An exchange-traded product (ETP) that tracks an Ethereum (ETH) proof-of-work (PoW) onerous forked token is already being deliberate for itemizing in Europe, regardless of no such token present as of now.

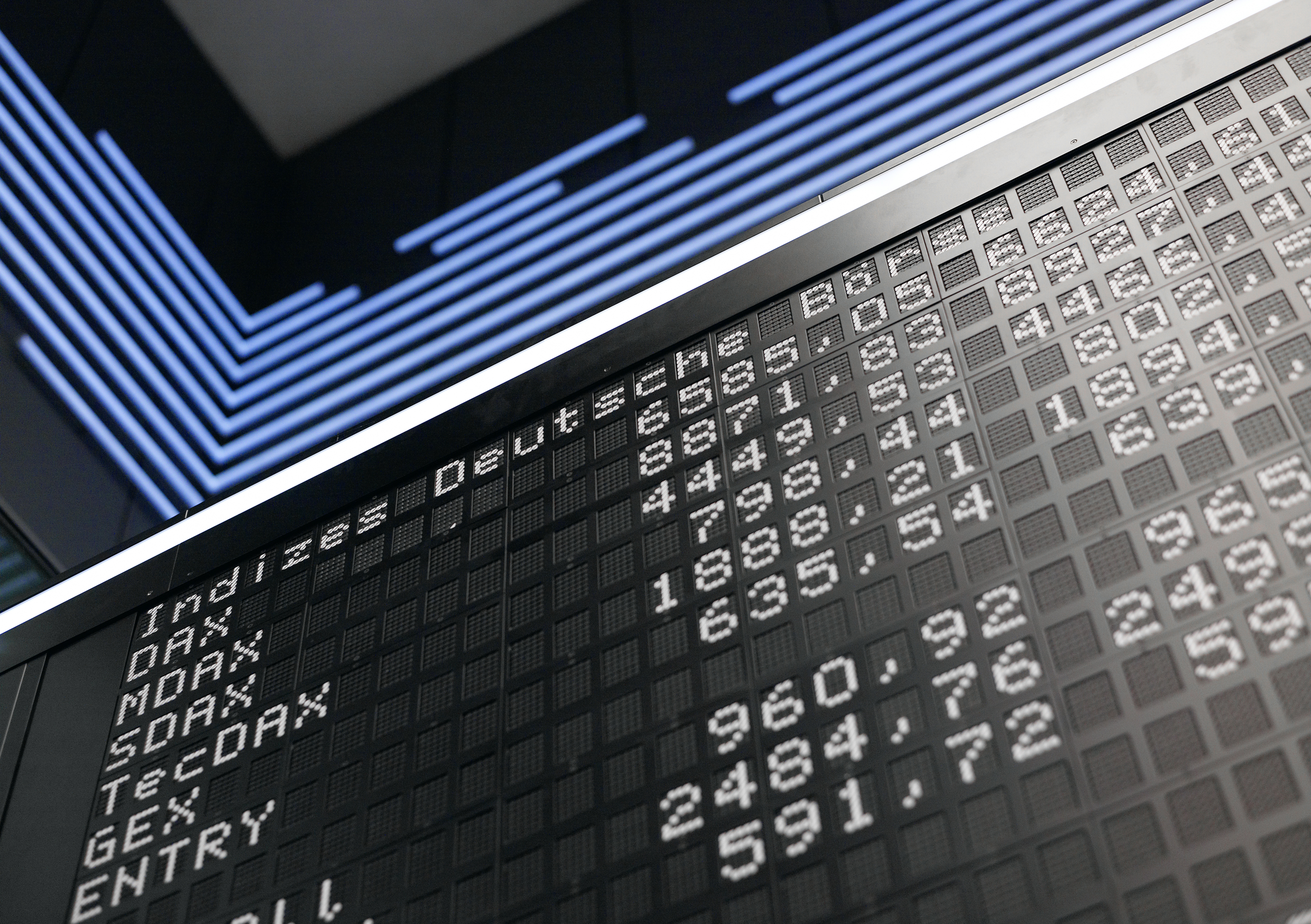

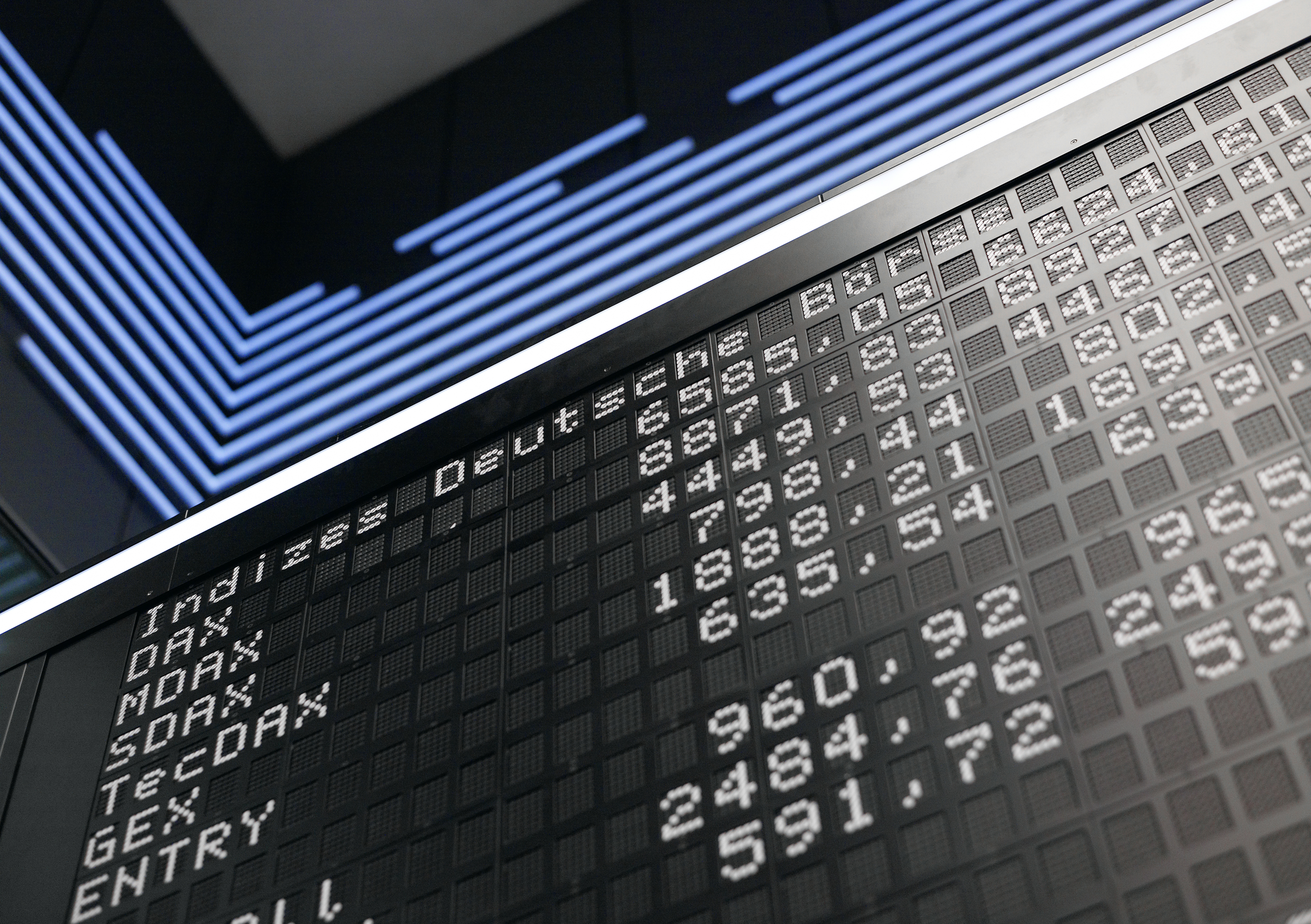

The brand new funding product is being ready by the London-based crypto agency ETC Group, and will likely be listed on Deutsche Borse’s Xetra market underneath the ticker ZETW shortly after a possible onerous fork, if all goes based on plan.

In response to an announcement from the corporate behind the deliberate fund, traders in its present ETH ETP with the ticker ZETH will mechanically obtain shares of the brand new fund on a one-to-one foundation if a tough fork happens. The agency expects the brand new fund to be listed on September 16, the announcement stated.

The complete title for the brand new fund will likely be ETC Group Bodily EthereumPoW.

Each the prevailing ETH ETP and the deliberate ETP are backed immediately by digital tokens. This stands in distinction to the Bitcoin (BTC) futures-backed exchange-traded funds (ETFs) which can be listed within the US, the place rules have made it unimaginable to record bodily backed ETPs or ETFs for now.

A possible new token that arises because of a tough fork as Ethereum’s most important chain transitions from proof-of-work to proof-of-stake is tentatively referred to as ETHPoW.

“After we launched ETC Group, we dedicated to holders of our digital asset-backed securities that they’d profit from onerous forks to the underlying digital belongings and cryptocurrencies,” Bradley Duke, founder and co-CEO of ETC Group, stated in a remark, whereas including:

“We imagine that it is just proper that traders in our merchandise ought to obtain the proceeds of this fork.”

ETC Group is one in all a number of firms that provide ETPs backed by digital belongings in Europe. Different firms embrace WisdomTree, 21Shares, CoinShares, and VanEck. Notably, European crypto ETPs have remained widespread amongst traders regardless of bitcoin futures ETFs now being extensively accessible within the US.

Exchanges stay supportive of PoS

Crypto exchanges have largely adopted the vast majority of the Ethereum neighborhood, making it clear that they are going to help the community’s transition to PoS, and that the tokens on the PoS-based chain will merely be referred to as ETH.

Nonetheless, many exchanges haven’t dominated out help for a possible Ethereum onerous fork that is still on the PoW chain. As an illustration, Binance – the biggest change by buying and selling quantity – has said that it’s going to credit score any forked ETH tokens to its customers, whereas noting {that a} potential itemizing will likely be topic to “the identical strict itemizing assessment course of as Binance does for every other coin/token.”

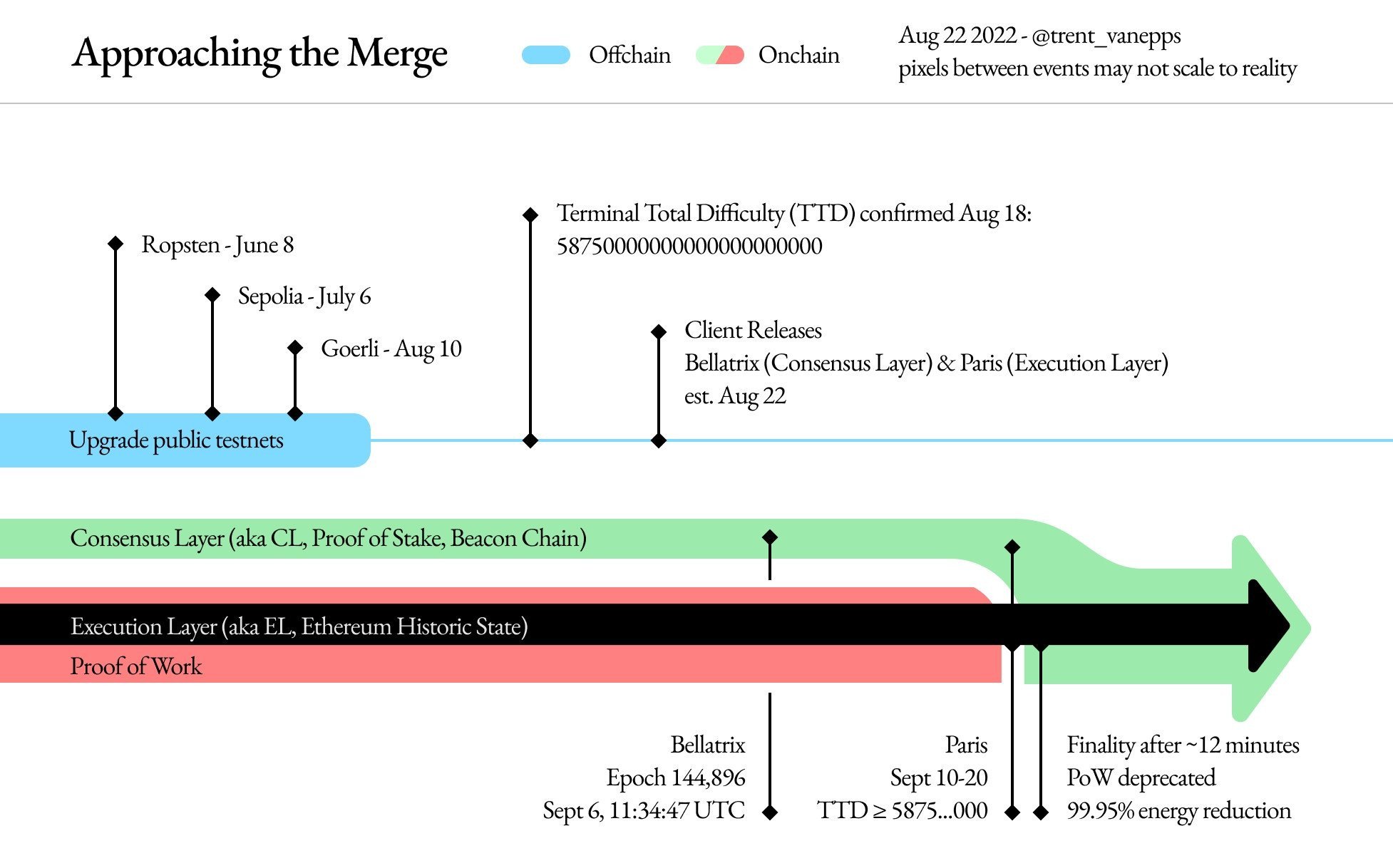

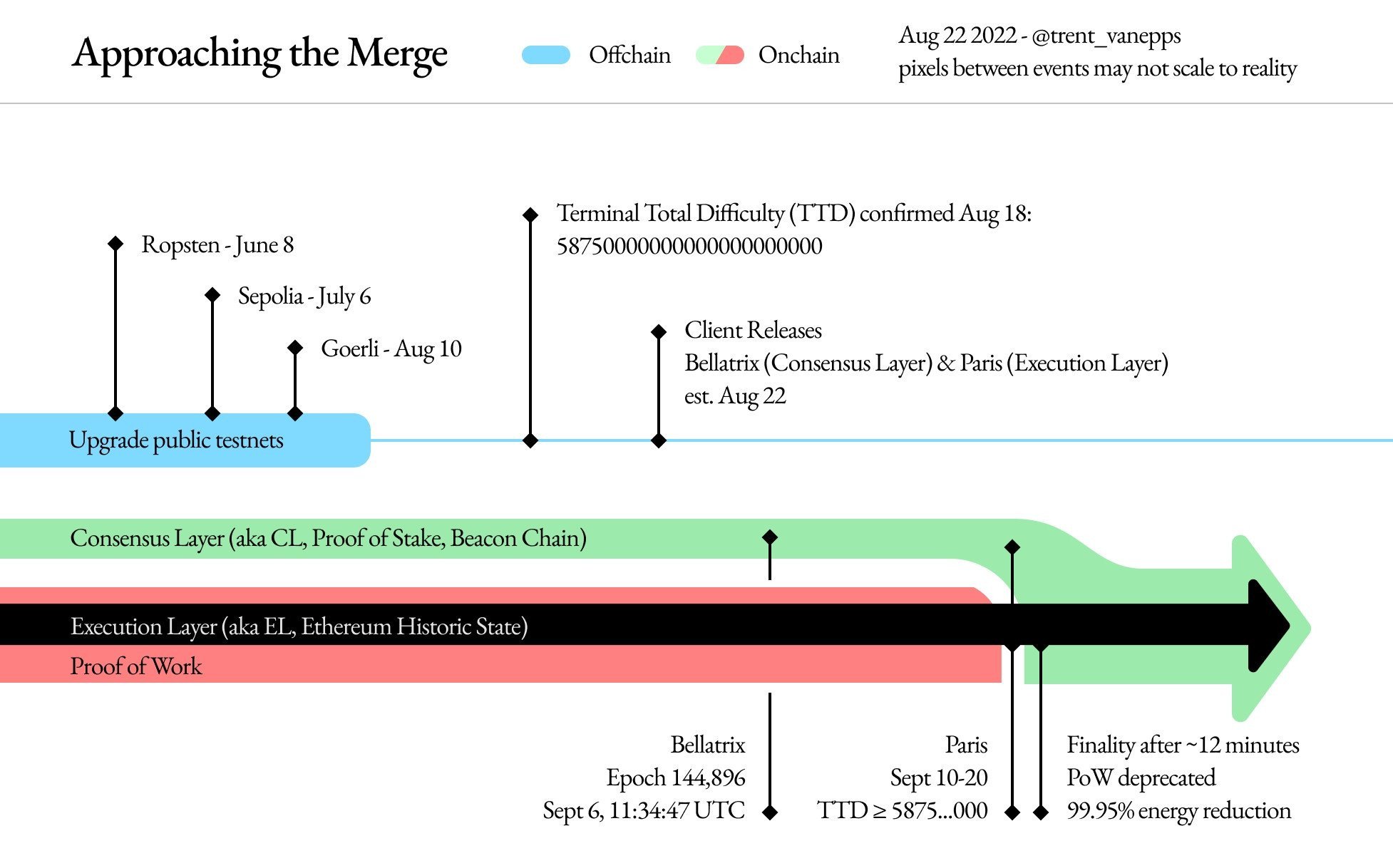

The Ethereum Basis has beforehand stated the Merge might be anticipated to occur someday between September 10 and 20.

An exchange-traded product (ETP) that tracks an Ethereum (ETH) proof-of-work (PoW) onerous forked token is already being deliberate for itemizing in Europe, regardless of no such token present as of now.

The brand new funding product is being ready by the London-based crypto agency ETC Group, and will likely be listed on Deutsche Borse’s Xetra market underneath the ticker ZETW shortly after a possible onerous fork, if all goes based on plan.

In response to an announcement from the corporate behind the deliberate fund, traders in its present ETH ETP with the ticker ZETH will mechanically obtain shares of the brand new fund on a one-to-one foundation if a tough fork happens. The agency expects the brand new fund to be listed on September 16, the announcement stated.

The complete title for the brand new fund will likely be ETC Group Bodily EthereumPoW.

Each the prevailing ETH ETP and the deliberate ETP are backed immediately by digital tokens. This stands in distinction to the Bitcoin (BTC) futures-backed exchange-traded funds (ETFs) which can be listed within the US, the place rules have made it unimaginable to record bodily backed ETPs or ETFs for now.

A possible new token that arises because of a tough fork as Ethereum’s most important chain transitions from proof-of-work to proof-of-stake is tentatively referred to as ETHPoW.

“After we launched ETC Group, we dedicated to holders of our digital asset-backed securities that they’d profit from onerous forks to the underlying digital belongings and cryptocurrencies,” Bradley Duke, founder and co-CEO of ETC Group, stated in a remark, whereas including:

“We imagine that it is just proper that traders in our merchandise ought to obtain the proceeds of this fork.”

ETC Group is one in all a number of firms that provide ETPs backed by digital belongings in Europe. Different firms embrace WisdomTree, 21Shares, CoinShares, and VanEck. Notably, European crypto ETPs have remained widespread amongst traders regardless of bitcoin futures ETFs now being extensively accessible within the US.

Exchanges stay supportive of PoS

Crypto exchanges have largely adopted the vast majority of the Ethereum neighborhood, making it clear that they are going to help the community’s transition to PoS, and that the tokens on the PoS-based chain will merely be referred to as ETH.

Nonetheless, many exchanges haven’t dominated out help for a possible Ethereum onerous fork that is still on the PoW chain. As an illustration, Binance – the biggest change by buying and selling quantity – has said that it’s going to credit score any forked ETH tokens to its customers, whereas noting {that a} potential itemizing will likely be topic to “the identical strict itemizing assessment course of as Binance does for every other coin/token.”

The Ethereum Basis has beforehand stated the Merge might be anticipated to occur someday between September 10 and 20.