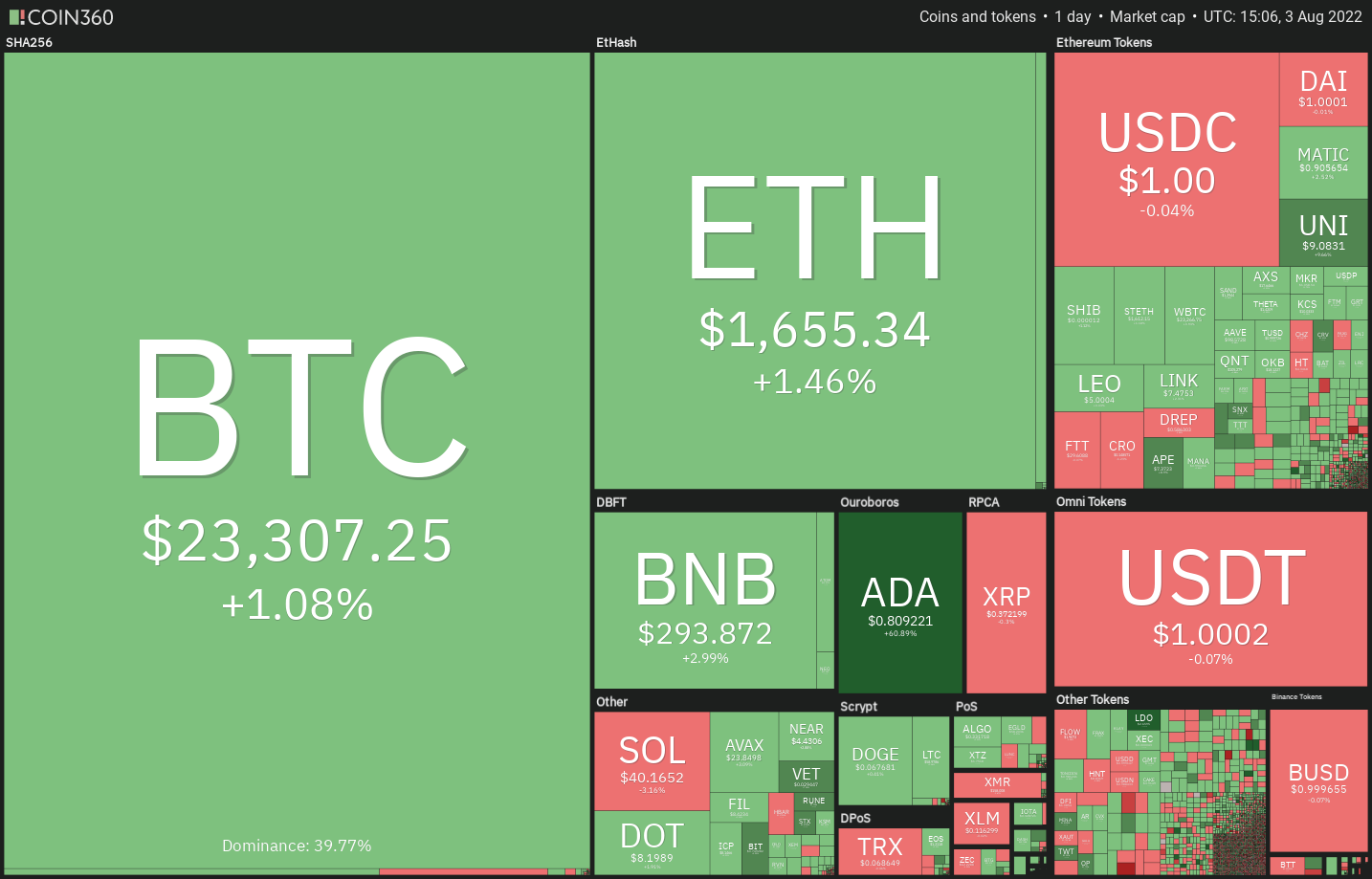

Bitcoin (BTC) and altcoins are monitoring america equities markets greater on Aug. 3 as merchants purchase the dip.

Smaller traders appear to be profiting from the bear market in Bitcoin because the variety of wholecoiners has soared by 40,000 because the sharp fall in June. As compared, pockets addresses with greater than 1,000 Bitcoin have declined by 113 since Might.

Some analysts imagine that Bitcoin has not but shaped a macro backside, nonetheless. Buying and selling agency QCP Capital expects Bitcoin to regularly rise for many of the third quarter amid excessive volatility.

They imagine Bitcoin’s rally may hit a roof round $28,700. For the long-term, the agency didn’t rule out a ultimate capitulation in Bitcoin to round $10,000, which can mark a backside for the bear market.

However, Bitcoin miners appear to be in an upbeat mode as they elevated their Bitcoin holdings in July following the capitulation in June. In response to information from on-chain analytics agency CryptoQuant, Bitcoin held by the miners hit the very best ranges since.

Might Bitcoin and altcoins resume their up-move or will the restoration falter at greater ranges? Let’s examine the charts of the top-10 cryptocurrencies to seek out out.

BTC/USDT

Bitcoin dropped to the 20-day exponential shifting common (EMA) ($22,632) on Aug. 2, which is performing as sturdy assist. The regularly up-sloping 20-day EMA and the relative energy index (RSI) within the optimistic territory counsel that bulls have a slight edge.

The patrons will now try and push the worth above the overhead resistance at $24,668. In the event that they succeed, the BTC/USDT pair may rally to $28,000 the place the bears could mount a stiff resistance. If bulls clear this hurdle, the rally may prolong to $32,000.

Opposite to this assumption, if the worth turns down from the present degree or the overhead resistance, it’ll counsel that greater ranges proceed to draw promoting from the bears. A break and shut beneath the 20-day EMA may sink the pair to the 50-day easy shifting common (SMA) ($21,344) after which to the assist line.

ETH/USDT

Ether (ETH) turned down and dropped to the 20-day EMA ($1,545) on Aug. 2 however the lengthy tail on the candlestick means that the bulls aggressively bought the dip.

The bulls will as soon as once more try and clear the overhead resistance zone between $1,700 and $1,785. In the event that they succeed, it’ll point out a possible pattern change. The ETH/USDT pair may then rally to $2,000 and later to $2,200.

To invalidate this bullish view, the bears should sink and maintain the worth beneath the 20-day EMA. That might open the doorways for a decline to the sturdy assist at $1,280. A bounce off this degree may preserve the pair caught between $1,280 and $1,700 for a couple of days.

BNB/USDT

Binance Coin (BNB) bounced off the $275 assist on Aug. 2, indicating that the sentiment has turned optimistic and merchants are shopping for on dips.

The bulls will now make another try and push the worth above the overhead resistance at $300. In the event that they succeed, the BNB/USDT pair may choose up momentum and rally towards the stiff overhead resistance at $350.

The rising 20-day EMA ($268) and the RSI within the optimistic territory point out that the trail of least resistance is to the upside. This bullish view may invalidate within the close to time period if the worth turns down and breaks beneath the 20-day EMA.

XRP/USDT

The lengthy tail on XRP’s Aug. 3 candlestick signifies that bulls try to defend the 20-day EMA ($0.36). The regularly up-sloping 20-day EMA and the RSI within the optimistic territory point out a slight benefit to patrons.

If bulls push the worth above the $0.39 to $0.41 resistance zone, the XRP/USDT pair may sign the beginning of a brand new up-move. The pair may then rally to $0.48 the place the bears could once more mount a powerful protection.

Opposite to this assumption, if the worth turns down from the present degree or the overhead resistance, the opportunity of a break beneath the 20-day EMA will increase. If that occurs, the pair could proceed its range-bound motion for a couple of extra days.

ADA/USDT

Cardano (ADA) has been caught in a wide range between $0.40 and $0.55 for the previous few days. The bulls are at present trying to defend the shifting averages.

In the event that they succeed, the ADA/USDT pair may climb to the overhead resistance at $0.55. This stays an essential degree to be careful for. If bulls overcome this barrier, the pair may rally to $0.63 and in a while to $0.70.

Alternatively, if the worth breaks beneath the shifting averages, the pair may slide to the instant assist at $0.45. A bounce off this degree may type a brand new tighter vary between $0.45 and $0.55 whereas a break beneath $0.45 may clear the trail for a drop to $0.40.

SOL/USDT

Solana (SOL) dipped beneath the 20-day EMA ($40) on Aug. 2 and dropped to the 50-day SMA ($37) on Aug. 3. The lengthy tail on the candlestick means that merchants are defending the assist line.

If bulls push and maintain the worth above the 20-day EMA, the SOL/USDT pair may regularly climb as much as $48. This is a vital degree to control as a result of a break and shut above it may full the ascending triangle sample that has a goal goal of $71.

Conversely, if the rebound lacks energy, the bears will try and sink the pair beneath the assist line. In the event that they handle to do this, the bullish setup shall be negated and the pair could slide to $31.

DOGE/USDT

The bulls try to arrest Dogecoin’s (DOGE) pullback on the 50-day SMA ($0.07). If the rebound sustains above the 20-day EMA ($0.07), a retest of $0.08 is feasible.

The bulls should push and maintain the worth above $0.08 to sign the completion of an ascending triangle sample. If that occurs, the DOGE/USDT pair may rally to $0.10 after which to the sample goal at $0.11.

Quite the opposite, if the rebound lacks energy, it’ll counsel that demand dries up at greater ranges. That might pull the worth all the way down to the trendline assist. A break and shut beneath this degree may invalidate the bullish setup.

Associated: Lido DAO: Ethereum’s greatest Merge staker simply jumped 30% — will LDO rally into September?

DOT/USDT

Polkadot (DOT) turned down from the overhead resistance and dipped to the 20-day EMA ($7.70) the place the bulls are attempting to stall the pullback.

The regularly up-sloping 20-day EMA and the RSI within the optimistic territory point out that bulls have a slight edge. If bulls propel the worth above the overhead resistance at $9, the DOT/USDT pair may rally to $10.80 after which to $12.

Alternatively, if the worth turns down from the present degree or the overhead resistance and breaks beneath the shifting averages, it’ll counsel that the pair could prolong its keep contained in the vary between $6 and $9 for a couple of extra days.

MATIC/USDT

Polygon (MATIC) bounced off the 20-day EMA ($0.84) on Aug. 2, indicating that bulls are shopping for on dips. The worth may subsequent retest the $0.98 to $1.01 overhead resistance zone.

Though the creating detrimental divergence on the RSI warrants warning, the up-sloping shifting averages point out benefit to patrons. If bulls clear the overhead resistance zone, the MATIC/USDT pair may rally to $1.26.

Quite the opposite, if the worth turns down and breaks beneath the 20-day EMA, the pair may drop to the sturdy assist at $0.75. A pointy rebound off this degree may preserve the pair range-bound between $0.75 and $1 for a couple of days.

AVAX/USDT

The bears tried to sink Avalanche (AVAX) beneath the 20-day EMA ($22.71) on Aug. 2 however the bulls held their floor. This means that merchants are viewing the dips as a shopping for alternative.

The bulls will try and push the worth above the overhead resistance at $26.38. In the event that they succeed, the AVAX/USDT pair may full a bullish ascending triangle sample, which has a goal goal at $33 after which $38.

Opposite to this assumption, if the worth turns down from the present degree or the overhead resistance and breaks beneath the 20-day EMA, the pair may slide to the assist line. This is a vital degree for the bulls to defend as a result of a break and shut beneath it may tilt the benefit in favor of the bears.

Market information is supplied by HitBTC trade.

The views and opinions expressed listed below are solely these of the writer and don’t essentially replicate the views of Cointelegraph.com. Each funding and buying and selling transfer entails danger, you need to conduct your individual analysis when making a call.