The connection between Bitcoin and conventional currencies is a posh one. Bitcoin seeks to undermine the standard approach of coping with cash, so Bitcoin vs conventional cash is a pure opposition.

The distinction of Bitcoin from…

The connection between Bitcoin and conventional currencies is a posh one. Bitcoin seeks to undermine the standard approach of coping with cash, so Bitcoin versus conventional cash is a pure opposition. This text outlines the principle variations between the 2.

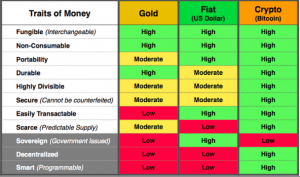

Traits of cash

Over the historical past of humanity, cash took many varieties. There was barter, bodily objects like rocks or shells, valuable metals, financial institution notes, paper payments, digital cash, and at last decentralized digital currencies like Bitcoin.

Over time, folks observed essentially the most fascinating traits that cash ought to have. For the foreign money to be helpful and handy, it must be:

- Divisible — could be changed into smaller items for sure makes use of like paying a certain quantity or micro-payments.

- Non-consumable — can’t be consumed for functions apart from an change of worth.

- Moveable — could be simply carried round.

- Sturdy — doesn’t put on away or depreciate by time or in sure situations.

- Safe — can’t be counterfeited.

- Simply transferable.

- Scarce — can’t be replicated with out finish.

- Fungible — each bit has the identical worth as its equal.

- Recognizable — it’s acknowledged and accepted as a method of transaction.

Right here is how gold, fiat currencies, and Bitcoin examine within the context of those traits.

The primary distinction of Bitcoin from conventional currencies lies in the truth that nobody controls Bitcoin as it’s decentralized. It permits Bitcoin to be an impartial peer-to-peer cash system that may perform no matter anybody’s needs. It depends on the mixed computing energy of the community contributors, every of which is equal amongst themselves — no one is kind of necessary than the others. Moreover, it helps convey down the price of utilizing the system by ideally eliminating charges and transaction instances, each of which banks want to remain in enterprise.

Nobody can have an affect over your cash and transactions you ship or obtain.

In distinction, fiat currencies depend on centralized entities like central banks, industrial banks, governments, fee processors like VISA or Mastercard, and different intermediaries. Any of these organizations have an authority to resolve whether or not to approve your transaction, whether or not you may ship cash to sure folks or organizations, or if the cash you’re utilizing is authorized or not. These processes additionally embody in-depth surveillance and data-sharing on the whole lot you do along with your cash.

Different vital distinction is that not like fiat, Bitcoin will not be sovereign. There may be nothing backing Bitcoin, which implies it’s worth will not be hooked up to any political or financial scenario, and it may exist independently outdoors of the standard system.

Final however not least, Bitcoin introduces a brand new dimension of programmability. It implies that sooner or later, Bitcoin transactions could be hooked up to good contracts or different applications that execute solely after sure situations are met. Such a function would permit constructing further options on prime of bitcoin, similar to fame administration techniques, insurance coverage contracts, or related. Such contracts wouldn’t require any third-party intervention to execute. Primarily, it introduces a brand new dimension to the idea of conventional money.

However Bitcoin isn’t backed by something?

When asking how Bitcoin is completely different from the greenback, most individuals will let you know that it’s as a result of Bitcoin will not be backed by something. This isn’t totally true: whereas Bitcoin certainly has nothing bodily to again it, neither does the greenback. Traditionally talking, up till 1971, most currencies have been backed by a commodity, normally gold or silver. This isn’t the case anymore. Additionally, there’s loads of room for the argument that each Bitcoin is roofed by the quantity of electrical energy used whereas mining it.

All in all, not like conventional currencies, Bitcoin:

- Has no central authority which claims it backs cash.

- Is a topic to deflation as a result of synthetic shortage, whereas central banks can print more cash anytime.

- Has each transaction without end recorded on an immutable public ledger.

- Requires transaction charges to be paid to miners, which serves like paying taxes to the federal government, besides that taxes could be evaded whereas it’s inconceivable to finish a switch with out paying charges on the blockchain.

- Transactions are accomplished over the web and embody public addresses, whereas money transactions are nameless and depart no path behind.

Many individuals name Bitcoin the subsequent step within the evolution of cash. Since we’ve by no means had cash like Bitcoin earlier than, it’s regular to query the idea and examine it with conventional currencies.

Hopefully, now you already know the important thing variations between Bitcoin and traditional cash.

In case you appreciated this text, don’t overlook to share it with your pals.