Bitcoin (BTC) value continues to battle on the $24,000 resistance and the value was rejected there on Aug. 10, however the rejection was not sufficient to knock the value out of the 52-day-long ascending channel. The channel has a $22,500 help and this bullish formation means that the BTC value will finally hit the $29,000 stage by early October.

Bitcoin derivatives information does present a scarcity of curiosity from leveraged longs (bulls), however on the similar time, it doesn’t value greater odds of a shock crash. Curiously, the newest Bitcoin downturn on Aug. 9 was accompanied by a destructive efficiency from U.S.-listed shares.

On Aug. 8, chip and video graphics card maker Nvidia Corp (NVDA) introduced that its 2Q gross sales would current a 19% drop in comparison with the earlier quarter. Furthermore, the U.S. Senate handed a invoice on Aug. 6 that might negatively influence company earnings. Regardless of liberating $430 billion to fund “local weather, healthcare and tax,” the supply would impose a 1% tax on the inventory buyback by publicly traded firms.

The excessive correlation of conventional belongings to cryptocurrencies stays an enormous concern for some buyers. Buyers shouldn’t be getting forward of themselves even when inflationary strain recedes as a result of the U.S. Fed displays employment information very intently. The newest studying displayed a 3.5% unemployment typical of overly heated markets, forcing the financial authority to maintain elevating rates of interest and revoking stimulus debt buy packages.

Decreasing threat positions ought to be the norm till buyers clearly point out that the U.S. Central Financial institution is nearer to easing the tighter financial insurance policies. That’s exactly why crypto merchants are following macroeconomic numbers so intently.

At present, Bitcoin lacks the energy to interrupt the $24,000 resistance, however merchants ought to examine derivatives to gauge skilled buyers’ sentiment.

Bitcoin derivatives metrics are neutral-to-bearish

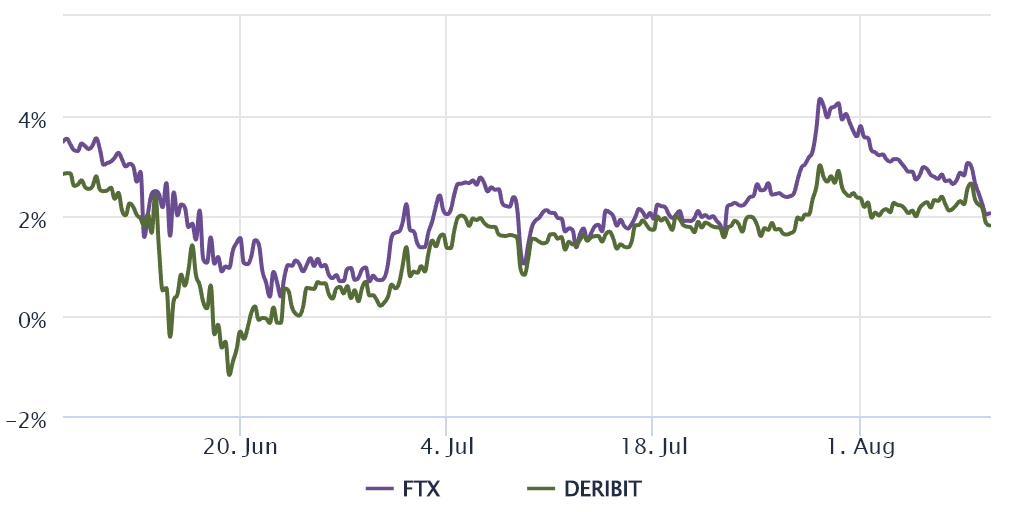

The Bitcoin futures annualized premium measures the distinction between longer-term futures contracts and the present spot market ranges. The indicator ought to run between 4% to eight% to compensate merchants for “locking in” the cash till the contract expiry. Thus, ranges beneath 2% are extraordinarily bearish, whereas the numbers above 10% point out extreme optimism.

The above chart exhibits that this metric dipped beneath 4% on June 1, reflecting merchants’ lack of demand for leverage lengthy (bull) positions. Nevertheless, the current 2% studying will not be significantly regarding, on condition that BTC is down 51% year-to-date.

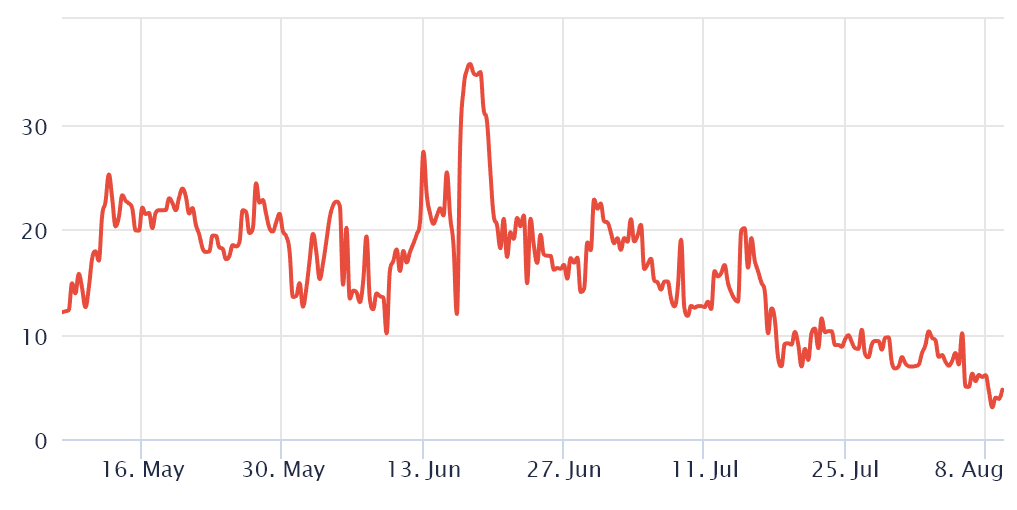

To exclude externalities particular to the futures instrument, merchants should additionally analyze Bitcoin choices markets. The 25% delta skew is a telling signal each time arbitrage desks and market makers overcharge for upside or draw back safety.

Associated: Bitcoin value sees $24K, Ethereum hits 2-month excessive as US inflation shrinks

If these merchants concern a Bitcoin value crash, the skew indicator will transfer above 12%. Alternatively, generalized pleasure displays a destructive 12% skew.

Knowledge exhibits that the skew indicator has been ranging between 3% and 5% since Aug. 5, which is deemed to be a impartial space. Choices merchants are not overcharging for draw back safety, which means they could lack pleasure, however no less than they’ve deserted the “concern” sentiment seen in the previous few months.

Contemplating Bitcoin’s present ascending channel sample, Bitcoin buyers in all probability shouldn’t fear an excessive amount of concerning the lack of shopping for demand, in keeping with futures market information.

After all, there may be wholesome skepticism mirrored in derivatives metrics, however the path to a $29,000 BTC value stays clear so long as inflation and employment statistics are underneath management.

The views and opinions expressed listed below are solely these of the writer and don’t essentially mirror the views of Cointelegraph. Each funding and buying and selling transfer includes threat. You must conduct your personal analysis when making a call