June 2022 is behind us, and it appears that there have been fewer avalanches for merchants and traders to dwell via throughout this crypto winter month than the one which preceded it.

As a reminder, June noticed the crypto market drop considerably, with all cash within the prime 10 by market capitalization seeing double-digit proportion losses and the highest two cryptoassets, bitcoin (BTC) and ethereum (ETH), recording a weaker efficiency than in Could. For instance, this was BTC’s worst month on file, with a 40% drop.

But, after the preliminary shock of the market crash and all the large points surrounding corporations resembling Terra (LUNA), Three Arrows Capital, Celsius Community (CEL), Voyager Digital, BlockFi, and others, the market lastly noticed inexperienced.

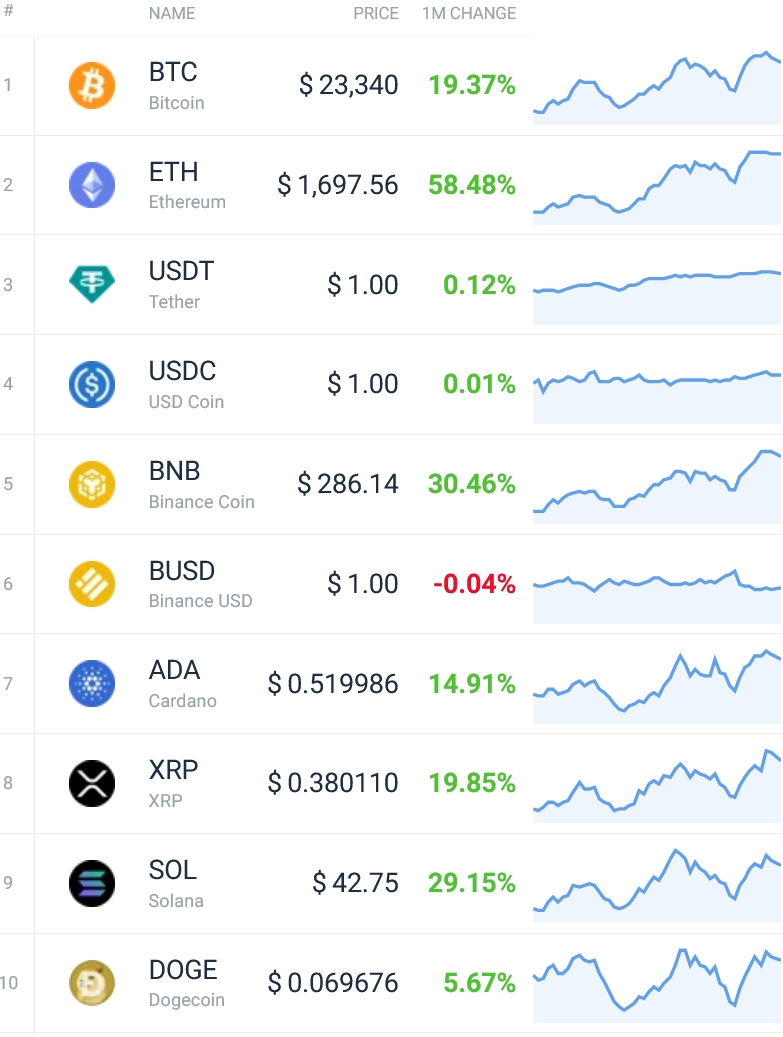

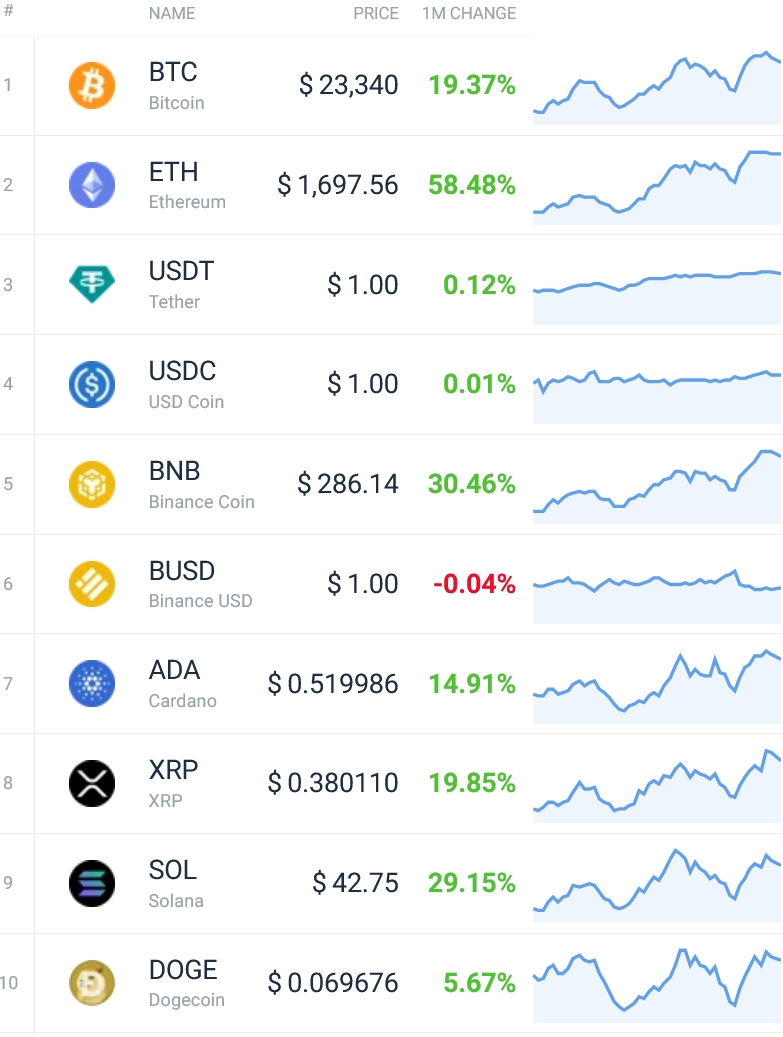

High 10 cash in July

Trying on the prime 10 cash by market capitalization clearly exhibits what a flip for the greener July had taken. All cash – aside from one – noticed double-digit will increase (not taking stablecoins into consideration).

The simple winner of the month is ETH, with an increase of greater than 58%. It’s notable that the month was stuffed with the information of the upcoming Merge, when the mission will transfer from the present proof-of-work (PoW) consensus mechanism to proof-of-stake (PoS). This has been tentatively scheduled for September.

ETH is adopted by BNB, the native token of the Binance change, which went up 30%, in addition to solana (SOL) and its 29% rise. Then come XRP and BTC, each of which appreciated greater than 19% in the course of the previous month.

Lastly, the final double-digit enhance of almost 15% was that of cardano (ADA), whereas the one coin that went up lower than 10% is dogecoin (DOGE).

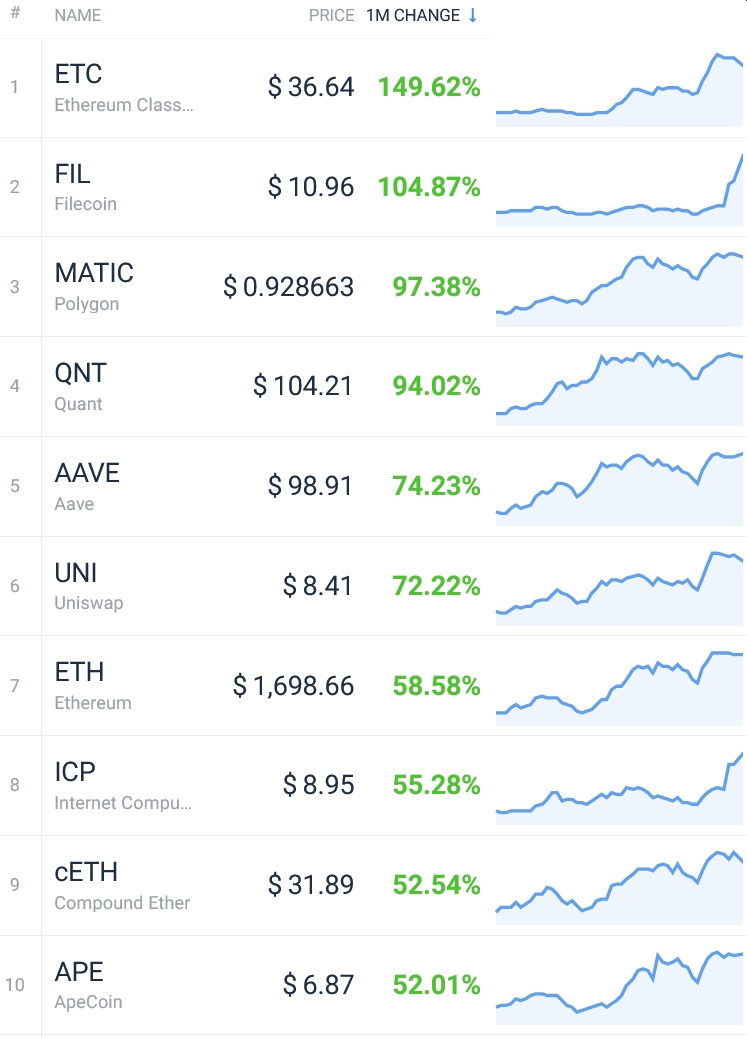

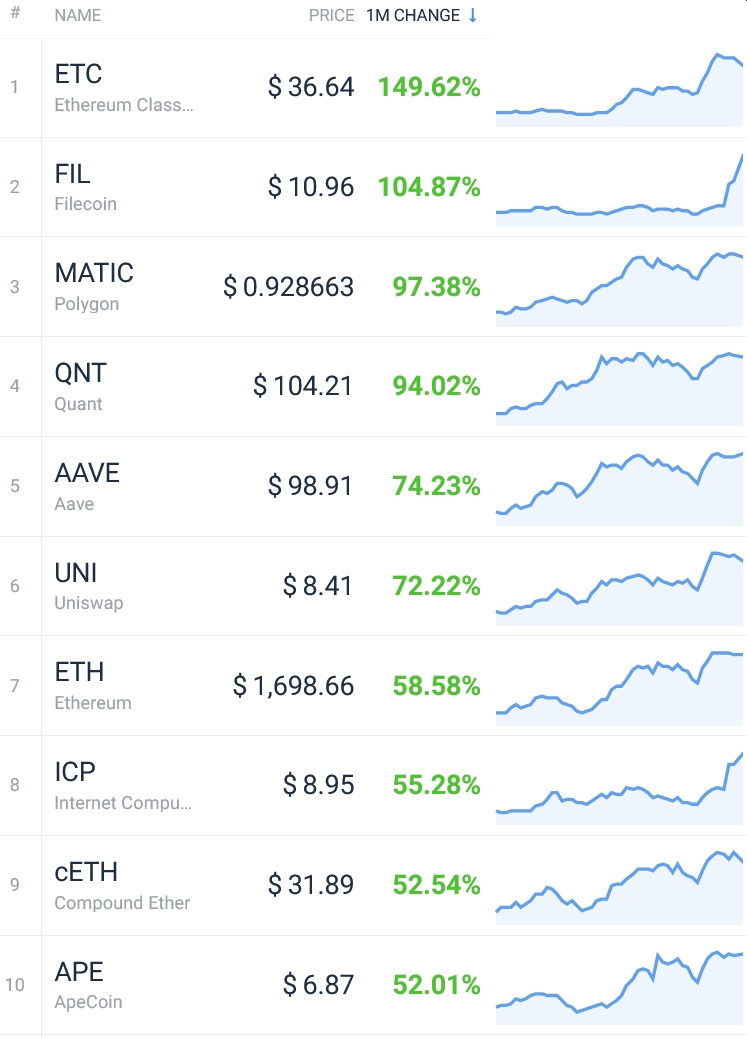

Finest from the highest 50 in July

And the greenery continues within the prime 50 class by market capitalization, the place the throne is occupied by ethereum basic (ETH) – it appreciated almost 150% in July. At one level in mid-July, ETC rallied available in the market and outperformed ETH on a year-to-date foundation. That is all occurring as a story about Ethereum miners doubtlessly switching over to Ethereum Basic as Ethereum transitions to PoS is gaining traction. Additionally, in late July, mining pool AntPool confirmed that it had invested USD 10m to assist the Ethereum Basic ecosystem and plans to proceed investing extra.

The second in line is filecoin (FIL), which additionally went up over 100%, and whereas polygon (matic) and quant (QNT) have been up over 90%, aave (AAVE) and uniswap (UNI) stood within the 72%-75% zone.

As for the opposite cash on this checklist, all of them appreciated between 52% and 59%, whereas the one coin from the highest 10 included right here is ETH.

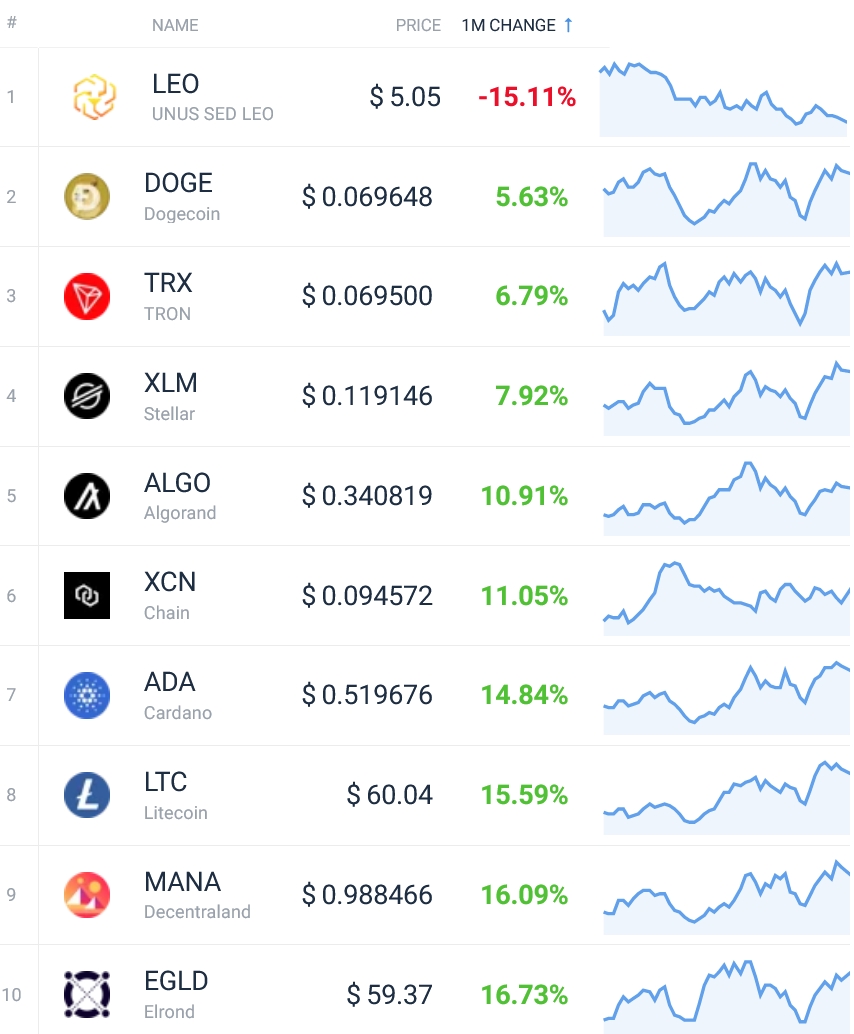

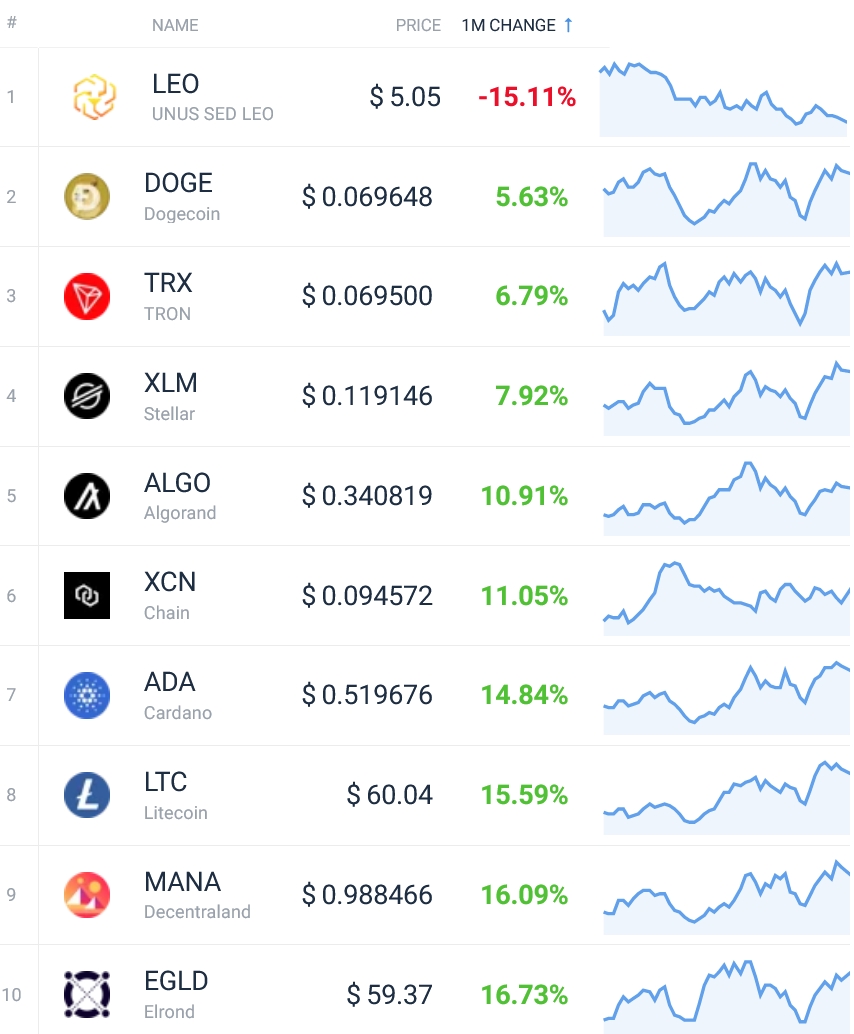

Worst from the highest 50 in June

Observing the red-to-green ratio within the prime 50 is all the time among the many finest methods to find out how the cash carried out within the month behind us.

Certainly, at the moment we see a totally reverse state of affairs from the one precisely a month in the past. Just one coin ended July in crimson on this class, and that’s LEO, an change token issued by Bitfinex. Curiously, this had been the very best performer within the month of June.

Finest & worst from the highest 100 in June

There have been loads of inexperienced cash to speak about in July among the many prime 100 by market capitalization. The primary place is occupied by lido DAO token (LDO), with a month-to-month enhance of 365%. Lido Finance made information in July, because it introduced that it aimed to develop providers throughout numerous Ethereum Layer 2 scaling options, nevertheless it additionally put ahead a proposal that turned out to be unacceptable – the group members voted in opposition to promoting LDO 10m tokens to crypto funding agency Dragonfly Capital for DAI 14.5m, and the staff quickly got here again with a second, “higher”, proposal.

LDO is adopted by the already talked about ETC, FIL, and MATIC. The second a part of the ten finest performers among the many prime 100 embody bitcoin gold (BTG), QNT, curve DAO token (CRV), and convex finance (CVX), respectively – all of that are up between 95% and 80%. The final on the checklist is the troubled CEL, which, regardless of the mess it has discovered itself in, managed to complete July with an increase of 79%.

Not taking stablecoins into consideration, there have been solely 4 crimson cash among the many 100. Huobi token (HT) is within the sixth place with a drop of three%, the talked about LEO is within the third place, the very troubled terra basic (LUNC) occupies the second place with a 17% fall, and within the first sits tenset (10SET) with a fall of 17%.

____

Study extra:

– Unhealthy Information is Good Information: Bitcoin Performs With USD 24K as Merchants Speculate on Fed Pivot and US Recession

– Bitcoin May Fall to USD 13.6K This 12 months, Panel Says After Adjusting Predictions As soon as Once more

– Unstable Months Forward for Ethereum & USD 1,711 Seemingly for 12 months-Finish, Says Crypto Business Panel

– BNB to Develop Modestly This 12 months, Would possibly Tripple by 2025 – Analyst Panel

– Little Upside for Solana This 12 months, However Lengthy-Time period Future Stays Brilliant, Panel Predicts

– Cardano Value to Finish 12 months at USD 0.63, More and more Bearish Panel Predicts

– Dogecoin is Heading to Zero, Based on Business Panel

– International Financial Development Slows Amid Gloomy and Extra Unsure Outlook

June 2022 is behind us, and it appears that there have been fewer avalanches for merchants and traders to dwell via throughout this crypto winter month than the one which preceded it.

As a reminder, June noticed the crypto market drop considerably, with all cash within the prime 10 by market capitalization seeing double-digit proportion losses and the highest two cryptoassets, bitcoin (BTC) and ethereum (ETH), recording a weaker efficiency than in Could. For instance, this was BTC’s worst month on file, with a 40% drop.

But, after the preliminary shock of the market crash and all the large points surrounding corporations resembling Terra (LUNA), Three Arrows Capital, Celsius Community (CEL), Voyager Digital, BlockFi, and others, the market lastly noticed inexperienced.

High 10 cash in July

Trying on the prime 10 cash by market capitalization clearly exhibits what a flip for the greener July had taken. All cash – aside from one – noticed double-digit will increase (not taking stablecoins into consideration).

The simple winner of the month is ETH, with an increase of greater than 58%. It’s notable that the month was stuffed with the information of the upcoming Merge, when the mission will transfer from the present proof-of-work (PoW) consensus mechanism to proof-of-stake (PoS). This has been tentatively scheduled for September.

ETH is adopted by BNB, the native token of the Binance change, which went up 30%, in addition to solana (SOL) and its 29% rise. Then come XRP and BTC, each of which appreciated greater than 19% in the course of the previous month.

Lastly, the final double-digit enhance of almost 15% was that of cardano (ADA), whereas the one coin that went up lower than 10% is dogecoin (DOGE).

Finest from the highest 50 in July

And the greenery continues within the prime 50 class by market capitalization, the place the throne is occupied by ethereum basic (ETH) – it appreciated almost 150% in July. At one level in mid-July, ETC rallied available in the market and outperformed ETH on a year-to-date foundation. That is all occurring as a story about Ethereum miners doubtlessly switching over to Ethereum Basic as Ethereum transitions to PoS is gaining traction. Additionally, in late July, mining pool AntPool confirmed that it had invested USD 10m to assist the Ethereum Basic ecosystem and plans to proceed investing extra.

The second in line is filecoin (FIL), which additionally went up over 100%, and whereas polygon (matic) and quant (QNT) have been up over 90%, aave (AAVE) and uniswap (UNI) stood within the 72%-75% zone.

As for the opposite cash on this checklist, all of them appreciated between 52% and 59%, whereas the one coin from the highest 10 included right here is ETH.

Worst from the highest 50 in June

Observing the red-to-green ratio within the prime 50 is all the time among the many finest methods to find out how the cash carried out within the month behind us.

Certainly, at the moment we see a totally reverse state of affairs from the one precisely a month in the past. Just one coin ended July in crimson on this class, and that’s LEO, an change token issued by Bitfinex. Curiously, this had been the very best performer within the month of June.

Finest & worst from the highest 100 in June

There have been loads of inexperienced cash to speak about in July among the many prime 100 by market capitalization. The primary place is occupied by lido DAO token (LDO), with a month-to-month enhance of 365%. Lido Finance made information in July, because it introduced that it aimed to develop providers throughout numerous Ethereum Layer 2 scaling options, nevertheless it additionally put ahead a proposal that turned out to be unacceptable – the group members voted in opposition to promoting LDO 10m tokens to crypto funding agency Dragonfly Capital for DAI 14.5m, and the staff quickly got here again with a second, “higher”, proposal.

LDO is adopted by the already talked about ETC, FIL, and MATIC. The second a part of the ten finest performers among the many prime 100 embody bitcoin gold (BTG), QNT, curve DAO token (CRV), and convex finance (CVX), respectively – all of that are up between 95% and 80%. The final on the checklist is the troubled CEL, which, regardless of the mess it has discovered itself in, managed to complete July with an increase of 79%.

Not taking stablecoins into consideration, there have been solely 4 crimson cash among the many 100. Huobi token (HT) is within the sixth place with a drop of three%, the talked about LEO is within the third place, the very troubled terra basic (LUNC) occupies the second place with a 17% fall, and within the first sits tenset (10SET) with a fall of 17%.

____

Study extra:

– Unhealthy Information is Good Information: Bitcoin Performs With USD 24K as Merchants Speculate on Fed Pivot and US Recession

– Bitcoin May Fall to USD 13.6K This 12 months, Panel Says After Adjusting Predictions As soon as Once more

– Unstable Months Forward for Ethereum & USD 1,711 Seemingly for 12 months-Finish, Says Crypto Business Panel

– BNB to Develop Modestly This 12 months, Would possibly Tripple by 2025 – Analyst Panel

– Little Upside for Solana This 12 months, However Lengthy-Time period Future Stays Brilliant, Panel Predicts

– Cardano Value to Finish 12 months at USD 0.63, More and more Bearish Panel Predicts

– Dogecoin is Heading to Zero, Based on Business Panel

– International Financial Development Slows Amid Gloomy and Extra Unsure Outlook