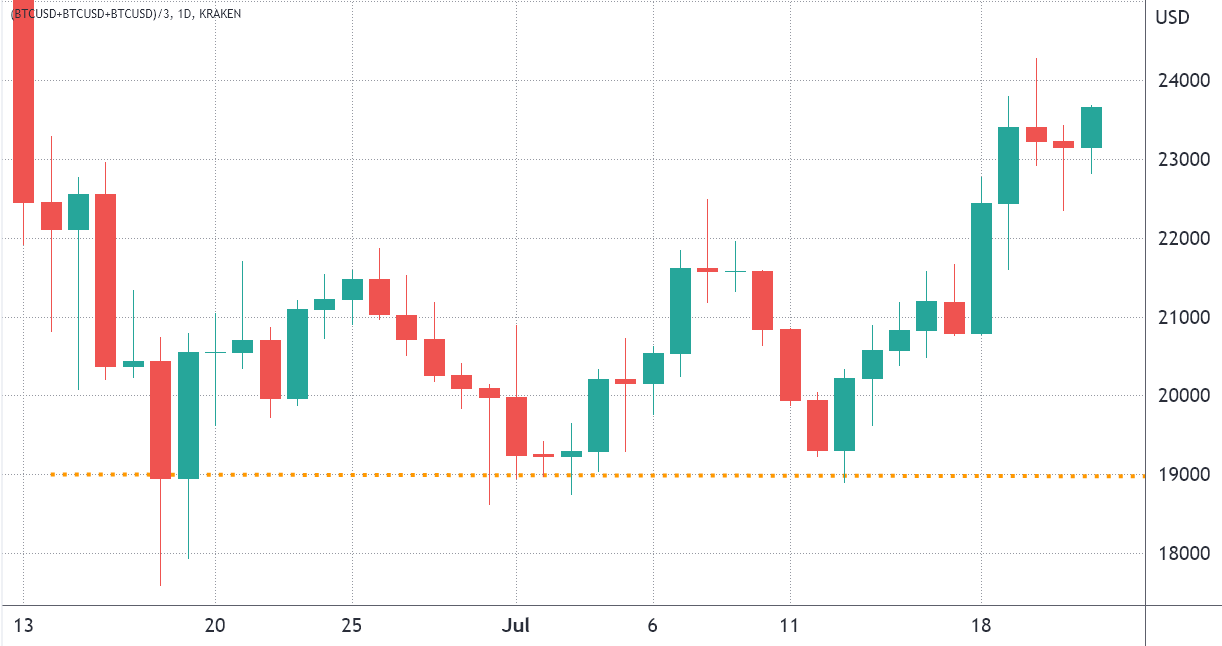

The earlier $19,000 Bitcoin (BTC) assist degree turns into extra distant after the 22.5% achieve in 9 days. Nevertheless, little optimism has been instilled because the influence of the Three Arrows Capital (3AC), Voyager, Babel Finance and Celsius crises stay unsure. Furthermore, the contagion has claimed one more sufferer after Thai crypto alternate Zipmex halted withdrawals on July 20.

Bulls’ hopes rely upon the $23,000 assist strengthening as time goes by, however derivatives metrics present skilled merchants are nonetheless extremely skeptical of steady restoration.

Macroeconomic headwinds favor scarce property

Some analysts attribute the crypto market energy to China’s lower-than-expected gross home product knowledge, inflicting traders to anticipate additional expansionary measures by policymakers. China’s economic system expanded 0.4% within the second quarter versus the earlier yr, because the nation continued to battle with self-imposed restrictions to curb one other outbreak of COVID-19 infections, according to CNBC.

The UK’s 9.4% inflation in June marked a 40-year excessive, and to supposedly support the inhabitants, Chancellor of the Exchequer Nadhim Zahawi introduced a $44.5 billion (GBP 37 billion) help bundle for susceptible households.

Underneath these circumstances, Bitcoin reversed its downtrend as policymakers scrambled to unravel the seemingly unattainable downside of slowing economies amid ever-increasing authorities debt.

Nevertheless, the cryptocurrency sector faces its personal points, together with regulatory uncertainties. For example, on July 21, the US Securities and Alternate Fee (SEC) labeled 9 tokens as “crypto asset securities,” thus not solely falling underneath the regulatory physique’s purview however accountable for having didn’t register with it.

Expressly, the SEC referred to Powerledger (POWR), Kromatika (KROM), DFX Finance (DFX), Amp (AMP), Rally (RLY), Rari Governance Token (RGT), DerivaDAO (DDX), LCX, and XYO. The regulator introduced prices in opposition to a former Coinbase product supervisor for “insider buying and selling” after they allegedly used personal data for private profit.

At present, Bitcoin traders face an excessive amount of uncertainty regardless of the seemingly useful macroeconomic backdrop, which ought to favor scarce property reminiscent of BTC. For that reason, an evaluation of derivatives knowledge is efficacious in understanding whether or not traders are pricing increased odds of a downturn.

Professional merchants stay skeptical of value restoration

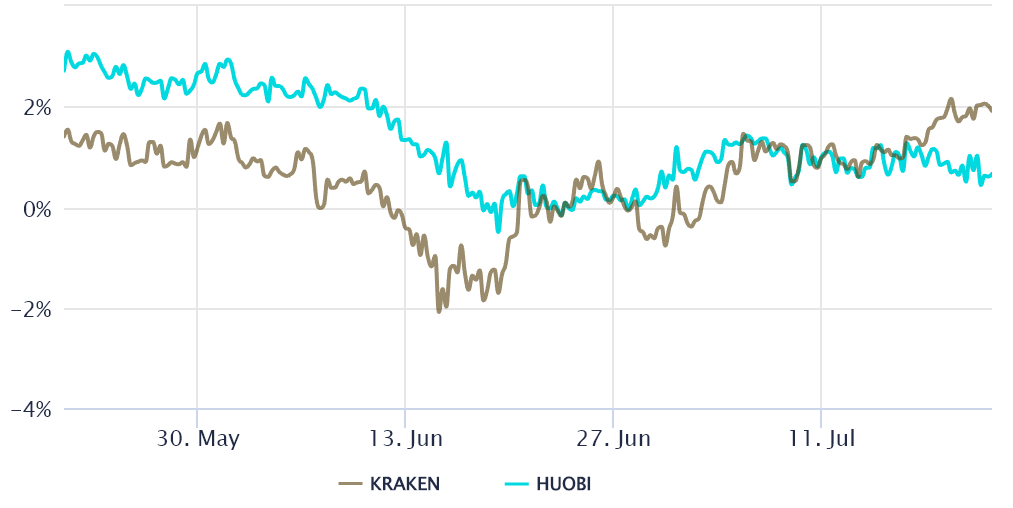

Retail merchants normally keep away from quarterly futures as a result of their value distinction from spot markets. Nonetheless, they’re skilled merchants’ most popular devices as a result of they forestall the perpetual fluctuation of contracts’ funding charges.

These fixed-month contracts normally commerce at a slight premium to identify markets as a result of traders demand more cash to withhold the settlement. However this case is just not unique to crypto markets, so futures ought to commerce at a 4% to 10% annualized premium in wholesome markets.

The Bitcoin’s futures premium flirted with the unfavourable space in mid-June, one thing is usually seen throughout extraordinarily bearish durations. The mere 1% foundation price, or annualized premium, displays skilled merchants’ unwillingness to create leverage lengthy (bull) positions. Buyers stay skeptical of the worth restoration regardless of the low price of opening a bullish commerce.

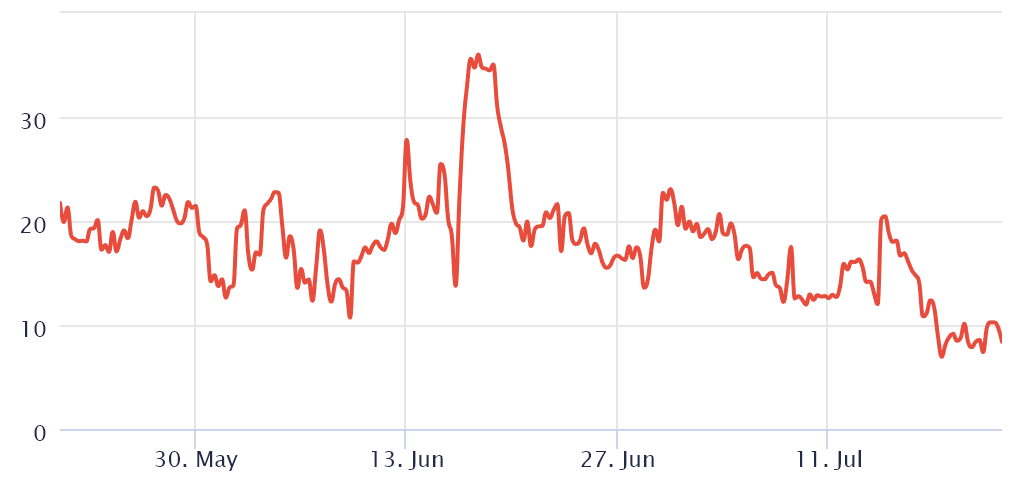

One should additionally analyze the Bitcoin choices markets to exclude externalities particular to the futures instrument. For instance, the 25% delta skew is a telling signal when market makers and arbitrage desks are overcharging for upside or draw back safety.

In bear markets, choices traders give increased odds for a value dump, inflicting the skew indicator to rise above 12%, whereas the other holds true throughout bullish markets.

The 30-day delta skew peaked at 21% on July 14 as Bitcoin struggled to interrupt the $20,000 resistance. The upper the indicator, the much less inclined choices merchants are to supply draw back safety.

Extra lately, the indicator moved beneath the 12% threshold, getting into a impartial space, and not sitting on the ranges reflecting excessive aversion. Consequently, choices markets at present show a balanced threat evaluation between a bull run and one other re-test of the $20,000 space.

Some metrics recommend that the Bitcoin cycle backside is behind us, however till merchants have a greater view of the regulatory outlook and centralized crypto service suppliers’ liquidity because the Three Arrows Capital disaster unfolds, the chances of breaking above $24,000 stay unsure.

The views and opinions expressed listed here are solely these of the author and don’t essentially mirror the views of Cointelegraph. Each funding and buying and selling transfer entails threat. It is best to conduct your individual analysis when making a call.