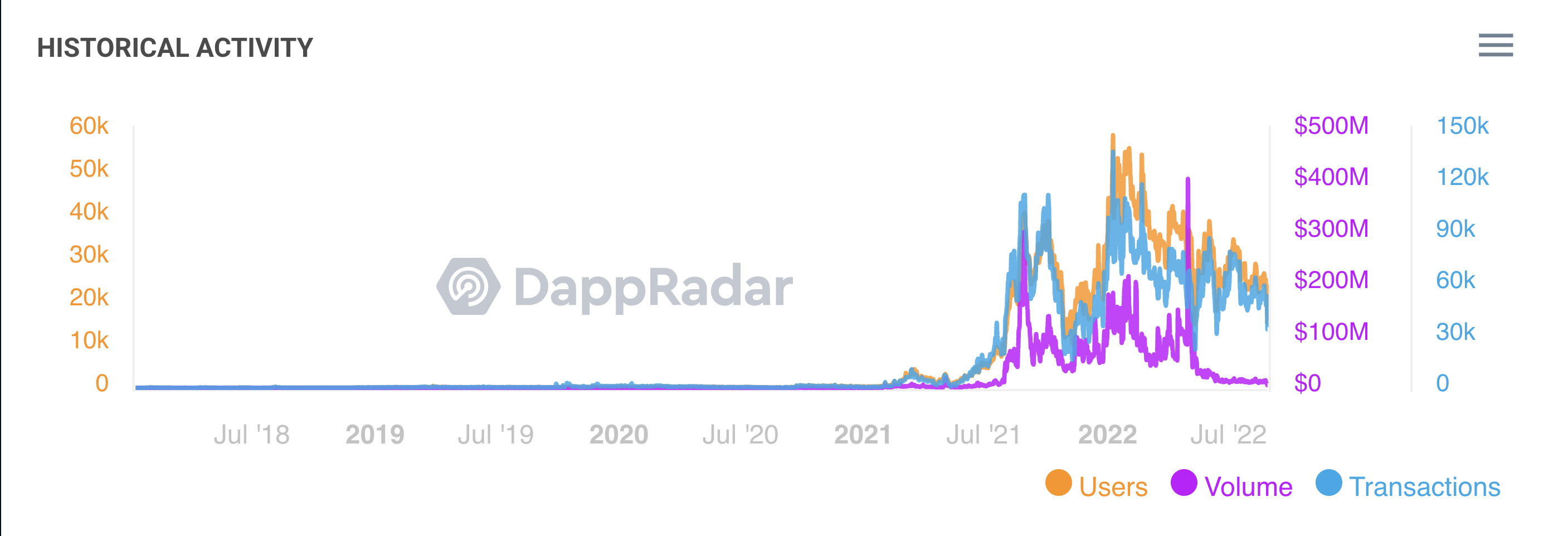

Notably, {the marketplace} processed almost $5 million price of NFT transactions on Aug. 28 — roughly 99% decrease than its document excessive of $405.75 million on Might 1, in accordance with DappRadar.

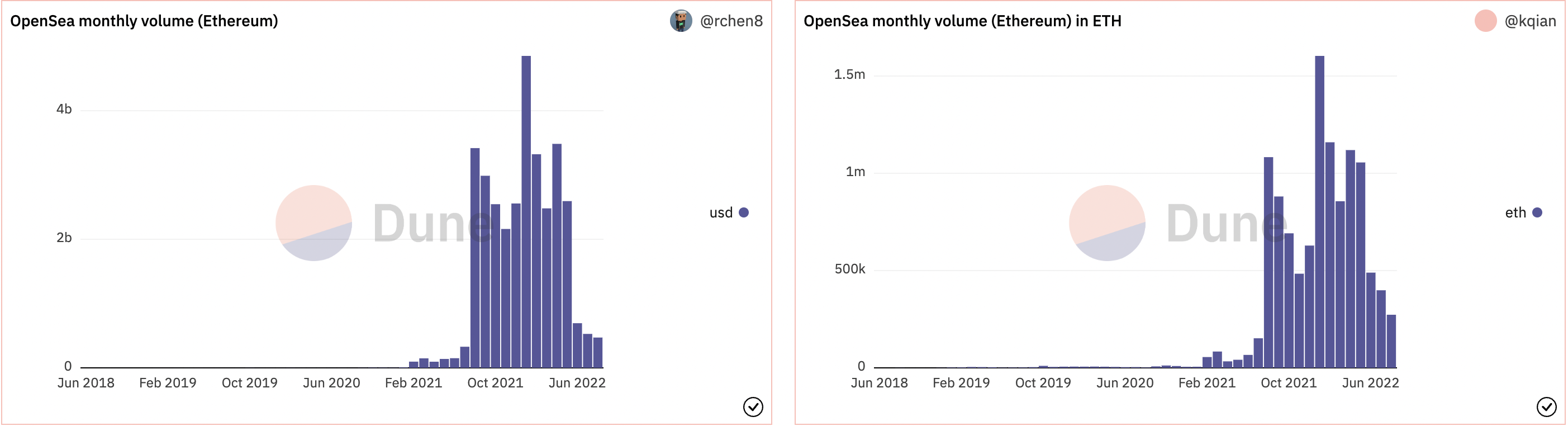

In the meantime, on a month-to-month timeframe, OpenSea’s quantity has dropped 90% from its January 2022’s peak of roughly $4.85 billion. In Ether (ETH) phrases, the month-to-month drop in the identical interval is round 82%, in accordance with Dune.

The large declines in each day and month-to-month volumes coincided with equally drastic drops in OpenSea customers and their transactions. This means that the worth and curiosity in blockchain-based collectibles have diminished in latest months.

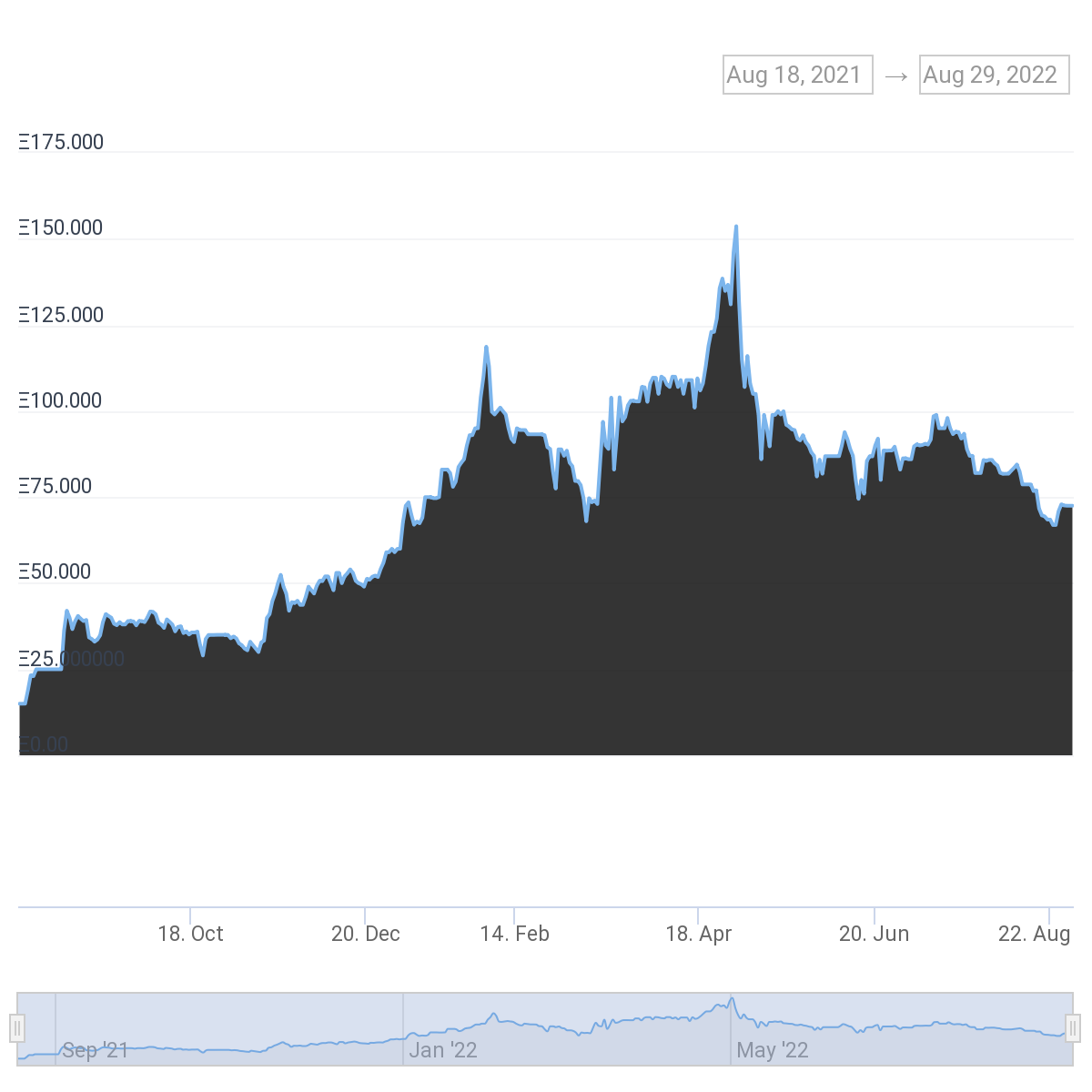

That’s additional seen within the falling ground costs — the minimal quantity one is able to pay for an NFT — of main digital collectible tasks.

As an illustration, the ground worth of Bored Ape Yacht Membership dropped by 53% to 72.5 E on Aug. 28 vs. a excessive of 153.7 ETH on Might 1.

Equally, the ground worth of CryptoPunks, one other prime NFT assortment, dropped nearly 20% from its July excessive of 83.72 ETH.

NFT bubble is bursting

NFT costs are quoted within the native forex of the blockchain on which they’re launched. So, a digital collectible created on Ethereum is bought utilizing Ether, which additionally implies that NFT costs will fall if ETH’s market valuation plummets.

A bearish ETH market seems to be one of many main drivers behind the poor NFT statistics. Notably, the worth of 1 ETH has fallen from $4,950 in November 2021 to under $1,500 in August 2022.

BendDAO votes to enhance NFT liquidity

Final week, BendDAO, a decentralized autonomous group that permits NFT homeowners to collateralize their digital collectibles to take loans (in ETH) price 30% to 40% of the NFT’s ground worth, voted to vary its protocol’s code to make its NFT collateral extra liquid.

The vote occurred after an increase in Ether’s worth elevated the worth of ETH-denominated loans in greenback phrases. In the meantime, however, NFT costs plummeted, lowering the worth of the collateral held by BendDAO.

In consequence, BendDAO is now dealing with its personal debt disaster second, the place debtors can’t pay their dollar-denominated loans resulting from falling ETH costs, whereas lenders are discovering it troublesome to recuperate their loaned quantities resulting from falling collateral valuations.

Associated: Prosecutors wish to declare NFTs as securities, alleges authorized workforce of former OpenSea worker

In other words, the floor price of NFTs, including BAYC, risks plunging further if the market’s liquidity continues to dry up.

agreed, 2020-2021 was crazy get-rich-in-months & the DeFi-NFT-Web3 bubble is going bust now, turns out founders & VCs were scammers only in for the $$$.

But pipl said its over in 2018 too after ICOs.

The next bubble will come 100%, you just need to survive.

play the long game. https://t.co/5f17JfdFfY— doncrypto (@DonCryptoDraper) August 29, 2022

The views and opinions expressed listed below are solely these of the creator and don’t essentially mirror the views of Cointelegraph.com. Each funding and buying and selling transfer entails danger, it is best to conduct your individual analysis when making a choice.