With Ethereum’s transition to proof-of-stake (PoS) now behind us, extra persons are pointing to the community’s environmental advantages, saying ESG-minded buyers will flock to ETH as they be taught extra about it.

Following Ethereum’s transition from proof-of-work to proof-of-stake – an occasion often known as the Merge – the community will use 99.95% much less power in comparison with earlier than, in accordance with the Ethereum Basis. Moreover, Ethereum co-founder Vitalik Buterin additionally retweeted a declare on Thursday saying “the Merge will scale back worldwide electrical energy consumption by 0.2%.”

Bitcoin, by comparability, continues to depend on the way more energy-intensive proof-of-work system as its consensus mechanism.

Not surprisingly, the promise of considerably decrease power utilization by Ethereum is engaging to ESG buyers, who take into account it necessary to scale back power use and – specifically – carbon emissions.

In line with Conor Svensson, CEO and Founding father of Web3 Labs, the swap to proof-of-stake for Ethereum might even make Bitcoin and different networks that stay on proof-of-work seem much less engaging to those buyers.

“If you happen to’re a company seeking to spend money on cryptocurrencies, given the ESG narrative I think about a variety of them shall be barely hesitant about getting publicity to Bitcoin when there’s this different asset which doesn’t use enormous quantities of energy,” Svensson was cited in a latest Night Normal article as saying, whereas additionally noting:

“I do imagine that Ethereum will long-term overtake Bitcoin.”

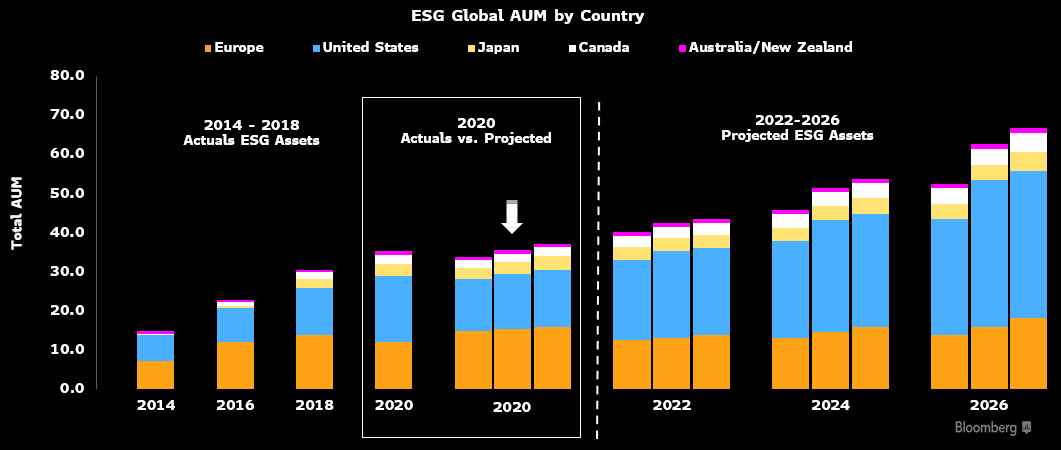

ESG is brief for environmental, social and governance, and so-called ESG investing has turn out to be extraordinarily fashionable amongst each retail buyers and monetary establishments lately. In line with a Bloomberg report on ESG investing, belongings below administration by ESG funds are set to succeed in $41trn by the top of 2022, with ESG-related belongings now accounting for one in three {dollars} managed globally.

ETH is the world’s second-most useful cryptoasset with a market capitalization on the time of writing of simply over $173bn. And though some imagine that ETH will at some point overtake BTC as essentially the most useful cryptoasset, an occasion dubbed “the flippening,” ETH’s market cap nonetheless stays lower than half that of BTC.

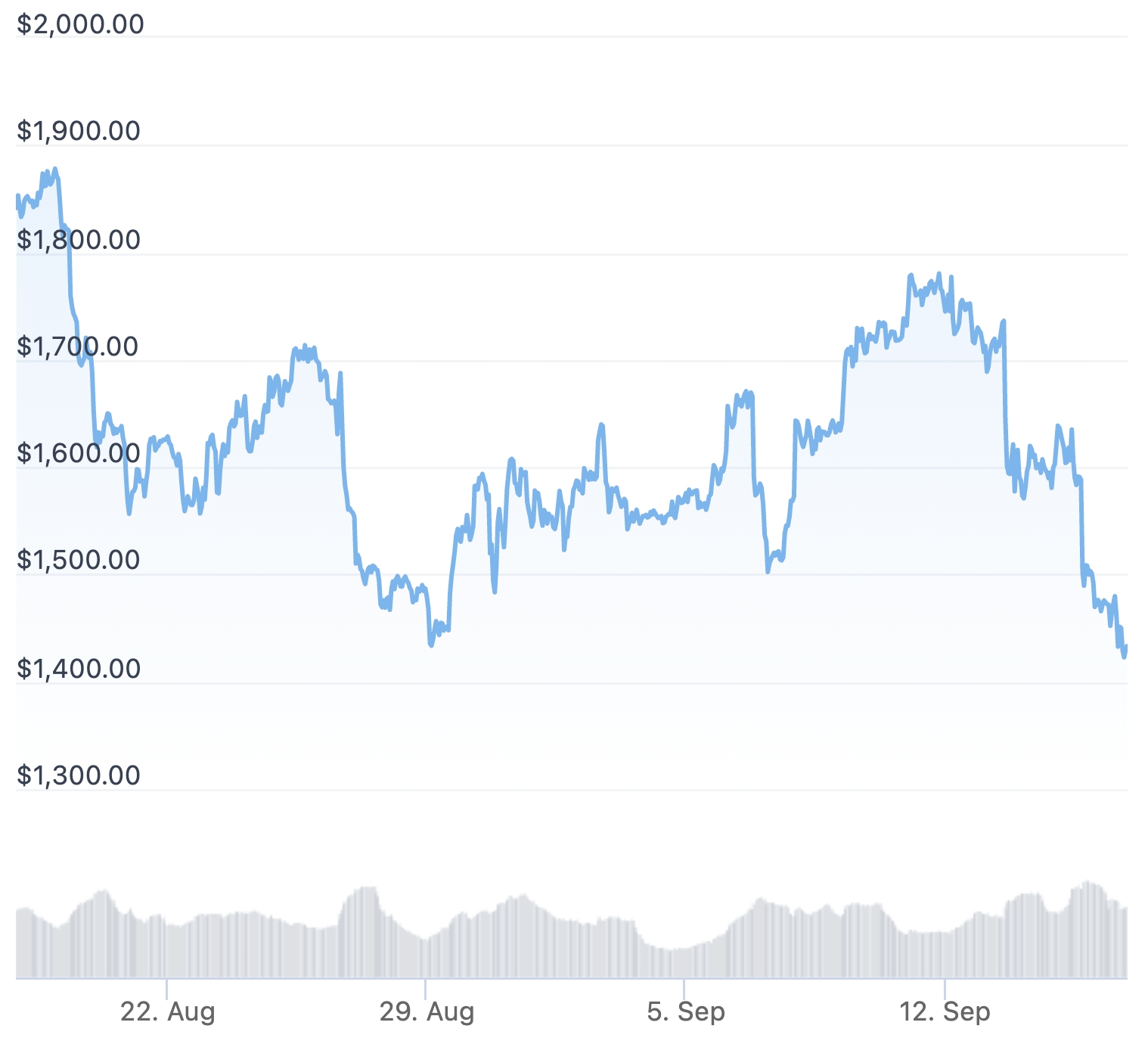

ETH fell in value instantly following the Merge, and was as of Friday at 9:50 pm UTC down 4.2% for the previous 24 hours to a value of $1,435.