Solana (SOL) value rallied by roughly 75% two months after bottoming out regionally close to $25.75, however the token’s splendid upside transfer is vulnerable to a whole wipeout on account of an ominous bearish technical indicator.

A serious SOL crash setup surfaces

Dubbed a “head-and-shoulders (H&S),” the sample seems when the value varieties three consecutive peaks atop a standard resistance stage (known as the neckline). Notably, the center peak (head) involves be larger than the opposite two shoulders, that are of just about equal top.

Head and shoulders patterns resolve after the value breaks beneath their neckline. In doing so, the value falls by as a lot as the gap between the top’s peak and the neckline when measured from the breakdown level, per a rule of technical evaluation.

It seems SOL has been forming an identical bearish setup on its longer-timeframe charts.

On the weekly chart, the token has been forming the appropriate shoulder of the general sample, suggesting a correction towards the neckline at $27 throughout the second half of 2022. In the meantime, a breakdown beneath $27 may lead to an prolonged correction towards $2.80.

In different phrases, a 95% value decline by the tip of 2022 or early 2023, a setup additionally projected by pseudonymous analyst “PROFIT BLUE.”

I’ll depart this right here, now that it appears higher.. #Solana pic.twitter.com/w03Y4Ffl8o

— PROFIT BLUE (@profit8lue) August 14, 2022

Is that this a bear market rally?

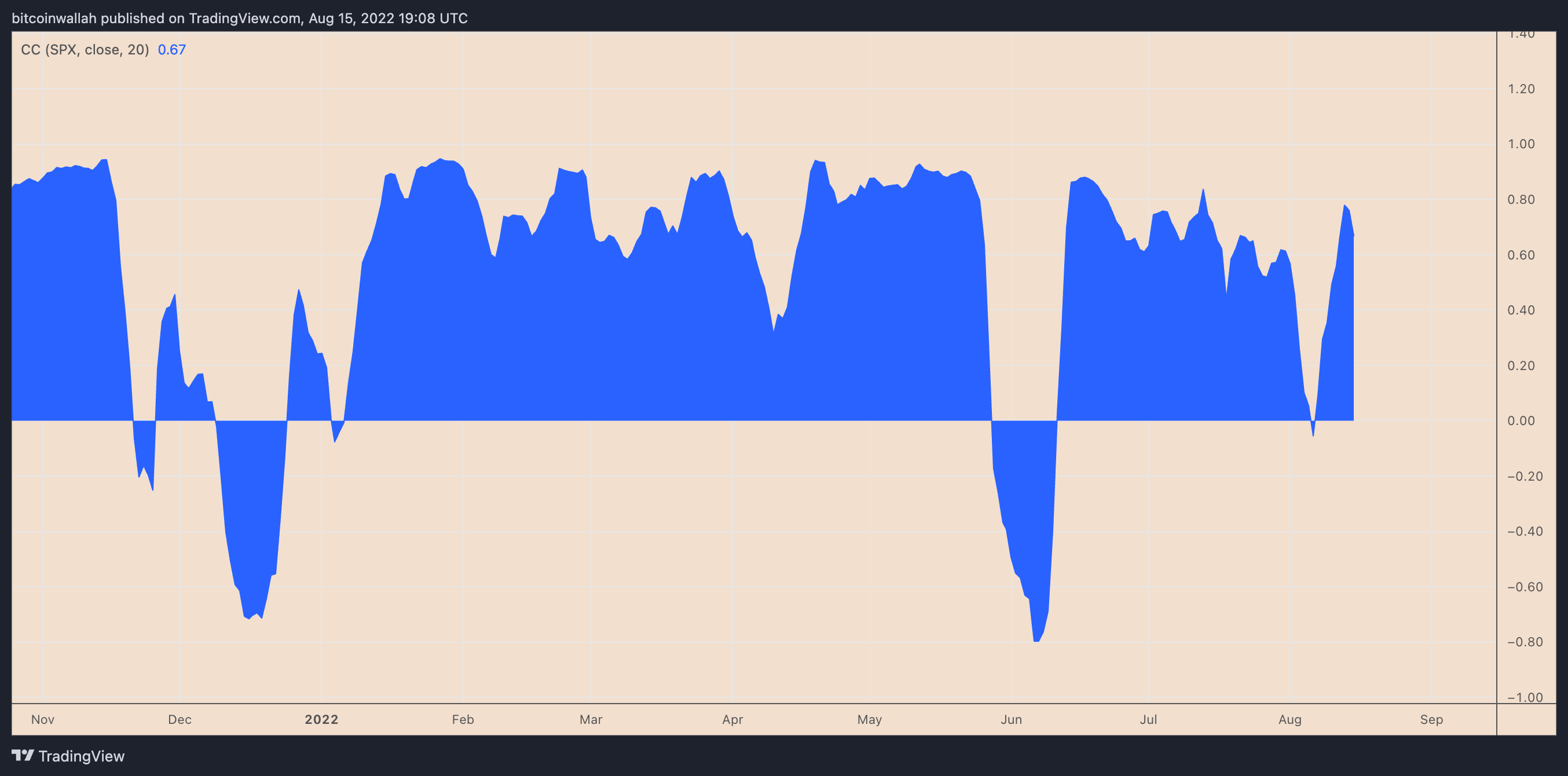

Solana’s extraordinarily eerie bearish setup seems because it carefully tails developments throughout risk-on markets, primarily pushed by the Federal Reserve’s hawkish response to inflationary pressures.

As an illustration, SOL closed the week ending Aug. 14 at a ten.5% revenue, much like Bitcoin (BTC) and the benchmark S&P 500 index. These markets reacted to a softer-than-anticipated U.S. shopper value index (CPI), elevating prospects that the Fed would gradual the tempo of its rate of interest hikes.

However many analysts have warned about these ongoing value rallies within the dangerous corners of the market, citing items of historic proof of comparable bear market bounces. So, SOL’s 75% rebound dangers flip right into a fakeout if its correlation with riskier belongings stays constructive.

From a elementary perspective, Solana additionally faces excessive FUD on account of its recurring community outages and rumored centralization. Nevertheless, the challenge’s backers have launched new upgrades to repair these points, as Cointelegraph mentioned.

However even then, a 95% value crash is simply too “wild,” suggests market analyst IncomeSharks, saying that it might imply Solana is a rug pull challenge like Terra (LUNA) — now Terra Basic (LUNC).

Associated: Fallout from crypto contagion subsides however no market reversal simply but

The subsequent huge drop may have SOL discover bounce alternatives close to a multi-year ascending assist trendline, as proven beneath.

In different phrases, SOL’s bearish continuation may final till its value hits $20, down over 55% from August 16’s value.

The views and opinions expressed listed here are solely these of the writer and don’t essentially mirror the views of Cointelegraph.com. Each funding and buying and selling transfer entails danger, you must conduct your individual analysis when making a call.