After weeks of decreased volatility, cryptocurrencies like Bitcoin (BTC) are prone to see sharp worth modifications within the short-to-medium time period, in response to one analyst.

The present scenario in cryptocurrency markets might probably generate “explosive volatility” because of large leverage and up to date low volatility, Arcane Analysis analyst Vetle Lunde suggested.

Lunde pointed to “leverage bonanza,” or leverage going parabolic within the crypto derivatives market, whereas Bitcoin has continued to hover round $19,000 over the previous few weeks.

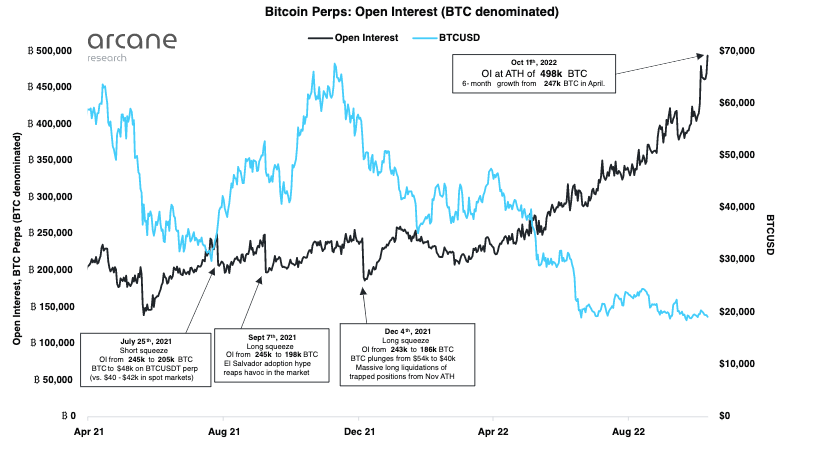

In crypto buying and selling, leverage refers to utilizing borrowed funds to make trades with a purpose to revenue larger by means of contracts like perpetual swaps. In accordance with Arcane, notional open curiosity (OI) in Bitcoin perpetual contracts was nearing 500,000 BTC as of Oct. 11, which marked parabolic progress in leverage amid Bitcoin’s flattening volatility.

Whereas forecasting potential bursts of volatility within the quick or medium time period, Lunde prevented predicting precise market strikes, stating:

“I view the present open curiosity as effectively blown above any ranges which may be assessed as sustainable, opaqueness from market indicators restricts me from having any directional view on the winddown of stated leverage.”

The analyst additionally confused that the present market may benefit refined merchants which are aware of the straddle technique, which entails concurrently shopping for each a put possibility and a name possibility with the identical worth and the identical expiration date.

Within the medium time period, Lunde pointed to the rising development in OI in crypto derivatives, which might result in a “very risky” breakout. As beforehand reported, Bitcoin futures OI hit an all-time excessive, with BTC-denominated futures OI hitting 660,000 BTC on Oct. 12.

Lunde additionally talked about just a few potent triggers within the medium time period for crypto, together with potential BTC purchases by Michael Saylor’s MicroStrategy in November. “If the standard MicroStrategy riddance repeats, anticipate small rallies and temporary hardcore sell-offs as MicroStrategy bids after which pronounces its purchases for the rest of This autumn 2022,” the analyst wrote.

Associated: Bitcoin analysts and merchants say BTC’s low volatility is ‘a relaxed earlier than the storm’

It doesn’t matter what development is coming within the short-to-medium time period, the Arcane Analysis analyst continues to be bullish on Bitcoin over an extended time period. Lunde expressed confidence that the following 12 months will convey “idiosyncratic crypto-related regulatory readability” in the USA in addition to a extra steady rate of interest and inflation regime.

He additionally predicted extra crypto progress as main monetary establishments like BlackRock, Citadel, and Nasdaq have been shifting into the trade just lately. He acknowledged:

“I’m sure that the present will go on, and new highs shall be met in a not too far distant future.”

As beforehand reported, some main monetary establishments like JPMorgan set a long-term theoretical goal for Bitcoin at $150,000.