MicroStrategy (MSTR) inventory opened greater on Aug. 3 as buyers digested the information of its CEO Michael Saylor’s exit after a depressive quarterly earnings report.

Microstrategy refill 142% since Might lows

On the every day chart, MSTR’s worth surged by practically 14.5% to $324.55 per share, the best degree since Might 6.

The inventory’s intraday good points got here as part of a broader restoration that began on Might 12 at $134. Since then, MSTR has grown by 142% versus Nasdaq’s 26.81% good points in the identical interval.

Dangerous Q2, Saylor’s resignation

The Aug. 3 MSTR rally got here a day after MicroStrategy reported a billion dollar loss in its second quarter (Q2) earnings name. Curiously, the corporate’s main Bitcoin publicity was a big cause for its poor quarterly efficiency.

To recap: MicroStrategy is an data expertise agency that gives enterprise intelligence, cell software program and cloud-based providers. However one in every of its main company methods is to spend money on Bitcoin to carry it long-term.

Sadly, holding Bitcoin has value MicroStrategy an impairment lack of $917.84 million from its 129,698 BTC holdings in Q2, primarily as a result of crypto’s 50% year-to-date (YTD) worth drop. Compared, MSTR plunged 42% in the identical interval.

Moreover, MicroStrategy’s income fell 2.6% year-over-year to $122.07 million. The online quarterly losses prompted Saylor—who has strongly backed the Bitcoin funding technique since August 2020—to give up because the agency’s CEO and grow to be an government chairman.

MSTR responded positively to Saylor’s resignation and the appointment of Phong Le, president of MicroStrategy, as his alternative, suggesting that buyers are comfy with the change in management.

What’s subsequent for MSTR?

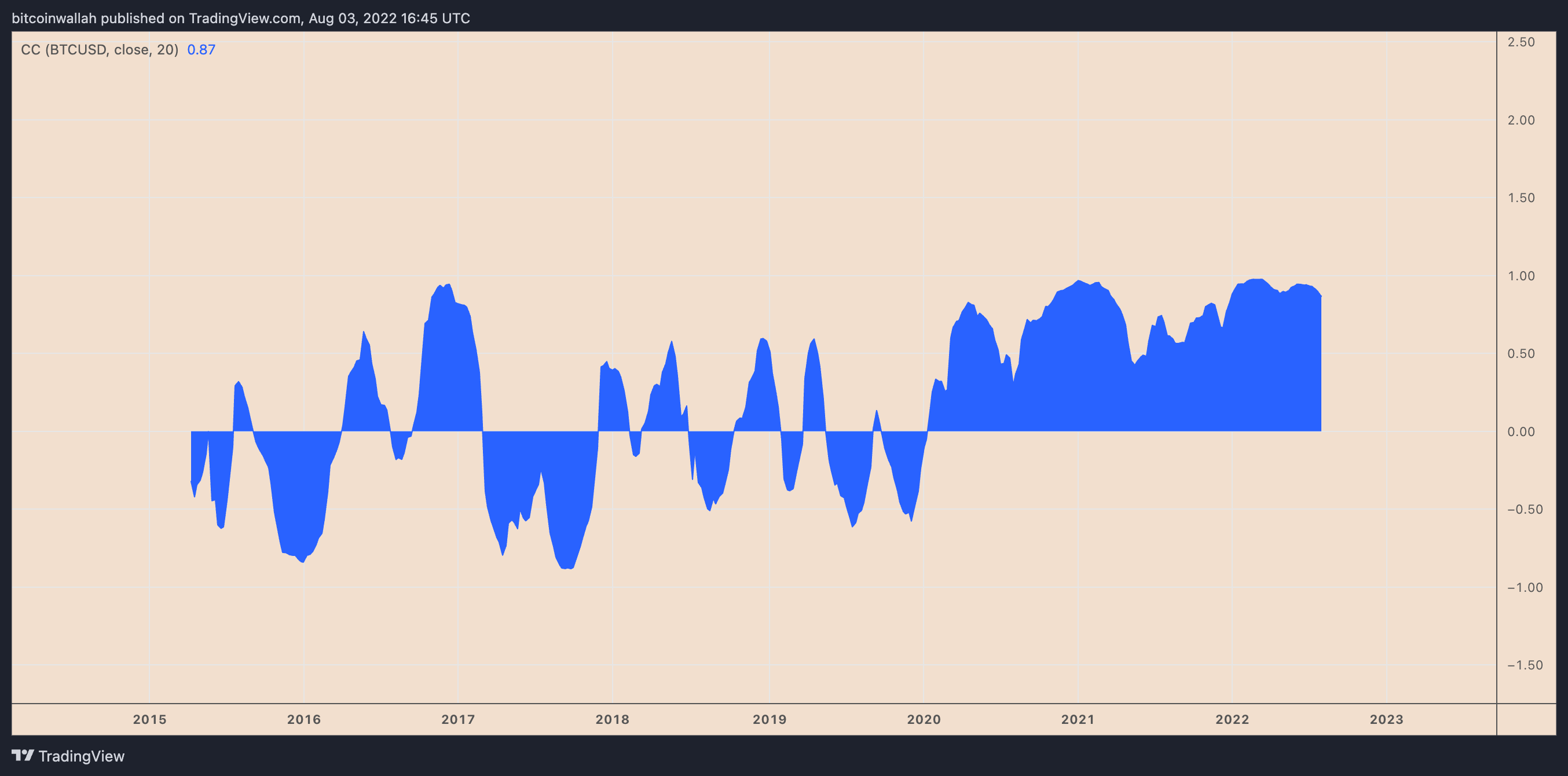

MSTR’s course for the rest of 2022 relies upon largely on Bitcoin’s efficiency, given their persistently optimistic correlation in recent times. However a number of metrics are hinting at a correction forward.

For example, MicroStrategy’s enterprise value-to-revenue (EV/R) ratio was at 10.76 on Aug. 3, or in “overvalued” territory.

Equally, MSTR’s ahead price-to-earnings (P/E) ratio has reached 54.95, greater than double the market common of 20–25. In different phrases, the market expects MicroStrategy to point out huge future earnings progress regardless of its underperformance in current quarters.

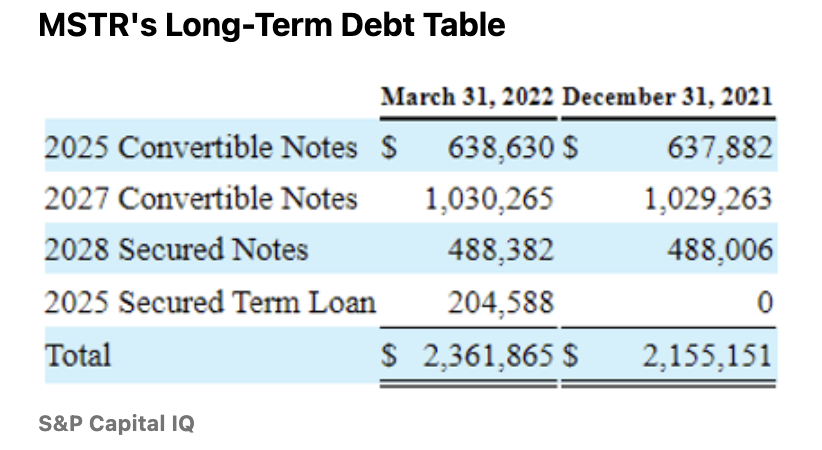

MicroStrategy additionally has amassed $2.4 billion in long-term money owed with $46.6 million in curiosity bills. Due to this fact, the corporate may discover it unable to satisfy its debt obligations if it continues to undergo losses on the present tempo.

In different phrases, MicroStrategy may pledge its practically $2 billion price of Bitcoin holdings as collateral or promote them to boost capital.

Associated: A short historical past of Bitcoin crashes and bear markets: 2009–2022

“Nonetheless, crypto and MSTR bulls might stay invested,” noted Juxtaposed Concepts, a Looking for Alpha contributor, in its newest evaluation, saying that almost all are keen to “gamble on Bitcoin’s eventual restoration to $40,000” or past by 2023 or 2024.

“That might be a optimistic catalyst for its future inventory restoration, returning some much-needed capital to the extremely unstable funding.”

The views and opinions expressed listed here are solely these of the creator and don’t essentially replicate the views of Cointelegraph.com. Each funding and buying and selling transfer entails danger, it is best to conduct your individual analysis when making a call.