The worth of Ethereum’s native ETH token rallied on Thursday after the Ethereum Basis on Wednesday introduced that the Bellatrix improve – a key step that have to be accomplished earlier than the Merge – is scheduled for September 6.

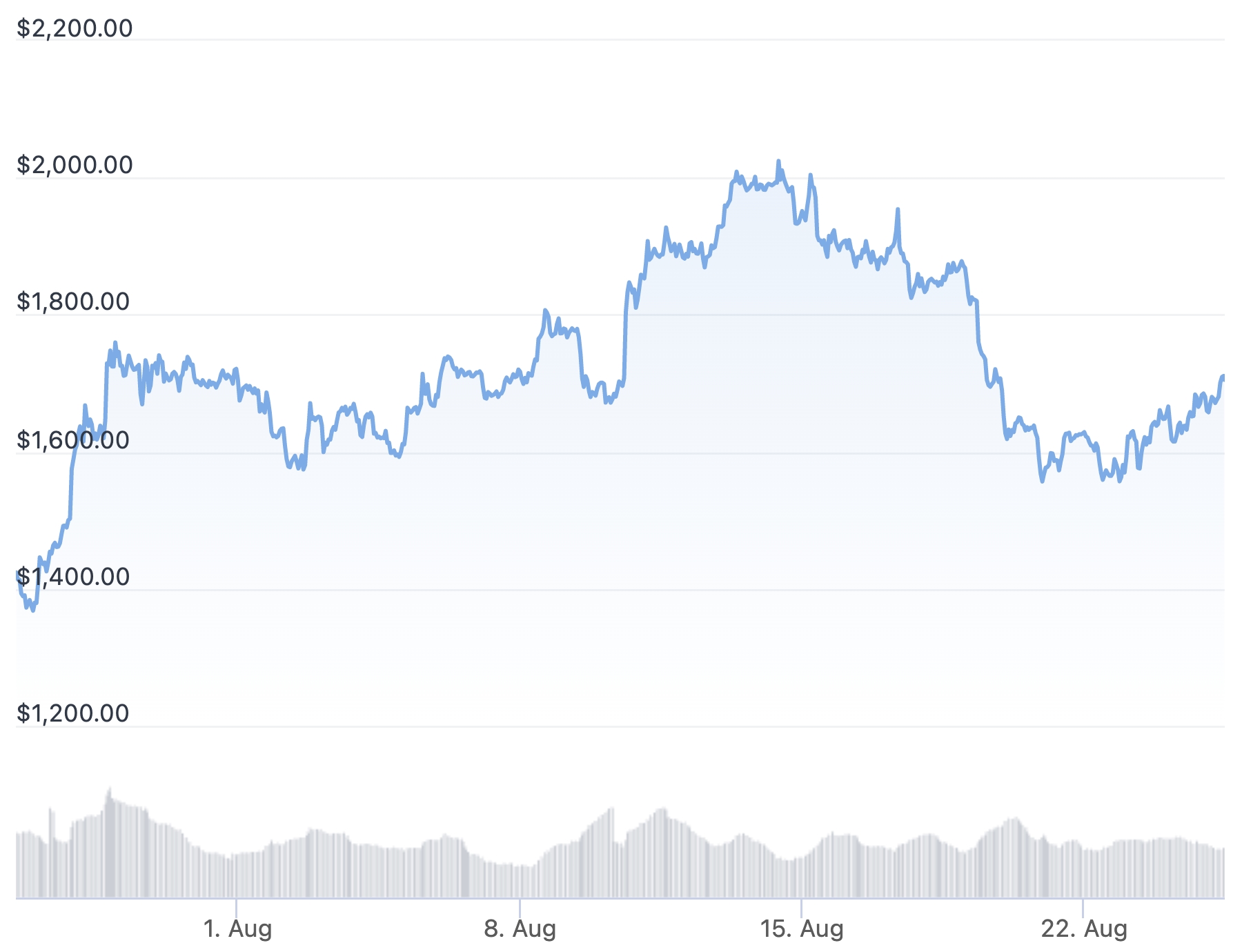

As of Thursday at 09:30 UTC, ETH stood at 1,707. The token is up 4.2% for the previous 24 hours, and it stays down by 7% for the previous 7 days.

Nonetheless, the day by day achieve was sufficient to place ETH because the day’s strongest performer among the many high 10 cash by market capitalization.

ETH value previous 30 days:

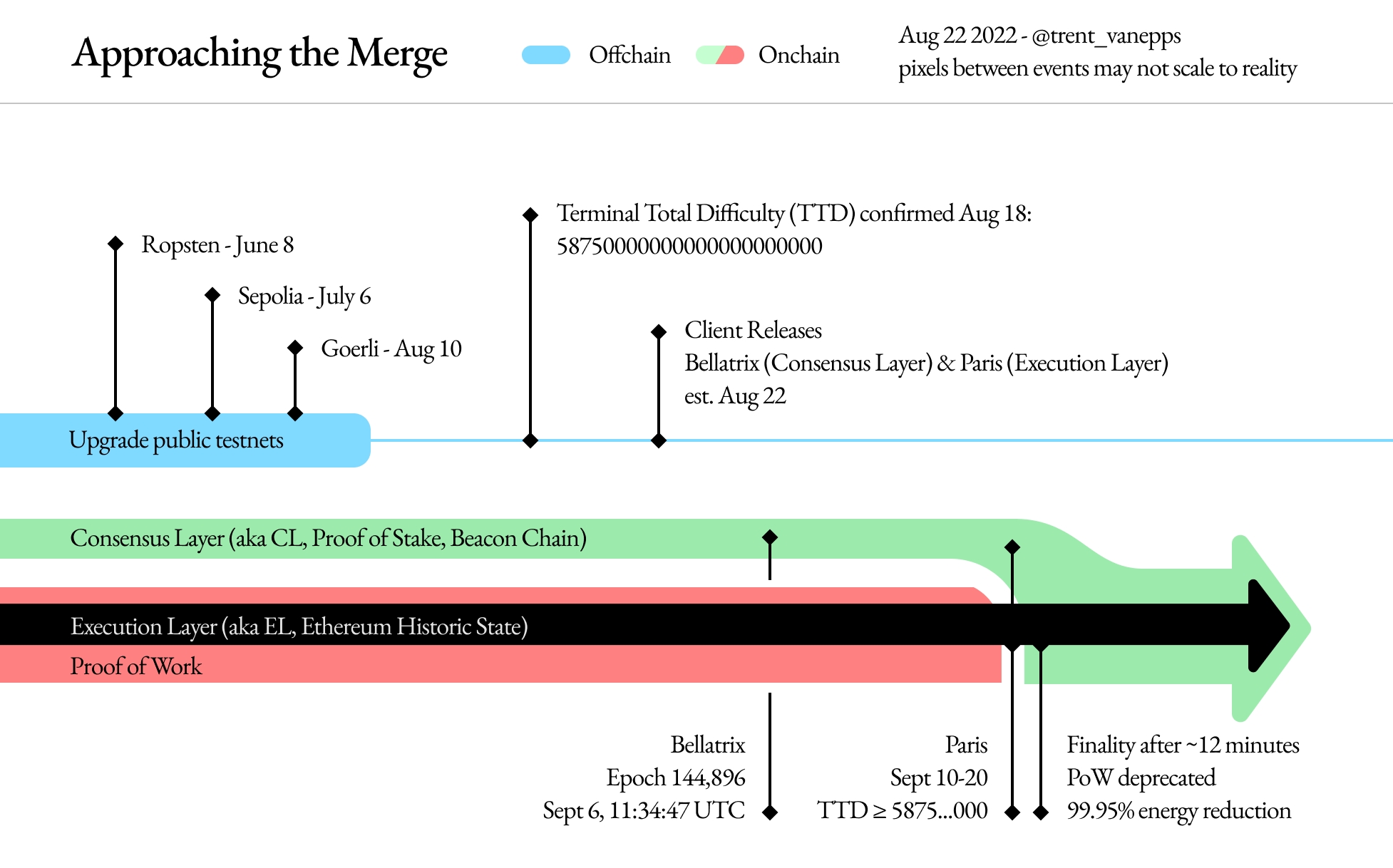

Based on the announcement from the inspiration that coordinates the event of the Ethereum community, the Bellatrix improve will occur in epoch 144896 on Ethereum’s new proof-of-stake-based Beacon Chain – 11:34:47am UTC on Sept 6.

Moreover, the Terminal Whole Problem (TTD) triggering The Merge is 58750000000000000000000, anticipated between September 10 and 20.

“Following years of onerous work, Ethereum’s proof-of-stake improve is lastly right here! The profitable improve of all public testnets is now full, and The Merge has been scheduled for the Ethereum mainnet,” the announcement stated.

The announcement added that new shopper software program for Ethereum node operators has now been launched. It famous that node operators “should run each an execution and consensus layer shopper to stay on the community throughout and after The Merge.”

Additional, the announcement additionally introduced excellent news for these seeking to money in on bug bounties forward of the Merge, saying:

All Merge-related bounties for vulnerabilities have acquired a 4x multiplier between now and the eighth of September. Important bugs are actually value as much as [USD] 1 million USD.

Steps in direction of Ethereum’s Merge:

Commenting on Twitter after the announcement, Ethereum lead developer Tim Beiko reminded node operators to replace their purchasers. He additionally reiterated that September 15 nonetheless stands because the estimated date for when the Merge will occur.

In the meantime, crypto alternate Coinbase revealed that it’ll add assist for what it calls Coinbase Wrapped Staked ETH (cbETH), an Ethereum-based ERC-20 token, becoming a member of different exchanges in getting ready for the Merge.

The brand new token was described by Coinbase as a utility token that “represents ETH2,” by ETH staked on Coinbase. The alternate stated that cbETH may be bought and despatched off the platform, whereas the precise ETH2 tokens it represents will stay locked till the Merge occurs.

And talking of exchanges, an article from The Info famous that main crypto exchanges reminiscent of Binance, Kraken, and Coinbase could find yourself as a number of the largest winners as soon as the Merge occurs. The reason being two-fold: firstly, the occasion could set off a surge in buying and selling exercise, which exchanges at all times profit from in that it generates buying and selling charges.

“It’s clearly a really tradable occasion,” Samuel Harrison, managing companion at crypto enterprise fund Faction, was quoted as saying, including that greater volatility usually results in greater quantity “which is nice for his or her enterprise.”

Along with buying and selling charges, exchanges additionally generate revenues from staking that occurs on their platforms, and with extra customers probably seeking to stake their ETH, income from this a part of the enterprise could rise considerably.

____

Study extra:

– Buterin Says Ethereum Will likely be ‘55% Full’ Put up-Merge

– Finish-of-Week Ethereum: Builders Agency Up Merge Date, Hedge Fund Investor Says Merge is ‘Not Priced In’, Aave Proposes Strongly Signaling Help for PoS

– Bitfinex Preps for ETH Fork

– Japan’s bitFlyer Will ‘Pay Shut Consideration’ to Any Ethereum Proof-of-Work Laborious Fork

– The Ethereum Merge: Why Crypto World Is So Excited

– Ethereum Merge – Largest Occasion In Crypto Since Bitcoin?