Bitcoin (BTC) has been trending up since mid-July, though the present ascending channel formation holds $21,100 assist. This sample has been holding for 45 days and will doubtlessly drive BTC in the direction of $26,000 by late August.

In response to Bitcoin derivatives knowledge, buyers are pricing increased odds of a downturn, however current enhancements in international financial perspective may take the bears unexpectedly.

The correlation to conventional property is the primary supply of buyers’ mistrust, particularly when pricing in recession dangers and tensions between the USA and China forward of Home Speaker Nancy Pelosi’s go to to Taiwan. In response to CNBC, Chinese language officers threatened to take motion if Pelosi moved ahead.

The U.S. Federal Reserve’s current rate of interest hikes to curb inflation introduced additional uncertainty for threat property, limiting crypto value restoration. Buyers are betting on a “gentle touchdown,” that means the central financial institution will be capable to steadily revoke its stimulus actions with out inflicting important unemployment or recession.

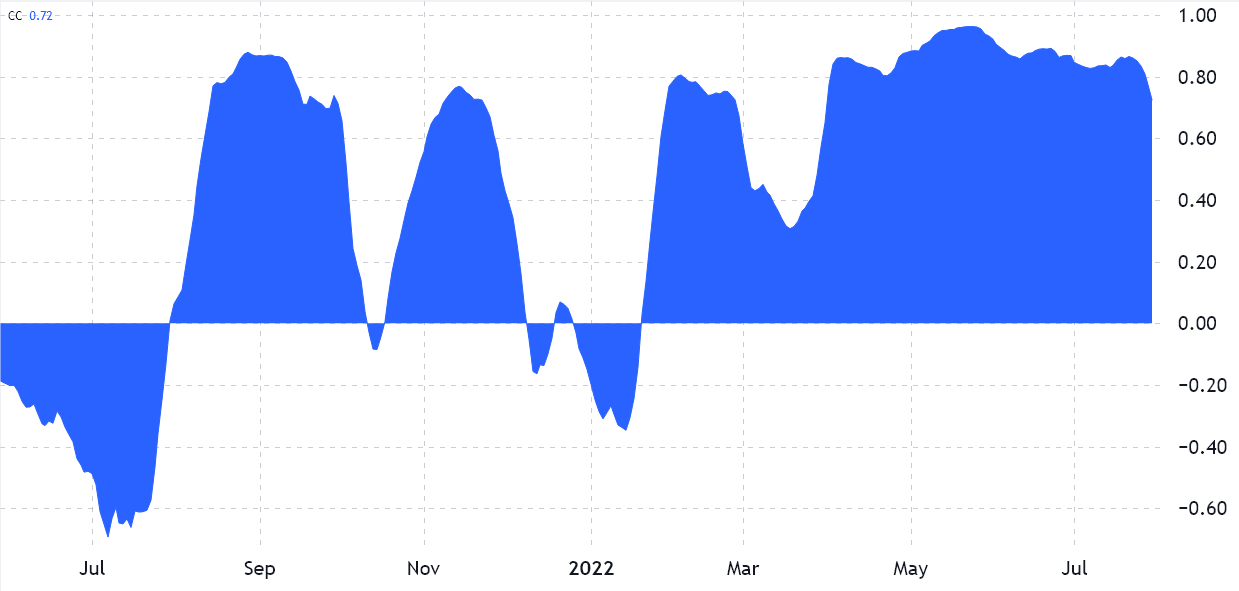

The correlation metric ranges from a adverse 1, that means choose markets transfer in reverse instructions, to a optimistic 1, which displays an ideal and symmetrical motion. A disparity or a scarcity of relationship between the 2 property could be represented by 0.

As displayed above, the S&P 500 and Bitcoin 40-day correlation at present stands at 0.72, which has been the norm for the previous 4 months.

On-chain evaluation corroborates longer-term bear market

Blockchain analytics agency Glassnode’s “The Week On Chain” report from Aug. 1 highlighted Bitcoin’s weak transaction and the demand for block area resembling the 2018–19 bear market. The evaluation suggests a trend-breaking sample could be required to sign new investor consumption:

“Lively Addresses [14 days moving average] breaking above 950k would sign an uptick in on-chain exercise, suggesting potential market power and demand restoration.”

Whereas blockchain metrics and flows are essential, merchants also needs to monitor how whales and market markers are positioned within the futures and choices markets.

Bitcoin derivatives metrics present no indicators of “worry” from professional merchants

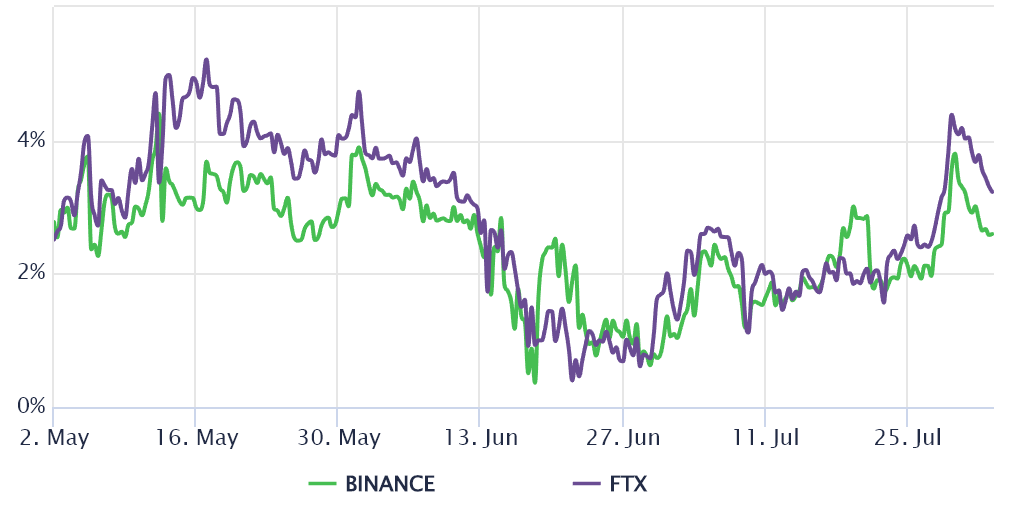

Retail merchants often keep away from month-to-month futures resulting from their mounted settlement date and value distinction from spot markets. However, arbitrage desks {and professional} merchants go for month-to-month contracts as a result of lack of a fluctuating funding charge.

These fixed-month contracts often commerce at a slight premium to common spot markets as sellers demand extra money to withhold settlement longer. Technically often known as “contango,” this example just isn’t unique to crypto markets.

In wholesome markets, futures ought to commerce at a 4% to eight% annualized premium, sufficient to compensate for the dangers plus the price of capital. Nevertheless, in accordance with the above knowledge, Bitcoin’s futures premium has been beneath 4% since June 1. The studying just isn’t significantly regarding provided that BTC is down 52% year-to-date.

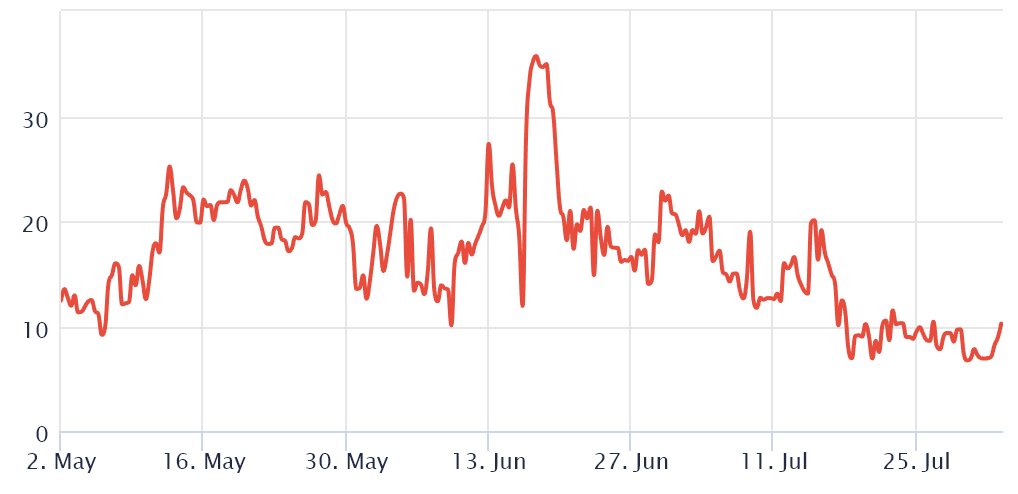

To exclude externalities particular to the futures instrument, merchants should additionally analyze Bitcoin choices markets. For example, the 25% delta skew indicators when Bitcoin whales and market makers are overcharging for upside or draw back safety.

If possibility buyers worry a Bitcoin value crash, the skew indicator would transfer above 12%. However, generalized pleasure displays a adverse 12% skew.

The skew indicator has been beneath 12% since July 17, thought of a impartial space. In consequence, choices merchants are pricing comparable dangers for each bullish and bearish choices. Not even the retest of the $20,750 assist on July 26 was sufficient to instill “worry” in derivatives merchants.

Bitcoin derivatives metrics stay impartial regardless of the rally towards $24,500 on July 30, suggesting that skilled merchants should not assured in a sustainable uptrend. Thus, knowledge exhibits that an sudden transfer above $25,000 would take skilled merchants unexpectedly. Taking a bullish wager may appear contrarian proper now, however concurrently, it creates an fascinating risk-reward state of affairs.

The views and opinions expressed listed below are solely these of the creator and don’t essentially mirror the views of Cointelegraph. Each funding and buying and selling transfer includes threat. It is best to conduct your personal analysis when making a call