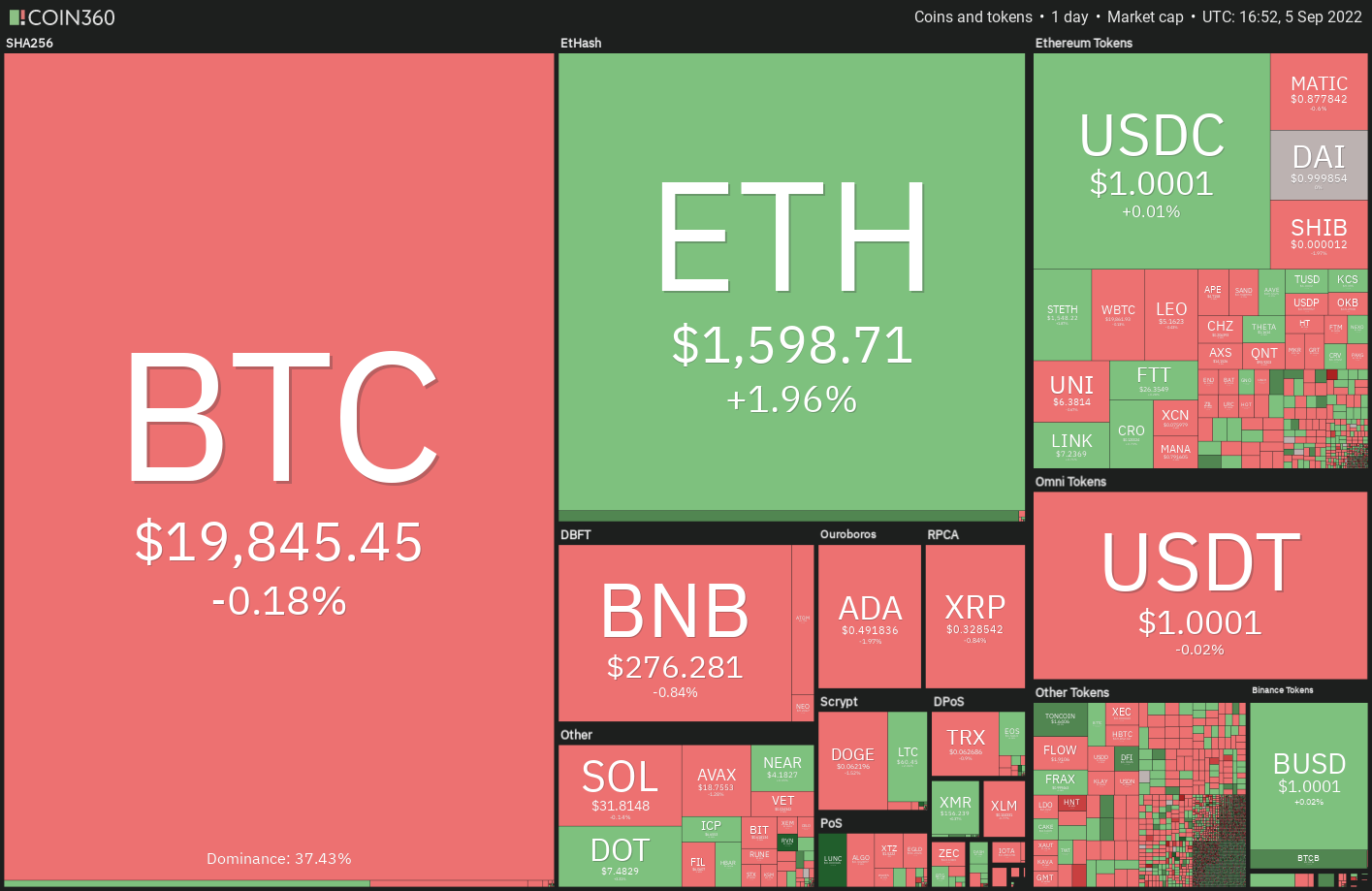

The cryptocurrency markets have been quiet over the weekend. The sideways value motion continues on Sept. 5 and there are unlikely to be any contemporary triggers from america equities markets, that are closed for Labor Day.

Nonetheless, the bullish image for cryptocurrencies seems clouded because the power disaster in Europe despatched the euro to a two-decade low versus the U.S. greenback. In the meantime, the U.S. greenback index (DXY) which has an inverse correlation with the equities markets and cryptocurrencies soared above 110 for the primary time since June 2002.

A constructive signal amongst all of the mayhem is that Bitcoin (BTC) has not given up a lot floor over the previous few days and continues to commerce close to the psychological degree of $20,000. This means that merchants should not panicking and dumping their positions in a rush.

Might bulls push and maintain Bitcoin above $20,000 and can this set off shopping for in altcoins? Let’s examine the charts of the top-10 cryptocurrencies to seek out out.

BTC/USDT

Bitcoin has been caught inside a good vary between $19,520 and $20,576 for the previous few days. This means indecision among the many bulls and the bears. Though bulls are shopping for the dips, they’ve did not clear the overhead resistance.

The downsloping 20-day exponential transferring common (EMA) ($20,775) and the relative energy index (RSI) within the adverse territory enhance the probability of a break beneath $19,520. If that occurs, the BTC/USDT pair might drop to the robust assist zone between $18,910 and $18,626.

Patrons are anticipated to defend this zone with all their may. If the rebound breaks above the 20-day EMA, the pair might rise to the 50-day easy transferring common (SMA) ($22,253). The bulls must clear this hurdle to open the doorways for a attainable rally to $25,211.

Conversely, if bears sink the value beneath $18,626, the pair might retest the ultimate assist at $17,622. A break beneath this assist might sign the resumption of the downtrend.

ETH/USDT

Ether (ETH) has been caught between the 20-day EMA ($1,605) and the neckline of the pinnacle and shoulders (H&S) sample since Aug. 31 however this tight-range buying and selling is unlikely to proceed for lengthy.

If patrons push and maintain the value above the 20-day EMA, the ETH/USDT pair might rally to the overhead resistance at $1,700. This is a vital degree to control as a result of a break and shut above it might sign that bulls are again in management. The pair might then rally to $2,030 and later to the downtrend line.

This bullish view shall be invalidated within the close to time period if the value turns down from the transferring averages and breaks beneath $1,422. If that occurs, the pair might slide to $1,280. The bulls are anticipated to defend this degree with vigor but when the bears overpower them, the decline might lengthen to the sample goal of $1,050.

BNB/USDT

BNB has been buying and selling close to the robust assist of $275 for the previous few days however the bulls haven’t been capable of obtain a robust rebound off it. This means an absence of demand at greater ranges.

The 20-day EMA ($286) has been sloping down and the RSI is beneath 41, indicating that bears have the higher hand. If the value breaks and closes beneath $275, the BNB/USDT pair will full a bearish head and shoulders sample. The pair might then begin its decline to $240 and later to the sample goal of $212.

Opposite to this assumption, if the value turns up from the present degree and breaks above the transferring averages, it can counsel that bulls are again within the recreation. The pair might then rise to the overhead resistance at $308.

XRP/USDT

Ripple (XRP) has been caught between $0.32 and $0.34 for the previous few days however this tight vary buying and selling is unlikely to proceed for lengthy.

The bears will try to sink the value beneath $0.32. In the event that they succeed, the XRP/USDT pair might lengthen its decline to the essential assist at $0.30. Patrons are prone to defend this degree aggressively as that they had achieved on three earlier events.

Alternatively, if the value rebounds off $0.32 and breaks above $0.34, it can counsel a short-term benefit to the bulls. The pair might then rise to the 50-day SMA ($0.36) and later to the stiff overhead resistance at $0.39.

ADA/USDT

Cardano (ADA) broke and closed above the 50-day SMA ($0.49) on Sept. 4 however the bulls couldn’t maintain the breakout. This means that bears proceed to promote on rallies.

The value turned down and broke beneath the 50-day SMA on Sept. 5, indicating that bears try to entice the aggressive bulls. If the value dips beneath the 20-day EMA ($0.47), the pair might drop to $0.44 and later to $0.42.

Conversely, if the value rebounds off the 20-day EMA and rises above $0.51, it can counsel a change in sentiment from promoting on rallies to purchasing on dips. The ADA/USDT pair might then rise to the downtrend line.

SOL/USDT

Solana (SOL) has been buying and selling close to $32 for the previous few days however a adverse signal is that patrons haven’t been capable of push and maintain the value above it.

If the value turns down and slips beneath $30, the SOL/USDT pair might decline to the important assist at $26. This is a vital degree for the bulls to defend as a result of if this assist offers method, the pair might begin the following leg of the downtrend.

Within the close to time period, if patrons push the value above the 20-day EMA ($34), it can counsel that the promoting stress may very well be decreasing. The pair might then try a rally to the 50-day SMA ($38) the place the bears might once more pose a robust problem.

DOGE/USDT

Dogecoin (DOGE) has stayed above the rapid assist at $0.06 for the previous few days however the bulls have failed to attain a robust rebound off it. This means that demand dries up at greater ranges.

A decent consolidation close to a assist often leads to a breakdown. The downsloping 20-day EMA ($0.06) and the RSI within the adverse zone point out the trail of least resistance is to the draw back. If bears sink and maintain the value beneath $0.06, the DOGE/USDT pair might drop to the essential assist at $0.05.

To invalidate this adverse view, patrons must push and maintain the pair above $0.07. In the event that they handle to do this, the pair might rise towards the overhead resistance at $0.09.

Associated: ETH Merge: CoinGecko co-founder shares technique for forked tokens

DOT/USDT

Polkadot (DOT) stays caught inside a wide variety between $6 and $10 for the previous a number of days. The value has step by step been inching greater and the bulls try to clear the overhead hurdle on the transferring averages.

In the event that they handle to do this, it can counsel that decrease ranges proceed to draw patrons. The DOT/USDT pair might then try a rally to $9.17 and later to the overhead resistance at $10.

Then again, if the value fails to rise above the transferring averages, it can counsel that bears are energetic at greater ranges. The sellers will then try to sink the value beneath the robust assist at $6.79. If that occurs, the pair might drop to the essential assist at $6, which is prone to entice robust shopping for.

The value motion inside a wide variety is often random and unstable. Therefore, it’s tough to mission the short-term value strikes contained in the vary with certainty.

MATIC/USDT

Polygon (MATIC) has been range-bound between $1.05 and $0.75 for the previous a number of days. Though bulls pushed the value above the 50-day SMA ($0.88) on Sept. 1, they haven’t been capable of construct upon this energy. This means that demand dries up at greater ranges.

The bears will try to sink the value beneath the 20-day EMA ($0.85). In the event that they succeed, the MATIC/USDT pair might drop towards the robust assist at $0.75.

This is a vital degree for the bulls to defend as a result of a break and shut beneath it might full a head and shoulders sample. The pair might then begin a correction to $0.63 and later to the sample goal at $0.45.

Quite the opposite, if the value rebounds off the transferring averages and rises above $0.91, the probability of a rally to $1.05 will increase. The bears are anticipated to pose a stiff resistance at this degree.

SHIB/USDT

Patrons pushed Shiba Inu (SHIB) above the 20-day EMA ($0.000013) on Sept. 4 however the lengthy wick on the day’s candlestick reveals that bears are promoting at greater ranges.

The value turned down and slipped beneath the transferring averages on Sept. 5. The bears will now attempt to sink the SHIB/USDT pair to $0.000012, which is prone to entice patrons. The 20-day EMA is flattening out and the RSI is slightly below the midpoint, indicating a stability between patrons and sellers.

This stability might tilt in favor of the bears in the event that they pull the value beneath $0.000012. The pair might then decline to $0.000010. Alternatively, if bulls drive and maintain the value above $0.000014, the pair might try a rally to $0.000018.

The views and opinions expressed listed below are solely these of the writer and don’t essentially replicate the views of Cointelegraph. Each funding and buying and selling transfer includes threat. You must conduct your personal analysis when making a choice.

Market knowledge is offered by HitBTC change.