Fifty-one days have handed since Bitcoin (BTC) final closed above $24,000, inflicting even essentially the most bullish dealer to query whether or not a sustainable restoration is possible. Nonetheless, regardless of the lackluster worth motion, bulls have the higher hand on Friday’s $510 million BTC choices expiry.

Buyers have been lowering their danger publicity because the Federal Reserve raises rates of interest and unwinds its report $8.9 trillion stability sheet. Because of this, the Bloomberg Commodity Index (BCOM), which measures worth adjustments in crude oil, pure gasoline, gold, corn and lean hogs, has traded down 9% in the identical interval.

Merchants proceed to hunt safety by way of U.S. Treasuries and money positions as San Francisco Fed president Mary Daly mentioned on Aug. 2 that the central financial institution’s battle in opposition to inflation is “removed from executed.” With that being mentioned, the tighter financial impression on inflation, employment ranges and the worldwide financial system are but to be seen.

Bearish bets are largely under $22,000

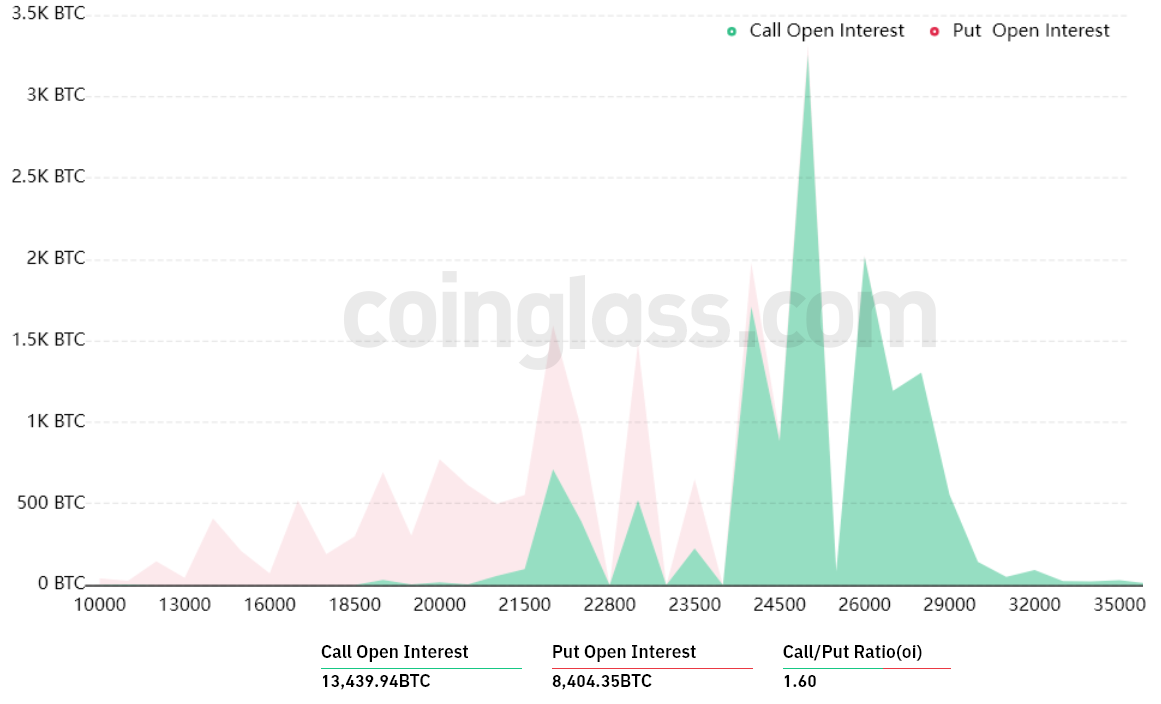

Bitcoin’s restoration above $22,000 on July 27 took bears unexpectedly as a result of solely 28% of the put (promote) choices for Aug. 5 have been positioned above such a worth stage. In the meantime, Bitcoin bulls could have been fooled by the $24,500 pump on July 30, as 59% of their bets lay above $25,000.

A broader view utilizing the 1.60 call-to-put ratio reveals extra bullish bets as a result of the decision (purchase) open curiosity stands at $315 million in opposition to the $195 million put (promote) choices. Nonetheless, as Bitcoin presently sits above $23,000, most bearish bets will possible turn into nugatory.

As an example, if Bitcoin’s worth stays above $23,000 at 8:00 am UTC on Aug. 5, solely $19 million price of those put (promote) choices can be out there. This distinction occurs as a result of there isn’t a use in a proper to promote Bitcoin at $22,000 or $20,000 if it trades above that stage on expiry.

Bulls may pocket a $200 million revenue

Under are the 4 almost certainly eventualities primarily based on the present worth motion. The variety of choices contracts out there on Aug. 5 for name (bull) and put (bear) devices varies, relying on the expiry worth. The imbalance favoring all sides constitutes the theoretical revenue:

- Between $20,000 and $22,000: 100 calls vs. 3,700 places. The online end result favors bears by $75 million.

- Between $22,000 and $24,000: 1,400 calls vs. 1,600 places. The online result’s balanced between name (purchase) and put (promote) devices.

- Between $24,000 and $25,000: 3,800 calls vs. 100 places. The online end result favors bulls to $90 million.

- Between $25,000 and $26,000: 0 calls vs. 7,900 places. Bulls lengthen their positive factors to $200 million.

This crude estimate considers the decision choices utilized in bullish bets and the put choices completely in neutral-to-bearish trades. Even so, this oversimplification disregards extra complicated funding methods.

Associated: Inflation punishes the prudent whereas Bitcoin offers future hope — Jordan Peterson

Bears have much less margin required to suppress Bitcoin worth

Bitcoin bulls have to push the worth above $24,000 on Aug. 5 to safe a $90 million revenue. However, the bears’ best-case state of affairs requires strain under $22,000 to set their positive factors at $75 million.

Nonetheless, Bitcoin bears had $140 million leverage brief positions liquidated on July 26-27, according to knowledge from Coinglass. Consequently, they’ve much less margin required to push the worth decrease within the brief time period.

Probably the most possible state of affairs is a draw, inflicting the Bitcoin worth to vary between $22,000 and $24,000 forward of the Aug. 5 choices expiry.

The views and opinions expressed listed below are solely these of the author and don’t essentially replicate the views of Cointelegraph. Each funding and buying and selling transfer includes danger. It’s best to conduct your personal analysis when making a call.