Crypto merchants had a short alternative to pause and take inventory of the place issues are on June 16 because the relentless promoting that has hammered Bitcoin (BTC) and the broader market over the previous week started to relent regardless of an ongoing sell-off in the traditional markets.

Information from Cointelegraph Markets Professional and TradingView reveals that after climbing to a excessive of $23,000 within the early buying and selling hours on June 16, the worth of Bitcoin slowly trended down on diminished buying and selling quantity to hit a low at $20,765.

Right here’s what a number of analysts available in the market are saying in regards to the outlook for Bitcoin transferring ahead as crypto merchants strive to determine if the bottom is in or if there is more downside ahead.

Expect multi-month consolidation at the 200-week MA

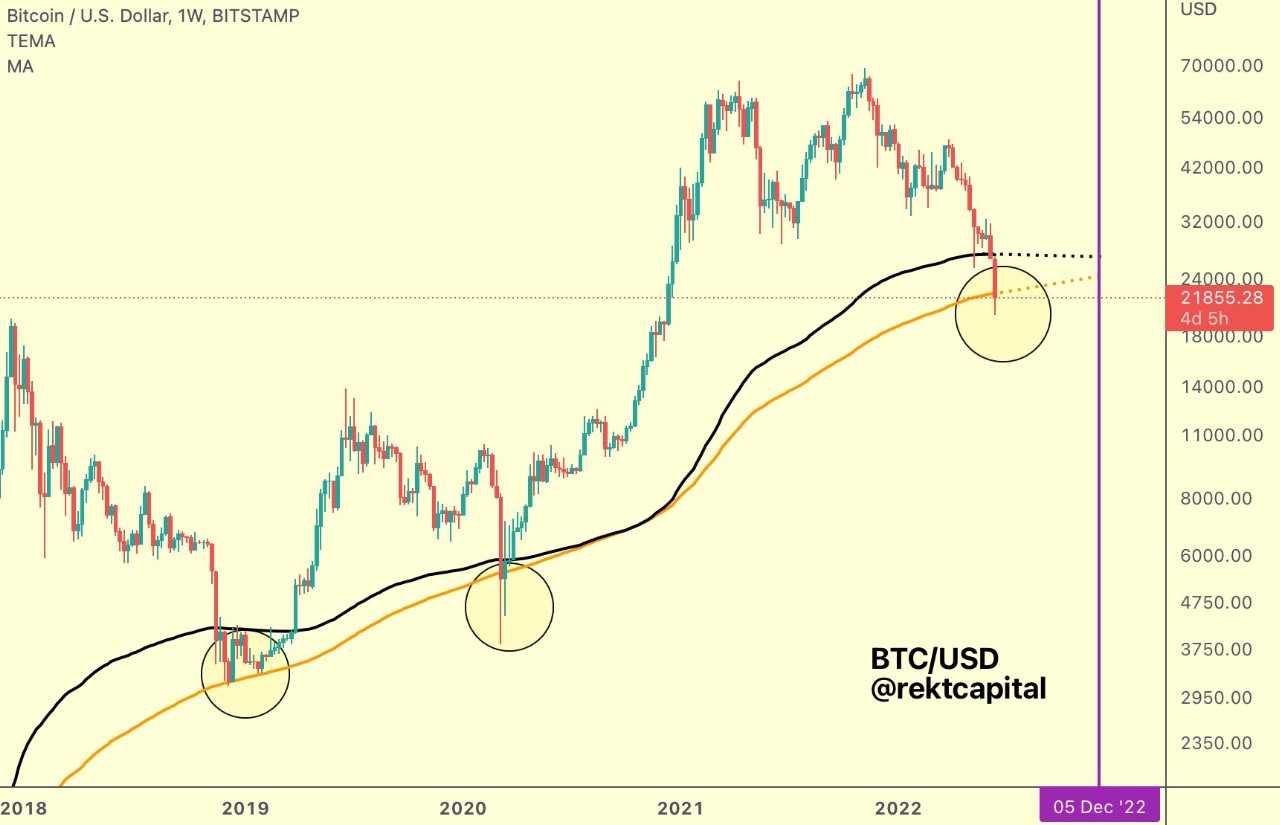

A macro perspective of the journey that Bitcoin has taken over the years and how its past can offer insight into the current market setup was discussed by analyst and pseudonymous Twitter user Rekt Capital, who posted the next chart highlighting BTC’s habits close to its 200-week transferring common (MA).

Rekt Capital mentioned,

“If #BTC continues to carry the orange 200-week MA as assist and the black 200-week EMA figures as resistance… $BTC may type an Accumulation Vary right here, identical to in 2018. This could allow multi-month consolidation to even so far as December 2022.”

If that is the state of affairs that performs out, then crypto merchants needn’t rush to build up BTC, a degree famous by crypto dealer and pseudonymous Twitter person Altcoin Sherpa, who posted a number of charts highlighting the period of time that BTC spent in earlier accumulation phases.

The longest accumulation interval famous by Altcoin Sherpa is the 287 day span outlined within the chart above. Different examples offered embody the 133 days of accumulation between November 2018 and April 2019 and the 63 days of accumulation between Might 2020 and July 2020.

Altcoin Sherap mentioned,

“It is doubtless that you’re going to get loads of time to catch a backside through the accumulation part. #Bitcoin takes some time for its backside to type and it’s best to most likely simply exit and contact some grass as a substitute of knife catching.”

Bitcoin may reclaim $25,000, if we’re fortunate

A extra optimistic tackle the newest developments for Bitcoin was supplied by crypto dealer Nebraskangooner, who provided the next chart noting that the “decrease Fibonacci degree has been reached.”

Nebraskangooner mentioned,

“Let’s examine if every day can shut sturdy above resistance after which we have now an opportunity for $25,000 and probably mid $30K’s. For the primary time in months, we’d lastly be prepared for the bounce everybody has been calling for since $40K.”

Associated: Additional draw back is predicted, however a number of knowledge factors counsel Bitcoin is undervalued

The RSI 1000 supplies a bullish signal

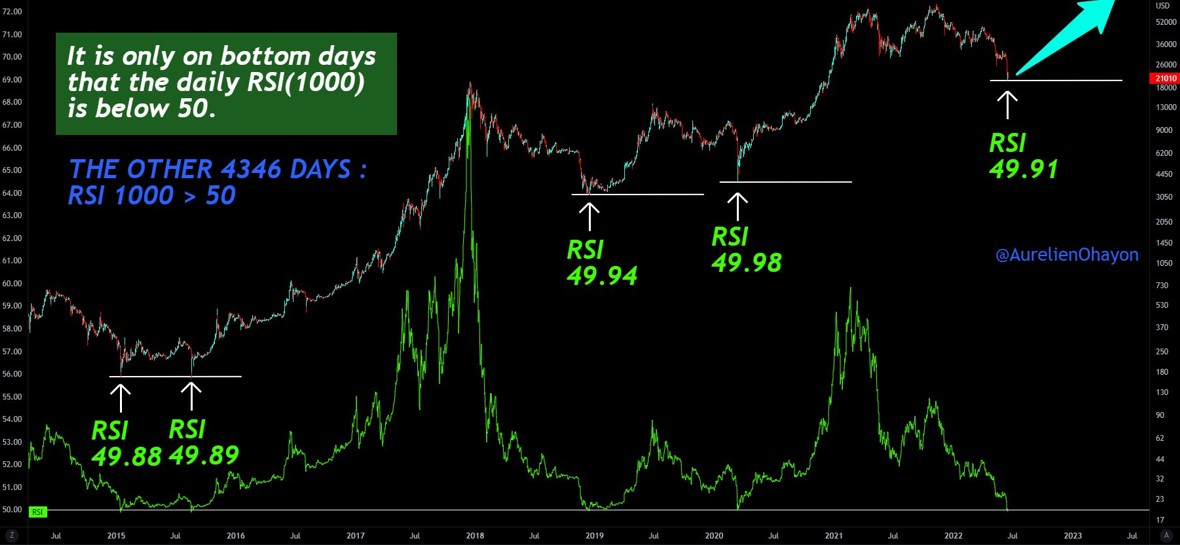

One other dealer who has noticed a probably bullish sign on the chart for BTC is pseudonymous Twitter person TAnalyst, who posted the next chart highlighting the current low for the relative power index (RSI) 1000.

TAnalyst mentioned,

“#Bitcoin It’s only on backside days, BEFORE BULL RUNS, that the every day RSI(1000) is beneath 50. Right this moment : RSI(1000) = 49.91. Conclude.”

Primarily based on the historical past of an RSI 1000 rating falling beneath 50, the worth of Bitcoin may quickly start to climb greater.

Maybe the most effective abstract of the present state of the Bitcoin market and the confusion it’s inflicting crypto merchants was supplied by crypto educator IncomeSharks.

#Bitcoin– At a value the place shorting not is smart. But in addition at a value that longing continues to be very dangerous. Except utilizing tight danger administration it is a spot purchase solely zone for majority. It is okay to attend for a pattern to develop to start out buying and selling once more.

— IncomeSharks (@IncomeSharks) June 16, 2022

The general cryptocurrency market cap now stands at $905 billion and Bitcoin’s dominance charge is 44.3%

The views and opinions expressed listed below are solely these of the writer and don’t essentially mirror the views of Cointelegraph.com. Each funding and buying and selling transfer includes danger, it’s best to conduct your individual analysis when making a choice.