Bitcoin’s (BTC) value has been caught in a descending channel since July 20 and it’s at present heading towards the $20,000 assist by the top of July. Including to this bearish value motion, BTC is down 50% year-to-date, whereas U.S. listed tech shares, as measured by the Nasdaq-100 index, gathered a 24% loss.

Because the U.S. Federal Reserve tightens its financial insurance policies by elevating rates of interest and scaling again debt asset purchases, danger property have reacted negatively. Fed chair Jerome Powell is ready to wrap up a two-day assembly on July 27 and market analysts anticipate a nominal 0.75% rate of interest hike.

Tensions in Europe escalate because the Russian state-controlled fuel firm Gazprom is slated to chop provides to the Nord Stream 1 pipeline beginning on July 27. In response to CNBC, the corporate blames a turbine upkeep problem, however European officers think in any other case.

Aiding tech shares’ efficiency on July 27 was the U.S. Senate approval of the “Chips and Science” invoice, which provides $52 billion in subsidies backed by debt and taxes for U.S. semiconductor manufacturing. A further $24 billion of credit for the sector is estimated, aiming to spice up the analysis to compete with China.

For these causes, merchants have blended emotions in regards to the upcoming Fed announcement and the impression of a worldwide disaster on cryptocurrency markets. So long as Bitcoin’s correlation to conventional markets stays excessive, particularly tech shares, traders will search safety by transferring away from risk-on asset courses equivalent to cryptocurrencies.

Bulls positioned their hope on $24,000 and better

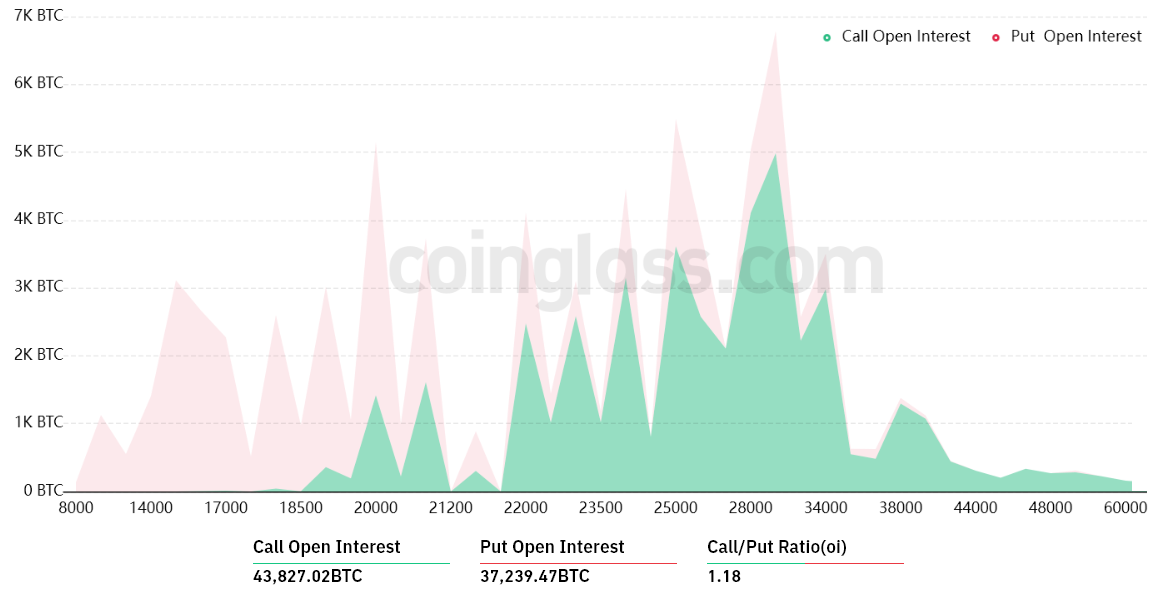

The open curiosity for the July 29 Bitcoin month-to-month choices expiry is $1.76 billion, however the precise determine will likely be decrease since bulls had been caught abruptly as BTC failed to interrupt the $24,000 resistance on July 20.

The 1.18 call-to-put ratio displays the $950 million name (purchase) open curiosity in opposition to the $810 million put (promote) choices. Nonetheless, as Bitcoin stands beneath $23,000, a lot of the bullish bets will possible turn into nugatory.

For example, if Bitcoin’s value stays beneath $23,000 on July 29, bulls will solely have $145 million value of those name (purchase) choices. This distinction occurs as a result of there isn’t a use in a proper to purchase Bitcoin at $23,000 if it trades beneath that degree on July 29 at 8:00 am UTC.

Bears can safe a $360 million revenue on Friday

Beneath are the 4 most probably situations based mostly on the present value motion. The variety of choices contracts accessible on July 29 for name (purchase) and put (promote) devices varies, relying on the expiry value. The imbalance favoring both sides constitutes the theoretical revenue:

- Between $19,000 and $20,000: 400 calls (purchase) vs. 19,300 places (promote). The web end result favors bears by $360 million.

- Between $20,000 and $22,000: 3,900 calls (purchase) vs. 11,800 places (promote). Bears have a $230 million benefit.

- Between $22,000 and $24,000: 10,300 calls (purchase) vs. 8,600 places (promote). The web result’s balanced between bulls and bears.

- Between $24,000 and $25,000: 14,400 calls (purchase) vs. 7,100 places (promote). Bulls have a $175 million benefit.

This crude estimate considers the decision choices utilized in bullish bets and the put choices solely in neutral-to-bearish trades. Even so, this oversimplification disregards extra complicated funding methods.

For instance, a dealer might have offered a name possibility, successfully gaining adverse publicity to Bitcoin above a selected value, however sadly, there isn’t any simple option to estimate this impact.

Bitcoin bears must stress the value beneath $20,000 on July 29 to safe a $360 million revenue. However, bulls can keep away from a loss by pushing BTC above $22,000, balancing the legitimate bets from each side. Bulls appear closely vested to place their losses behind and begin August with a clear sheet, but it surely might nonetheless go both means.

The views and opinions expressed listed below are solely these of the author and don’t essentially replicate the views of Cointelegraph. Each funding and buying and selling transfer includes danger. You must conduct your individual analysis when making a choice.