Bitcoin (BTC) drifted close to $21,000 on the Aug. 22 Wall Avenue open as the brand new week started with no rebound.

European commodity surge hammers euro

Information from Cointelegraph Markets Professional and TradingView confirmed BTC/USD failing to summon a comeback after final week’s 11.6% losses.

The pair put in recent multi-week lows underneath $20,800 over the weekend, subsequently staging a modest aid bounce to circle $21,200 on the time of writing.

Anxiousness over European markets and the upcoming United States Federal Reserve Jackson Gap symposium contributed to a downbeat temper on danger property. The S&P 500 misplaced 1.8% inside two hours of opening, whereas the Nasdaq Composite Index shed 2.2%.

In Europe, gasoline and electrical energy costs surged once more over fears that provides from Russia could possibly be throttled tougher and prior to anticipated.

OOPS! German benchmark electrical energy worth jumped >25% on Monday to go €700 per megawatt-hour for the primary time. The extent is about 14 occasions the seasonal common over the previous 5 years. pic.twitter.com/gMQZkk7ncB

— Holger Zschaepitz (@Schuldensuehner) August 22, 2022

Consequently, the euro fell beneath parity with the U.S. greenback for the primary time since July.

“The tip of summer time sees the euro again underneath stress, partly as a result of the greenback is bid and partly as a result of the Damoclean sword hanging over the European financial system isn’t going away,” Equipment Juckes, a international alternate strategist at Societe Generale, wrote in a be aware quoted by Bloomberg.

As Cointelegraph reported, the euro was already dealing with a number of headwinds, with inflation within the Eurozone nonetheless climbing in July in distinction to america.

Under 200-week shifting common “dangerous for bulls”

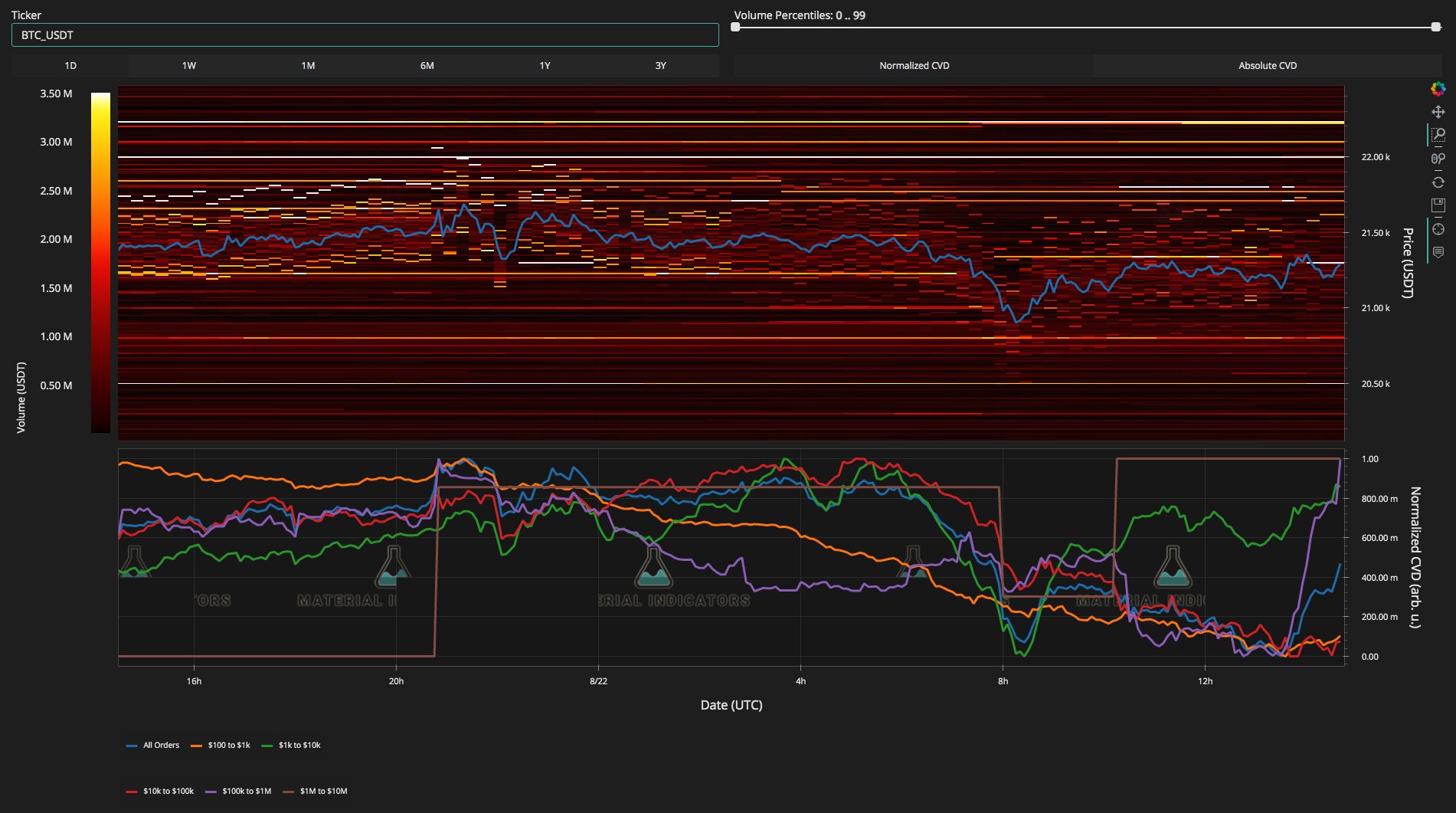

Analyzing the scenario, on-chain analytics useful resource Materials Indicators nonetheless had a silver lining for merchants on shorter timeframes.

Associated: BTC to lose $21K regardless of miners’ capitulation exit? 5 issues to know in Bitcoin this week

The weekend dip had nonetheless seen the market protect lows from July, it famous, that means that the 2022 “bear market rally,” which had taken BTC/USD above $25,000, might nonetheless make a return.

Nonetheless, so long as Bitcoin traded beneath its important 200-week shifting common (WMA) close to $23,000, the scenario favored bears.

Defending the LL means the Bear Market Rally might regain momentum if we get some good financial information this week, however a take a look at the #BTC weekly chart exhibits indicators that any potential rally can be brief lived. Dropping the 200 WMA is dangerous for bulls. If 50 and 100 WMAs cross it is worse. pic.twitter.com/j19Vp7SkiS

— Materials Indicators (@MI_Algos) August 22, 2022

An additional submit showed information from the order e-book of main alternate Binance, with a few of the largest-volume whales trying to clear a promote wall instantly above spot worth.

Adopting a equally upbeat view on the long run, dealer and analyst Rekt Capital in the meantime argued that purchasing BTC beneath $35,000 nonetheless represented a “discount.”

The world round that worth stage represents a zone of main alternate quantity, one which is able to determine as a significant hurdle ought to spot worth motion head greater.

In 2015, #BTC bottomed 547 days earlier than the Halving

In 2018, $BTC bottomed 517 days earlier than the Halving (low cost March 2020 crash)

If Bitcoin goes to backside 517-547 days earlier than the upcoming April 2024 Halving…

Then the underside will happen in This fall this 12 months#Crypto #Bitcoin

— Rekt Capital (@rektcapital) August 22, 2022

Further analysis from Rekt Capital nonetheless predicted a macro cycle low coming in This fall if BTC/USD have been to repeat the timing of earlier macro lows from 2015 and 2018.

The views and opinions expressed listed below are solely these of the creator and don’t essentially mirror the views of Cointelegraph.com. Each funding and buying and selling transfer includes danger, it is best to conduct your personal analysis when making a call.