After the rising wedge formation was damaged on Aug. 17, the full crypto market capitalization rapidly dropped to $1 trillion and the bulls’ dream of recouping the $1.2 trillion help, final seen on June 10, turned much more distant.

The worsening circumstances usually are not unique to crypto markets. The worth of WTI oil ceded 3.6% on Aug. 22, down 28% from the $122 peak seen on June 8. The United StatesTreasuries 5-year yield, which bottomed on Aug. 1 at 2.61%, reverted the pattern and is now buying and selling at 3.16%. These are all indicators that buyers are feeling much less assured concerning the central financial institution’s insurance policies of requesting extra money to carry these debt devices.

Not too long ago, Goldman Sachs chief U.S. fairness strategist David Kostin acknowledged that the risk-reward for the S&P 500 is skewed to the draw back after a 17% rally since mid-June. In response to a shopper notice written by Kostin, inflation surprises to the upside would require the U.S. Federal Reserve to tighten the economic system extra aggressively, negatively impacting valuations.

In the meantime, prolonged lockdowns supposedly aimed toward containing the unfold of COVID-19 in China and property debt issues triggered the PBOC led the central financial institution to scale back its five-year mortgage prime charge to 4.30% from 4.45% on Aug. 21. Curiously, the motion occurred every week after the Chinese language central financial institution lowered the rates of interest in a shock transfer.

Crypto investor sentiment is on the fringe of ‘neutral-to-bearish’

The danger-off perspective introduced by surging inflation led buyers to count on extra rate of interest hikes, which can, in flip, diminish buyers’ urge for food for development shares, commodities and cryptocurrencies. Consequently, merchants will possible search shelter within the U.S. greenback and inflation-protected bonds in periods of uncertainty.

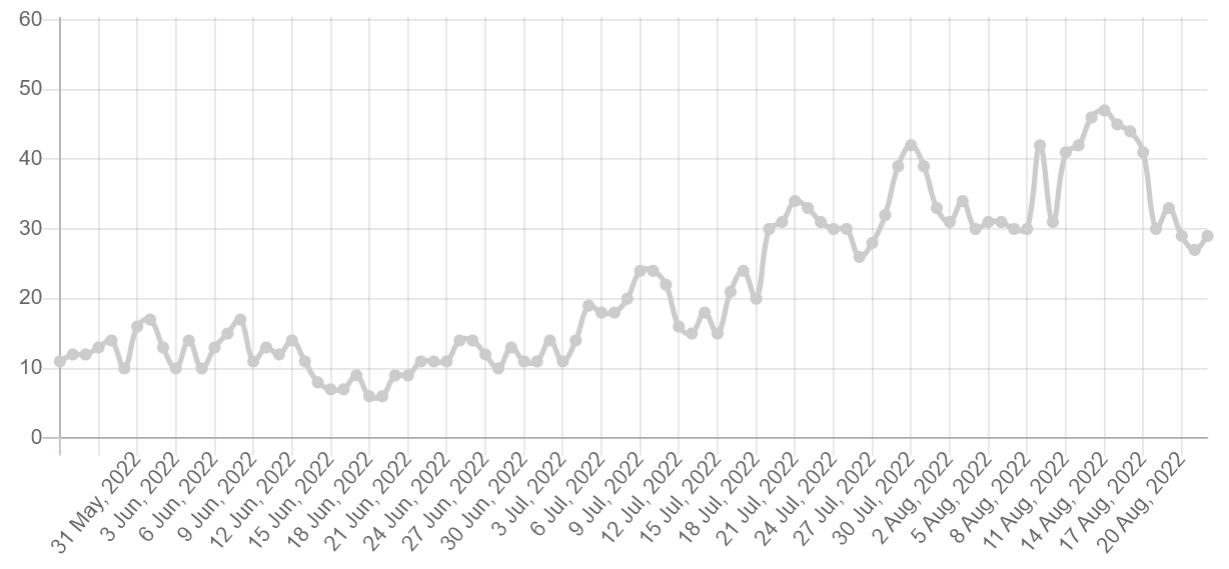

The Concern and Greed Index hit 27/100 on Aug. 21, the bottom studying in 30 days for this data-driven sentiment gauge. The transfer confirmed buyers’ sentiment was shifting away from a impartial 44/100 studying on Aug. 16 and it displays the truth that merchants are comparatively afraid of the crypto market’s short-term value motion.

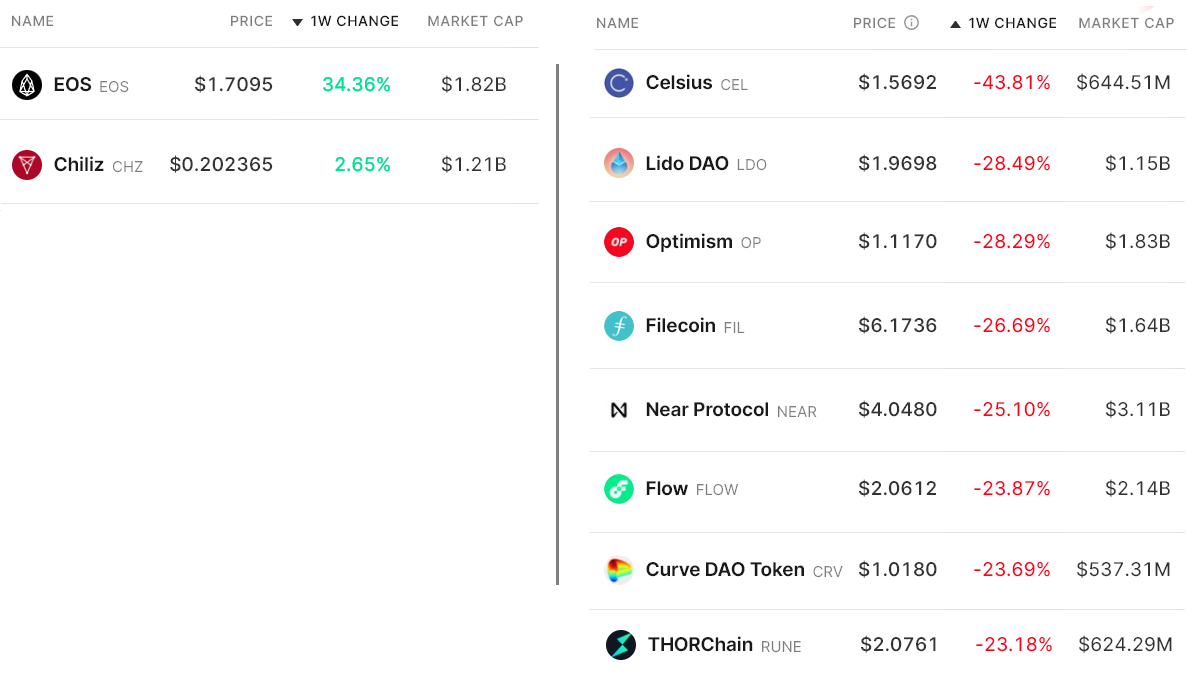

Under are the winners and losers from the previous seven days as the full crypto capitalization declined 12.6% to $1.04 trillion. Whereas Bitcoin (BTC) offered a 12% decline, a handful of mid-capitalization altcoins dropped 23% or extra within the interval.

EOS jumped 34.4% after its neighborhood turned bullish on the “Mandel” laborious fork scheduled for September. The replace is predicted to fully terminate the connection with Block.one.

Chiliz (CHZ) gained 2.6% after Socios.com invested $100 million for a 25% stake within the Barcelona Soccer Membership’s new digital and leisure arm.

Celsius (CEL) dropped 43.8% after a chapter submitting report on Aug. 14 displayed a $2.85 billion funds mismatch.

Most tokens carried out negatively, however retail demand in China barely improved

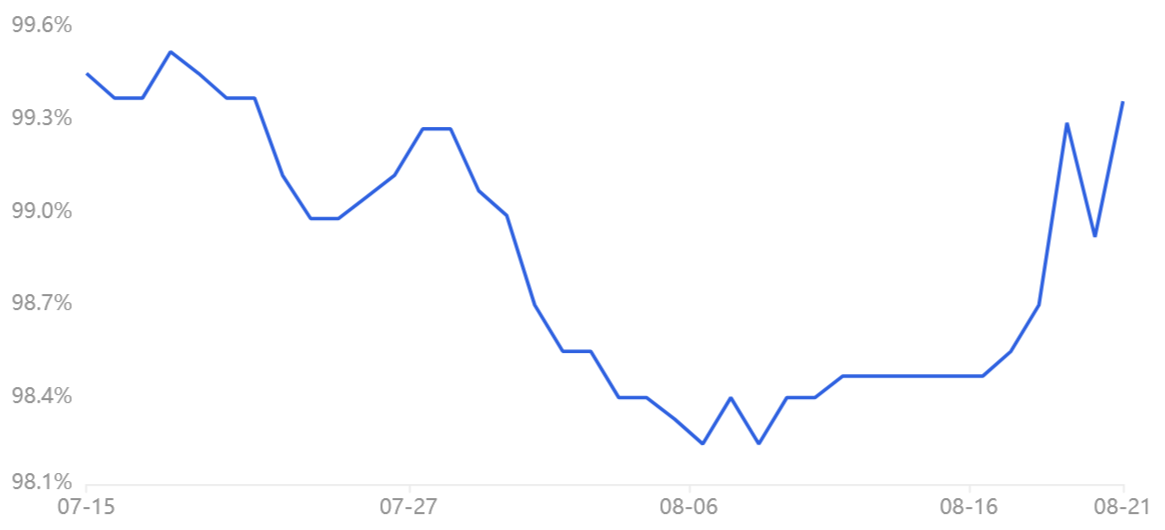

The OKX Tether (USDT) premium is an efficient gauge of China-based retail crypto dealer demand. It measures the distinction between China-based peer-to-peer (P2P) trades and the USA greenback.

Extreme shopping for demand tends to stress the indicator above honest worth at 100%, and through bearish markets, Tether’s market provide is flooded and causes a 4% or greater low cost.

On Aug. 21, the Tether value in Asia-based peer-to-peer markets reached its highest degree in two months, at present at a 0.5% low cost. Nonetheless, the index stays beneath the neutral-to-bearish vary, signaling low demand from retail shopping for.

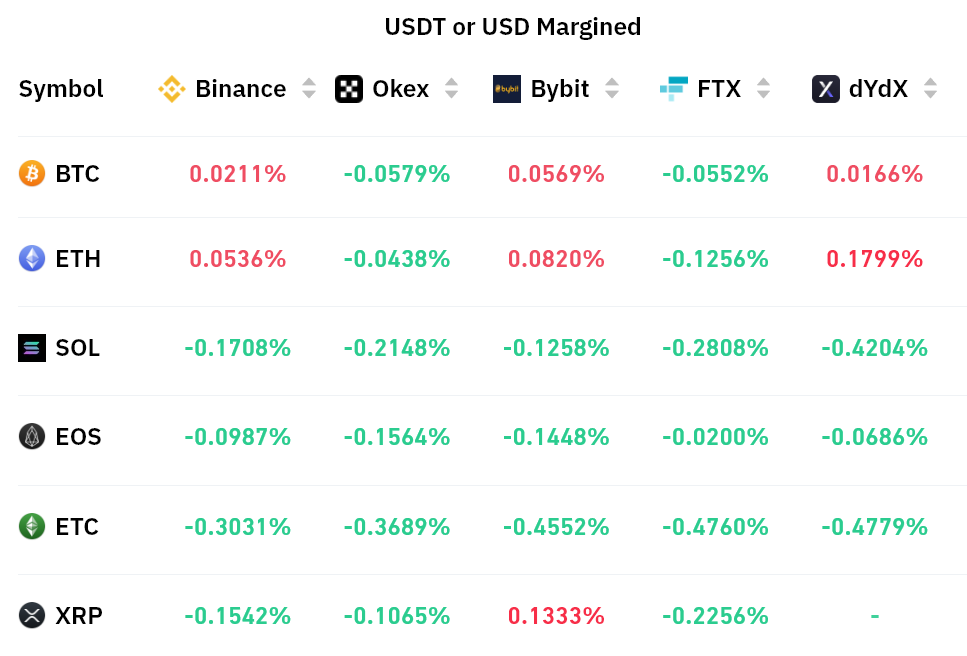

Merchants should additionally analyze futures markets to exclude externalities particular to the Tether instrument. Perpetual contracts, also referred to as inverse swaps, have an embedded charge normally charged each eight hours. Exchanges use this price to keep away from trade threat imbalances.

A constructive funding charge signifies that longs (consumers) demand extra leverage. Nonetheless, the alternative scenario happens when shorts (sellers) require extra leverage, inflicting the funding charge to show unfavorable.

Perpetual contracts mirrored a impartial sentiment after Bitcoin and Ether held a comparatively flat funding charge. The present charges resulted from a balanced scenario between leveraged longs and shorts.

As for the remaining altcoins, even the 0.40% weekly unfavorable funding charge for Ether Basic (ETC) was not sufficient to discourage brief sellers.

A 20% drop to retest yearly lows is probably going within the making

In response to derivatives and buying and selling indicators, buyers are reasonably apprehensive a few steeper world market correction. The absence of consumers is obvious in Tether’s slight low cost when priced in Chinese language yuan and the near-zero funding charges seen in futures markets.

These neutral-to-bearish market indicators are worrisome, provided that complete crypto capitalization is at present testing the crucial $1 trillion help. If the U.S. Federal Reserve successfully continues to tighten the economic system to suppress inflation, the percentages of crypto retesting yearly lows at $800 billion are excessive.

The views and opinions expressed listed below are solely these of the author and don’t essentially mirror the views of Cointelegraph. Each funding and buying and selling transfer includes threat. You need to conduct your individual analysis when making a choice.