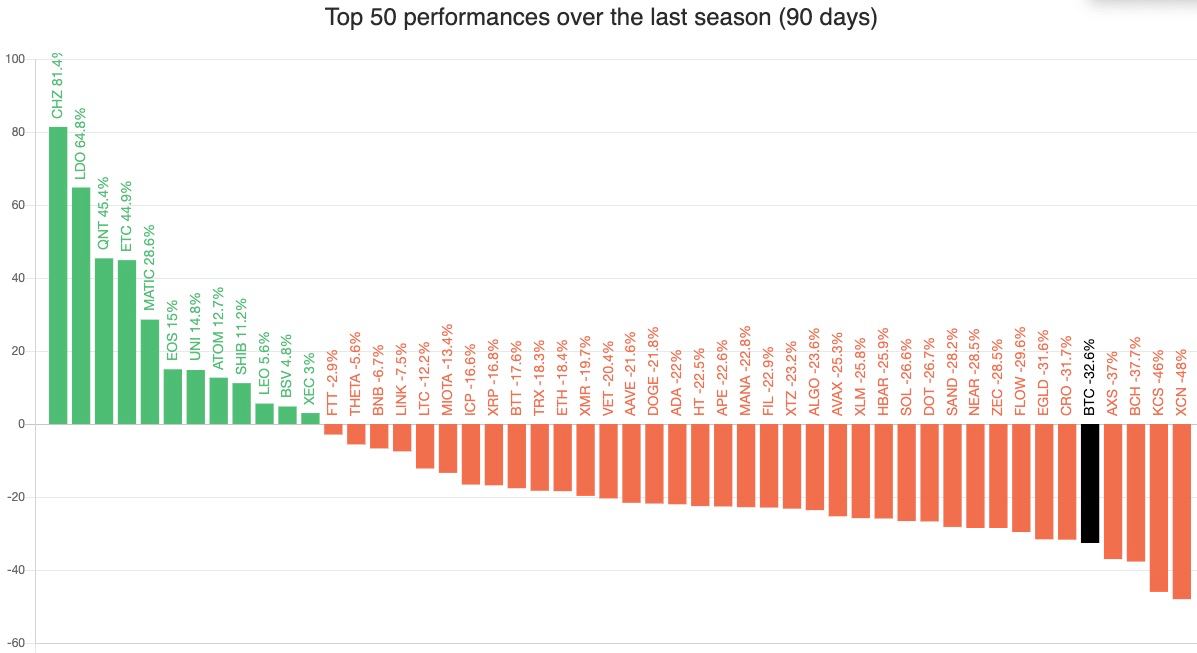

The cryptocurrency market general endured a nasty summer time on back-to-back items of unhealthy information, starting from Terra’s (Luna) —now renamed Terra Traditional (LUNC) — collapse to the Celsius Community’s liquidity disaster. However some tokens have bucked the downtrend and have truly seen their valuations go up over the summer time.

Particularly, the final 90 days have seen these so-called various cryptocurrencies, or “altcoins,” outperforming high cash like Bitcoin (BTC) and Ether (ETH). Listed here are three amongst them:

Chiliz (CHZ)

Chiliz’s (CHZ) return within the final 90 days involves be above 80%, the best among the many top-cap cryptocurrencies. Furthermore, CHZ is down solely 26% year-to-date in contrast with BTC and ETH shedding 57% and 60%, respectively.

On the day by day chart, CHZ’s value reached $0.20 per piece on Aug. 29, and was trying to shut the month in revenue. Conversely, from a technical perspective, the Chiliz token stares at a possible 55% correction to $0.09 in September, primarily based on the setup proven beneath.

Initially, the CHZ value rally began amid a rebound witnessed throughout the crypto market. However ts upside transfer picked momentum on a flurry of optimistic updates, together with a partnership with crypto change Huobi World and an almost 25% acquisition of FC Barcelona’s Barça Studios.

FC Barcelona declares the sale of 24.5% of Barça Studios to the corporate https://t.co/SkC8g62KY4 for 100 million euros to speed up the membership’s audiovisual, blockchain, NFT and Internet.3 technique.

Extra particulars https://t.co/0sM9grct3L pic.twitter.com/5xcLWYg440

— FC Barcelona (@FCBarcelona) August 1, 2022

Chiliz additionally benefited from the hype round its back-to-back community updates because it makes an attempt to cast off Ethereum and launch its personal chain CHZ 2.0.

Lido DAO (LDO)

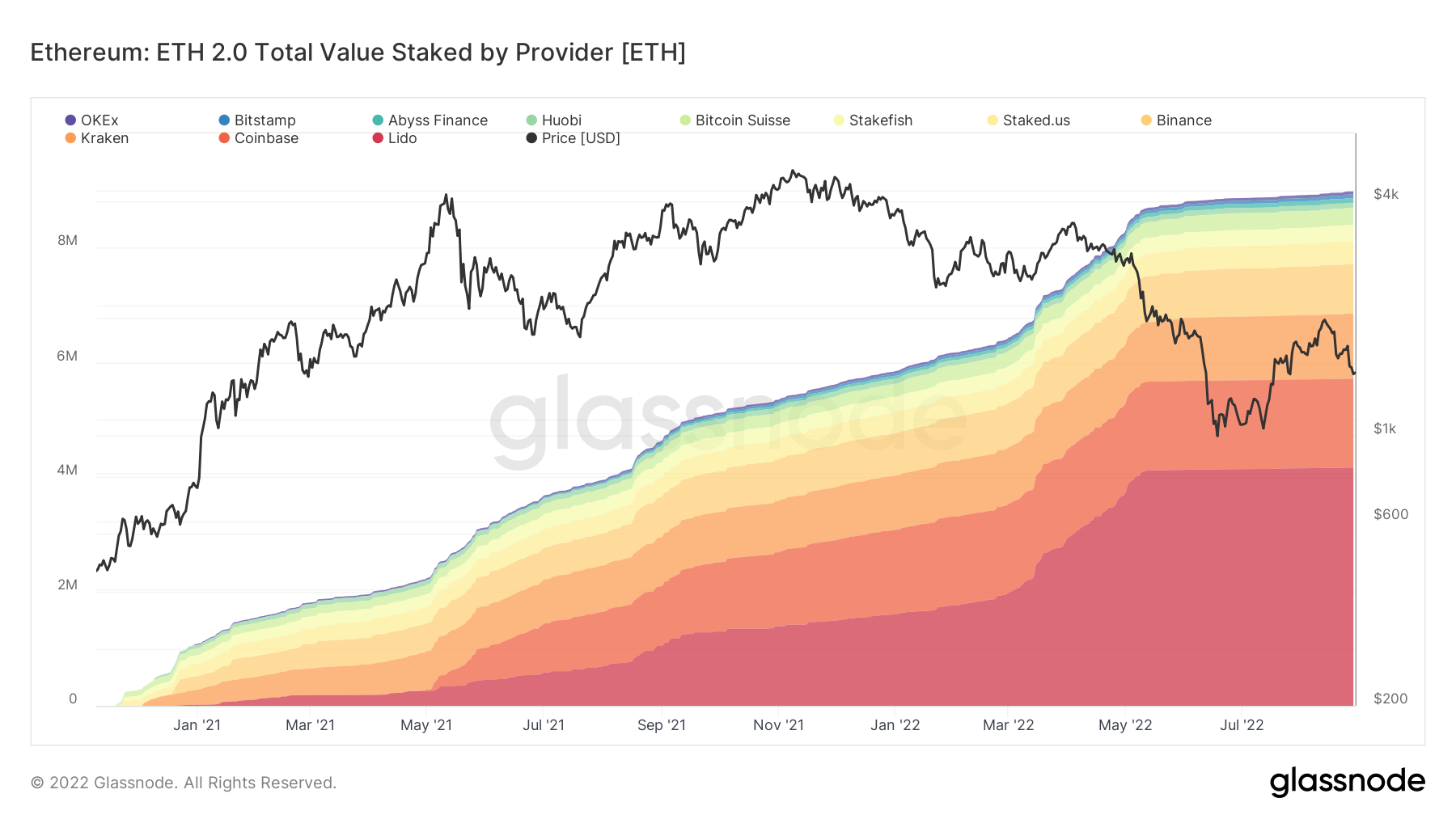

Lido DAO (LDO) has rallied round 60% within the final 90 days primarily as a result of euphoria round “the Merge,” Ethereum’s long-awaited community transition from proof-of-work to proof-of-stake in September.

Associated: US dollar hits new 20-year high — 5 things to know in Bitcoin this week

Lido DAO helps underfunded users to become stakers on Ethereum’s upcoming proof-of-stake chain. It does so by collecting users’ Ether funds into a pool of 32 ETH—as required by the Ethereum network—and depositing them into the Merge’s official smart contract.

The prospects of Lido DAO attracting more users in the days leading to and after the Merge have triggered buying in an otherwise bear market.

But like Chiliz, LDO’s price risks plunging lower by 20% to $1.31 in September as shown in the setup below.

The $1.31-target serves as the support in the consolidation area marked in red, given its historical performance.

Quant Network (QNT)

Quant Network (QNT) rose by more than 40% in the last 90 days, initially driven higher by a broader crypto market uptrend but picking momentum on speculations that their interoperable blockchain protocol would find adoption across governmental and regulatory bodies.

⚔️ Group 2 — Financial Action Task Force (FATF)

Quant CEO @GVerdian has labored diligently to maintain Overledger in compliance with all current and forthcoming laws, together with the FATF’s framework for VASPs (see picture).☑️ Gilbert’s #FATF hashtag from 2019 says all of it. ⬇️ https://t.co/0hvTDqAESh pic.twitter.com/F3Txe8rWPr

— Greg Lunt (@GregLunt27) July 8, 2022

However from a technical perspective, QNT dangers a 40% value decline from its present value degree owing to the formation of a head-and-shoulders setup on its day by day chart with a $57 goal by September, as proven beneath.

Different winners

Ethereum Traditional (ETC) has additionally surged by greater than 40% within the final 90 days in hopes that it will provide a secure haven for Ethereum miners after the PoS improve.

WhilPolygon (MATIC) has rallied by 27% in the identical interval, adopted by Uniswap (UNI), which is up 13%.

The views and opinions expressed listed here are solely these of the writer and don’t essentially mirror the views of Cointelegraph.com. Each funding and buying and selling transfer includes danger, you must conduct your personal analysis when making a call.