The ethereum (ETH) choices market exhibits continued sturdy urge for food for bullish bets on ETH amongst merchants, regardless of falling spot costs. The query now’s if it is a signal that good cash is positioning for a future rally, and if now is an efficient time to start out dollar-cost averaging (DCA) into ETH.

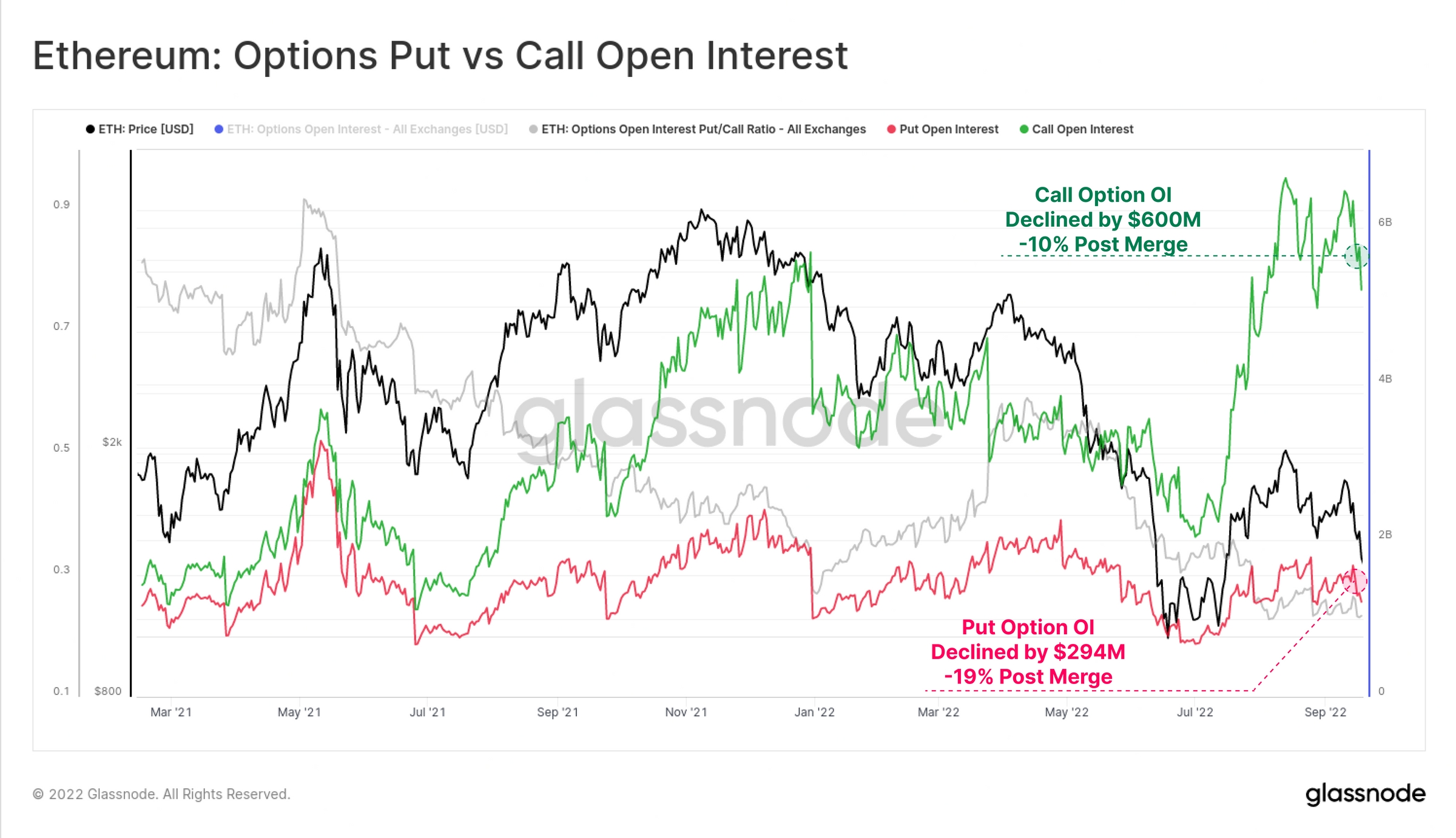

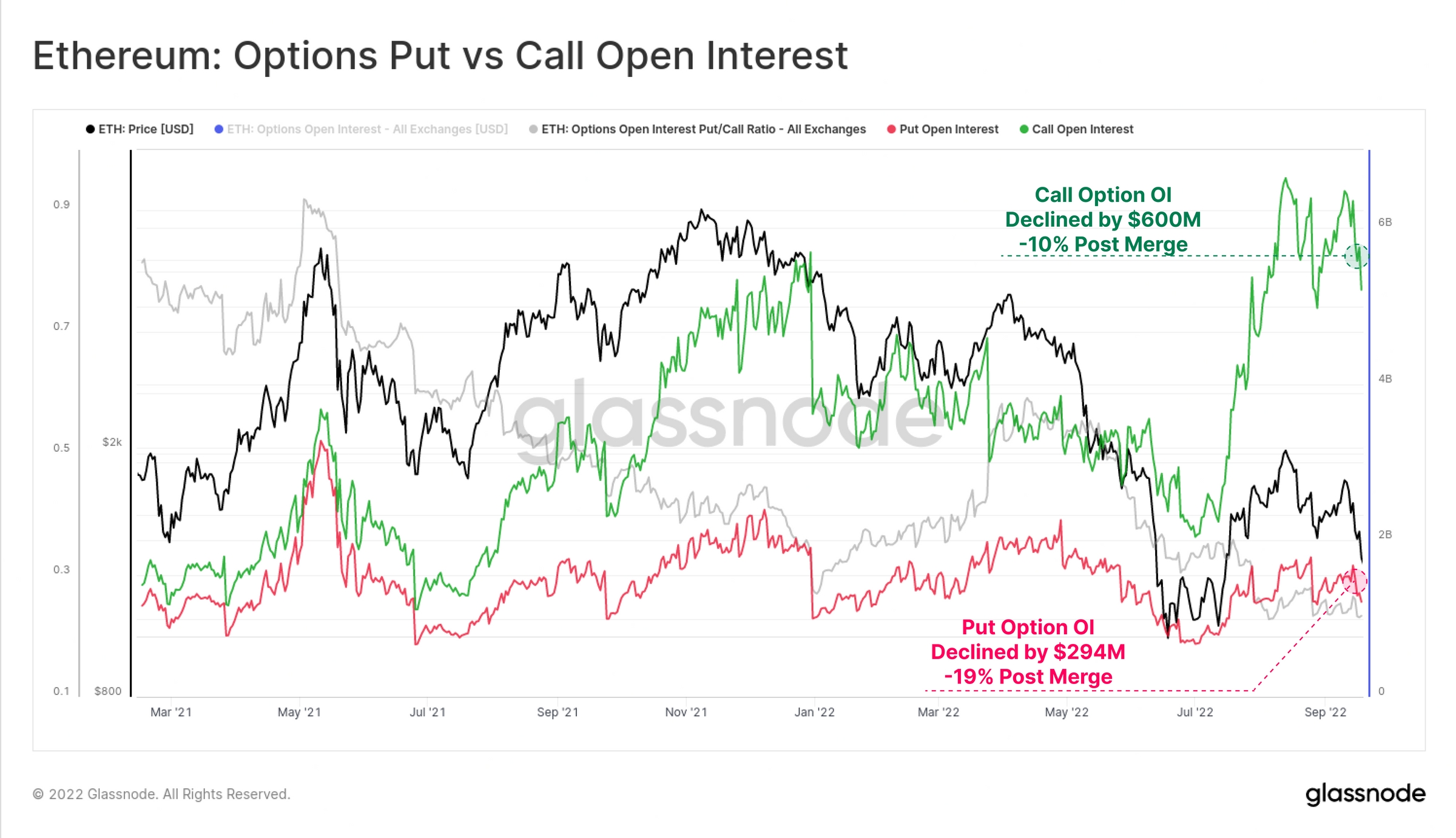

The surprisingly bullish bias out there for ETH choices was identified within the newest The Week Onchain report from Glassnode, the place the agency famous that the worth of excellent name choices stays increased than the norm from 2021.

A name choice is a wager that the spot value of an asset will rise, whereas a put choice is a wager that the value will fall.

In response to Glassnode, there’s now a complete of $5.2bn in excellent name choice worth for ETH, which is “a lot increased” than what was the norm final 12 months. On the similar time, put choice positions have seen a sharper drop in worth than name choice positions, with $294m in internet place worth closed.

“In some ways, it seems that ETH markets stay closely utilized, levered up, and speculating on additional upside, regardless of a -22% ETH value correction,” the crypto analytics agency wrote within the report.

Time to DCA into ETH

With such a heavy bullish bias within the ETH choices market, it’s solely pure to ask if now is an efficient time to start out shifting slowly into ETH, maybe by way of the so-called dollar-cost common (DCA) technique.

The DCA technique has traditionally been a great way to take a place in main cryptoassets, and stays fashionable each within the Ethereum and Bitcoin (BTC) communities as a technique to make investments with out making an attempt to completely time tops and bottoms, which only a few are in a position to do.

With ETH spot costs now as little as they’re, it appears as if beginning to DCA into ETH now might repay within the long-run. And with the Merge already behind us and extensively deemed a hit, is it actually so stunning that refined choices merchants have already positioned themselves for a rally?

As Glassnode put it of their report:

“The Ethereum Merge was a hit, and a historic one to say the least. A few years of devoted analysis, improvement, and technique have now come collectively to realize a exceptional engineering feat.”

Possibly it’s solely a matter of time earlier than the market additionally realizes this.

The ethereum (ETH) choices market exhibits continued sturdy urge for food for bullish bets on ETH amongst merchants, regardless of falling spot costs. The query now’s if it is a signal that good cash is positioning for a future rally, and if now is an efficient time to start out dollar-cost averaging (DCA) into ETH.

The surprisingly bullish bias out there for ETH choices was identified within the newest The Week Onchain report from Glassnode, the place the agency famous that the worth of excellent name choices stays increased than the norm from 2021.

A name choice is a wager that the spot value of an asset will rise, whereas a put choice is a wager that the value will fall.

In response to Glassnode, there’s now a complete of $5.2bn in excellent name choice worth for ETH, which is “a lot increased” than what was the norm final 12 months. On the similar time, put choice positions have seen a sharper drop in worth than name choice positions, with $294m in internet place worth closed.

“In some ways, it seems that ETH markets stay closely utilized, levered up, and speculating on additional upside, regardless of a -22% ETH value correction,” the crypto analytics agency wrote within the report.

Time to DCA into ETH

With such a heavy bullish bias within the ETH choices market, it’s solely pure to ask if now is an efficient time to start out shifting slowly into ETH, maybe by way of the so-called dollar-cost common (DCA) technique.

The DCA technique has traditionally been a great way to take a place in main cryptoassets, and stays fashionable each within the Ethereum and Bitcoin (BTC) communities as a technique to make investments with out making an attempt to completely time tops and bottoms, which only a few are in a position to do.

With ETH spot costs now as little as they’re, it appears as if beginning to DCA into ETH now might repay within the long-run. And with the Merge already behind us and extensively deemed a hit, is it actually so stunning that refined choices merchants have already positioned themselves for a rally?

As Glassnode put it of their report:

“The Ethereum Merge was a hit, and a historic one to say the least. A few years of devoted analysis, improvement, and technique have now come collectively to realize a exceptional engineering feat.”

Possibly it’s solely a matter of time earlier than the market additionally realizes this.