After a big enhance within the open curiosity (OI) in ethereum (ETH) choices contracts over the course of July and the primary half of August, warnings have emerged that merchants ought to brace for elevated volatility within the nearest time period.

Elevated volatility will likely be on the horizon as choices merchants exit their positions across the time of Ethereum’s Merge, or transition from proof-of-work (PoW) to proof-of-stake (PoS).

On the time of writing, OI within the ETH choices market stood at USD 7.17bn, near its highest for the yr, and proper across the identical degree as main peaks in OI seen in Might and December of final yr, when the ETH market was unusually risky.

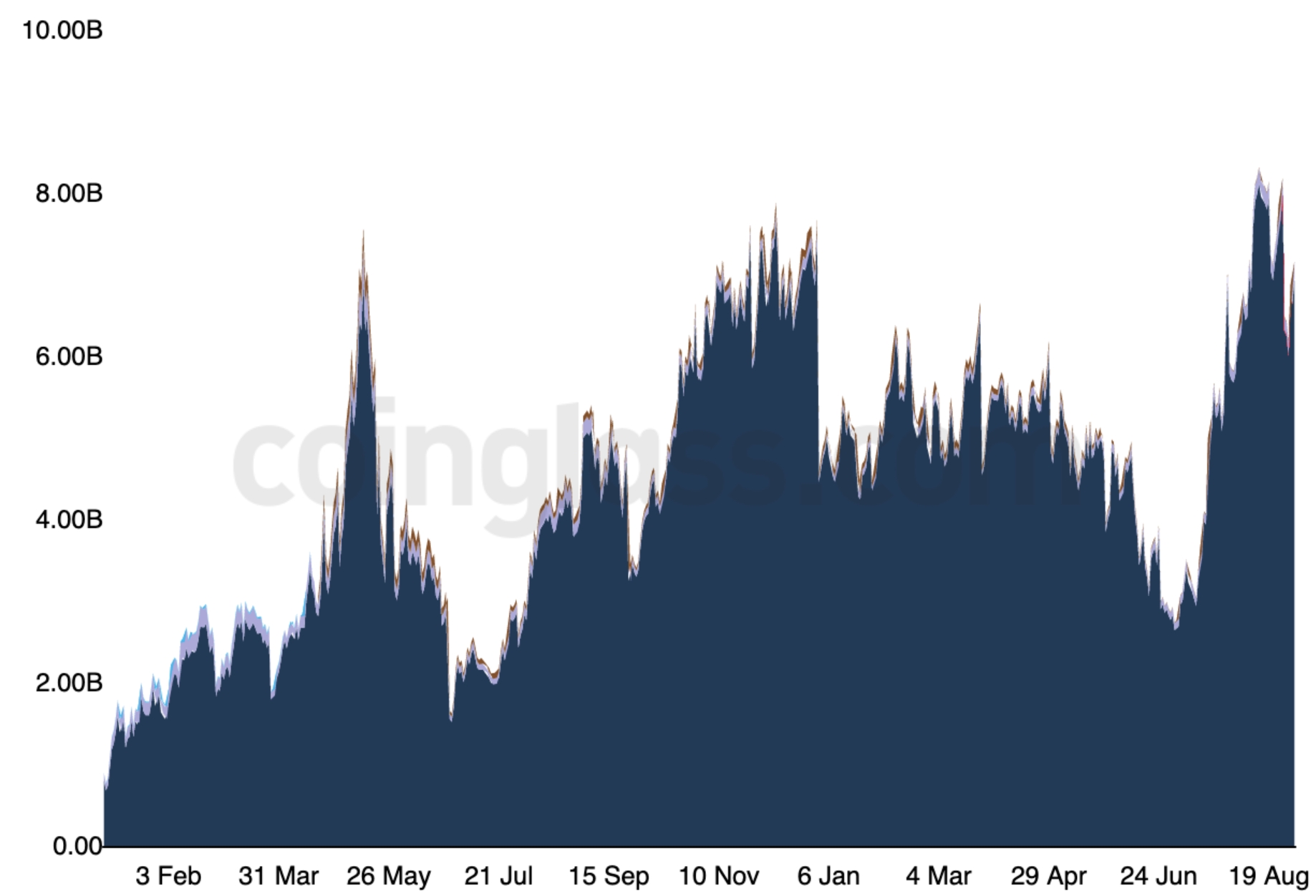

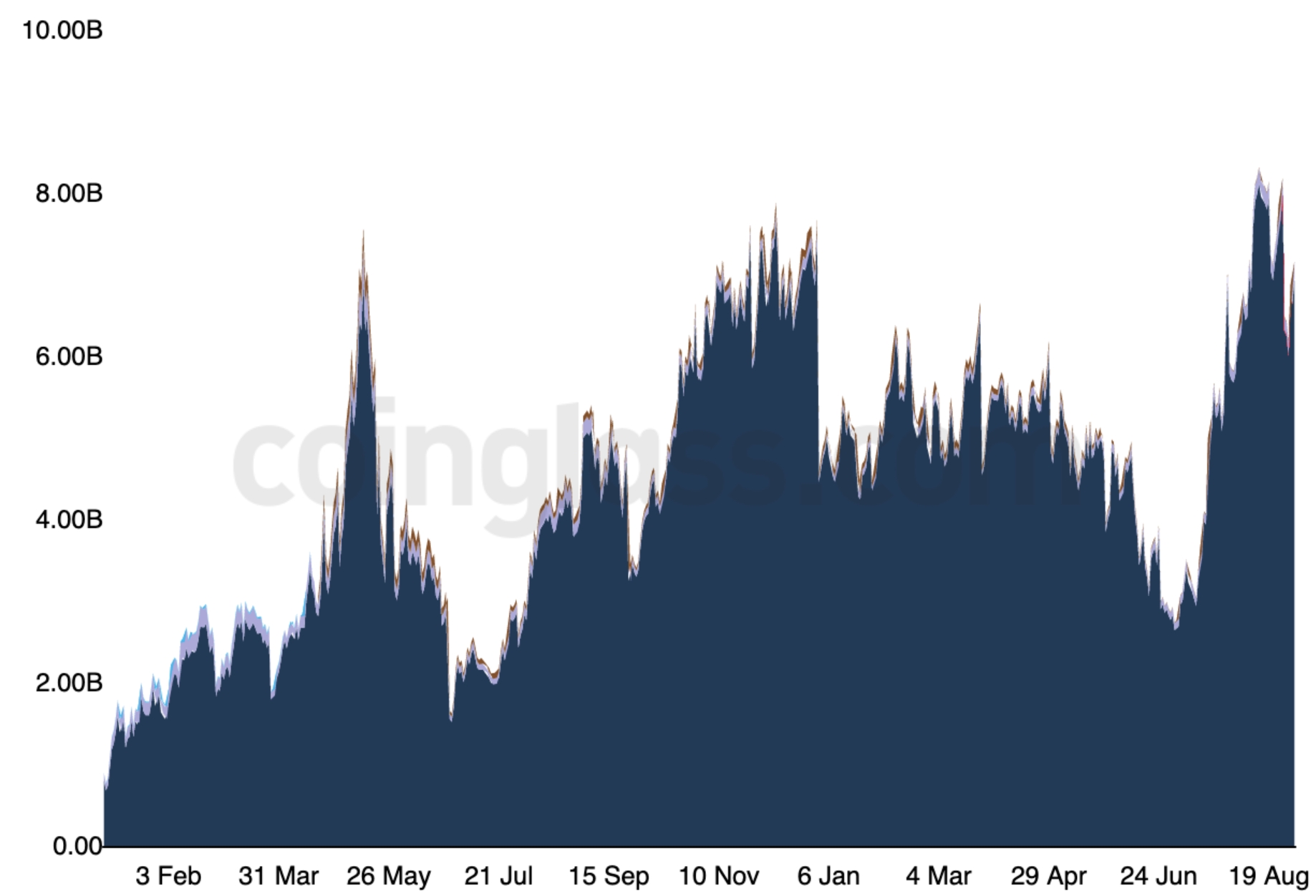

Complete ETH choices open curiosity:

As may be anticipated, risky costs will probably be seen this time round as effectively, and with the Merge anticipated to occur someday between September 10 and 20, a warning to merchants might be warranted.

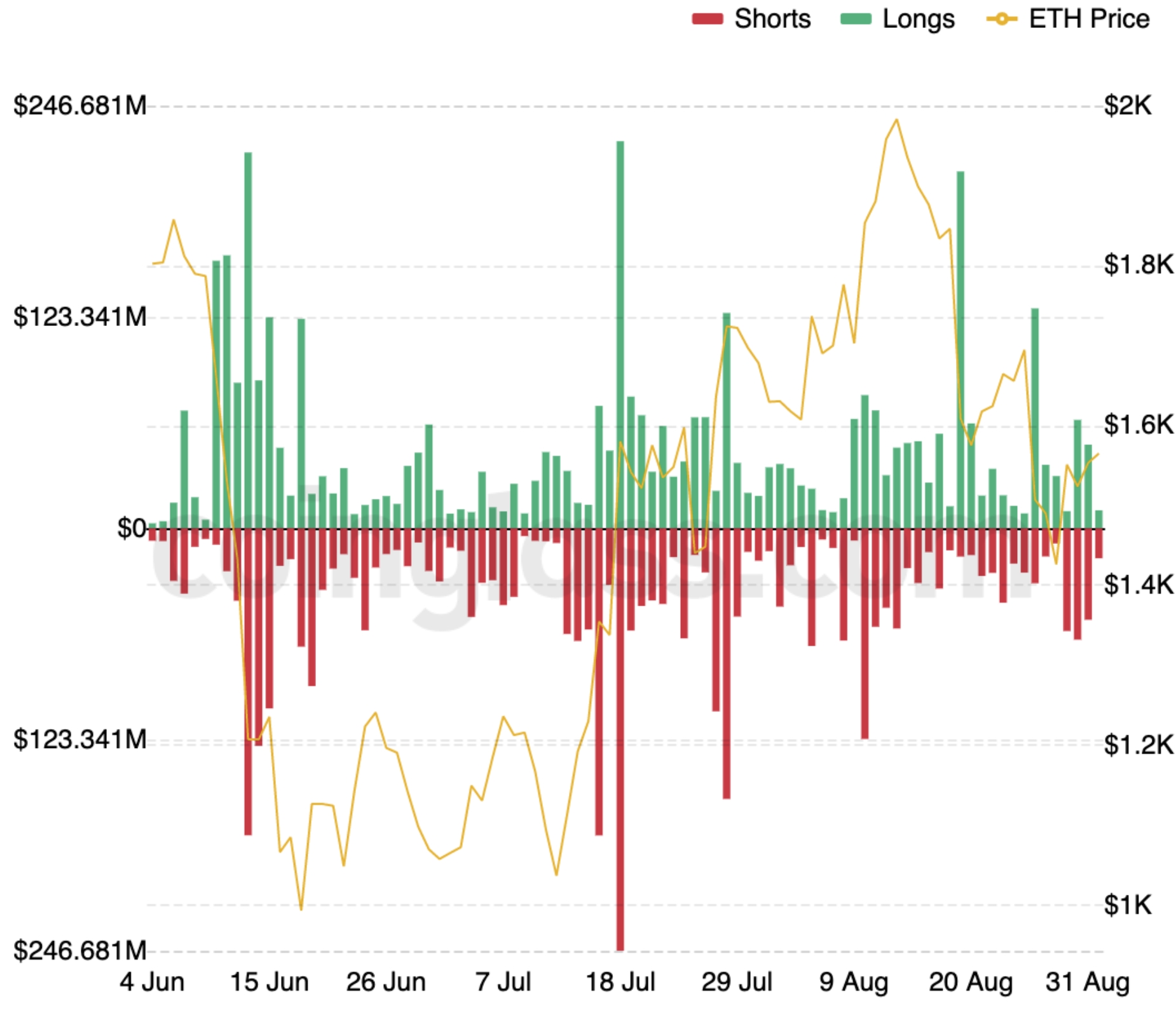

In the meantime, volatility can also be felt within the ETH futures market, the place, on the time of writing, near USD 130m have been liquidated in 24 hours on Tuesday, per data from Coinglass. Though not large in comparison with liquidations sometimes seen throughout giant selloffs and rallies, the ETH liquidations have been nonetheless far increased than these seen within the bigger bitcoin (BTC) market, the place solely round USD 50m was liquidated.

A liquidation is the compelled closing of leveraged positions out there, and is completed by exchanges when merchants are unable or unwilling to place up the required capital to maintain the place open.

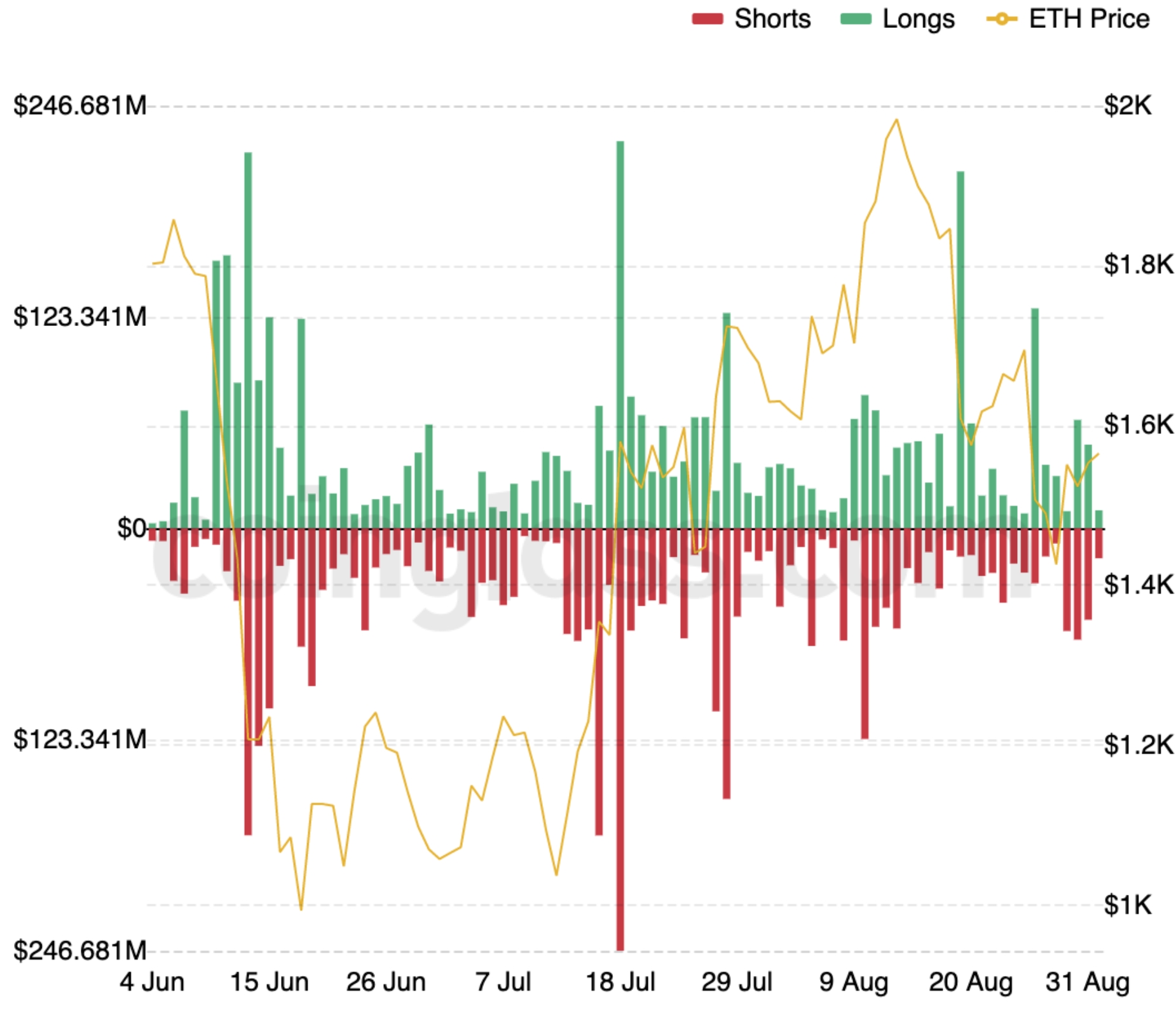

ETH whole liquidations per day:

ETH has been risky over the previous month, with a lot bigger strikes than BTC each to the upside and draw back.

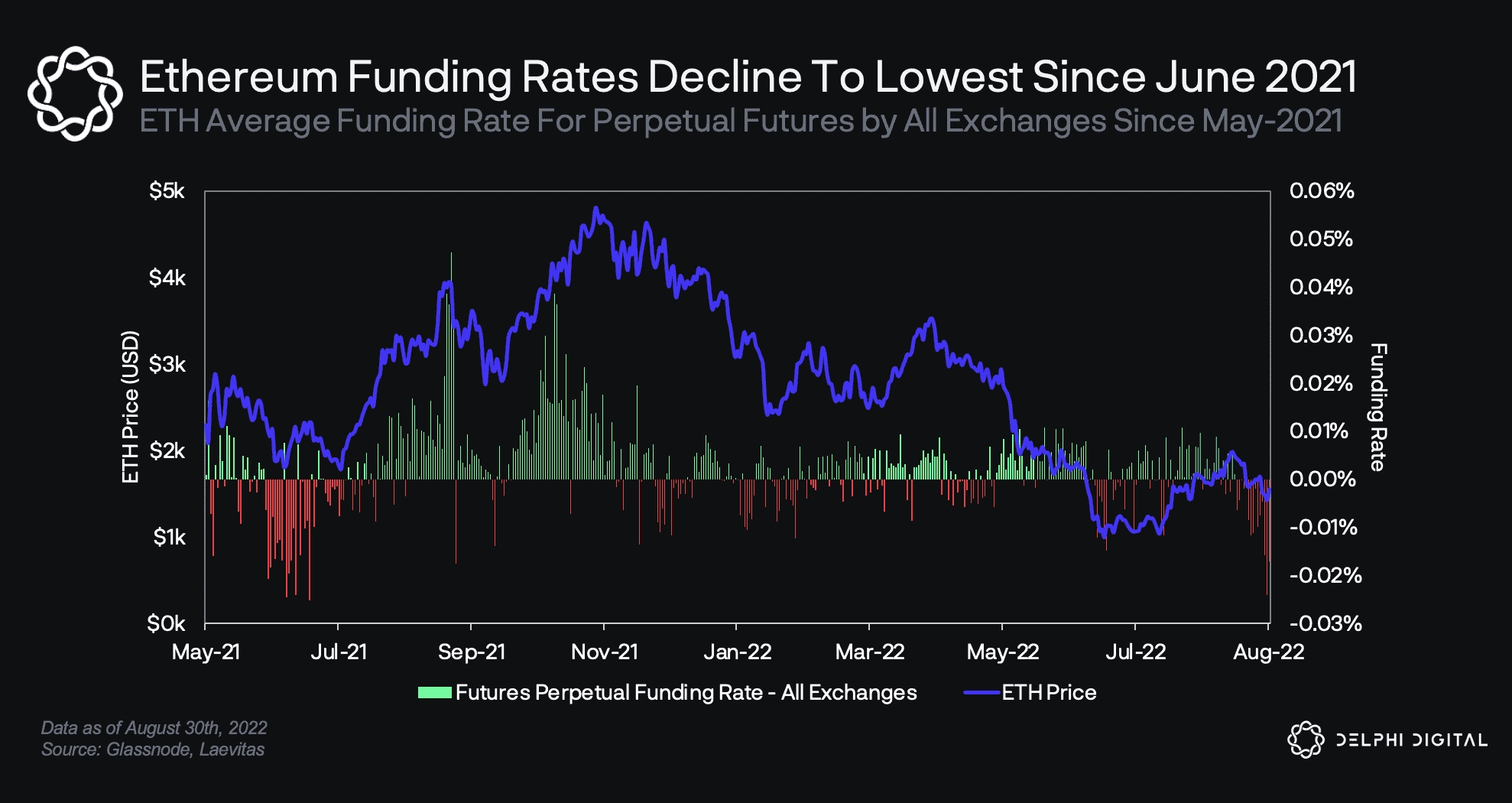

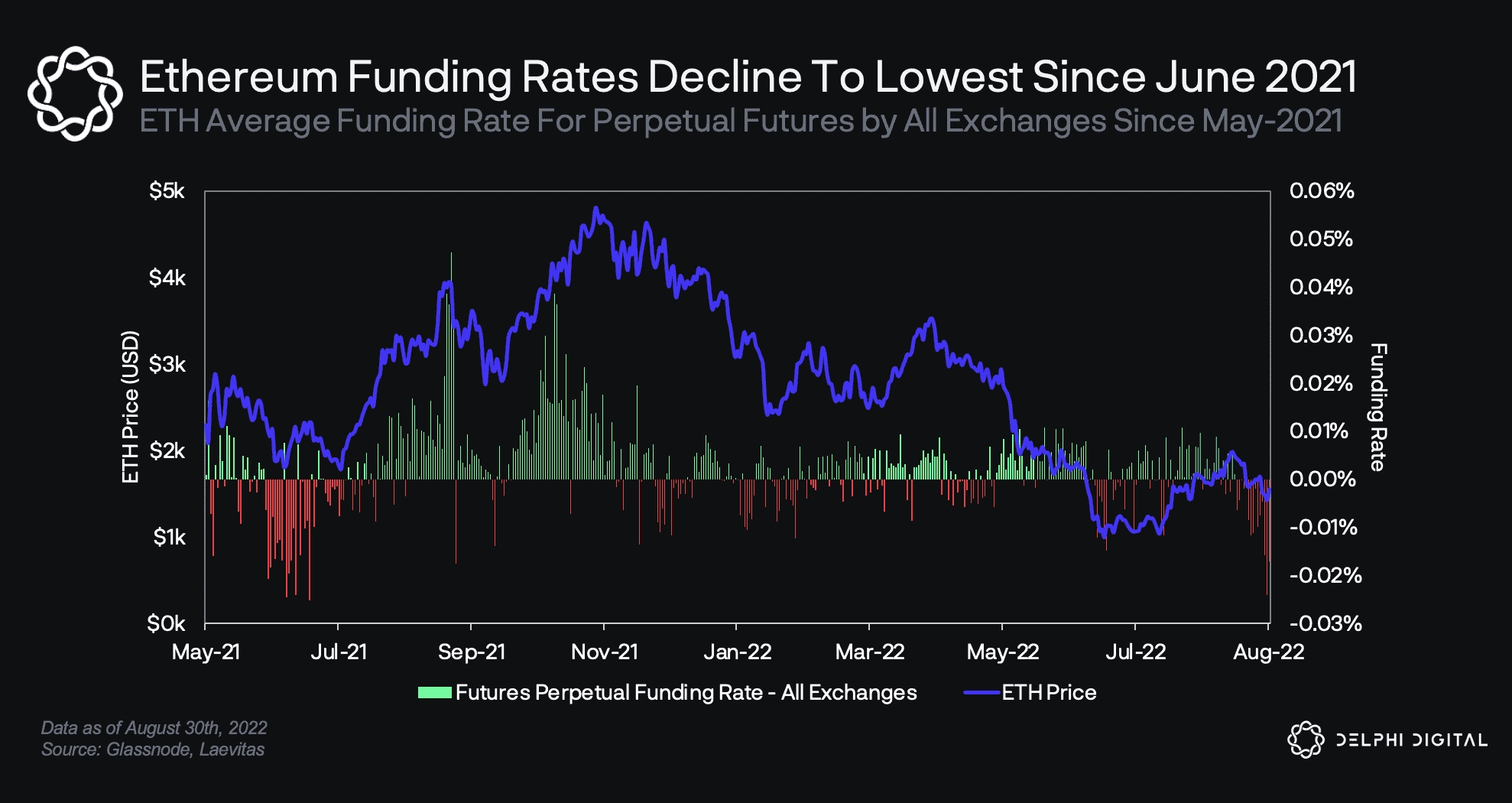

Based on analysts at crypto analysis and funding agency Delphi Digital, this might must do with funding charges within the ETH futures market, which have declined to achieve a low of -0.024% on August 27. A degree that low has not been seen since June 2021, and was adopted by a “large short-squeeze” the next month, a current Delphi Digital report mentioned.

Funding charges sooner or later market is a mechanism developed to maintain the pricing of futures contracts according to spot costs. A detrimental funding fee implies that merchants who’re quick pay those that are lengthy, and vice versa. As such, a deeply detrimental funding fee implies that extra merchants need to go quick – a bearish signal for the market.

Delphi Digital’s report added that open curiosity within the ETH futures market has additionally risen because the market’s “capitulation” in June, with a peak of USD 6.8bn seen on August 13. For the month as a complete, open curiosity has remained above USD 5bn, “most of which is prone to be quick as funding charges have flipped detrimental from August 14th,” the report mentioned.

At 13:40 UTC, ETH traded at USD 1,564 within the spot market. The token was down greater than 1% in a day virtually 6% in per week.

_____

Be taught extra:

– Analysts Advise Ethereum Customers to Keep away from Transacting on Merge Day, Define Quite a few Dangers

– Finish-of-Week Ethereum: Merge Information Fails to Maintain Value Up, Merchants Talk about Merge-Associated Promote-Off, Binance Joins Exchanges Getting ready for Potential Fork

– Buterin Says Ethereum Will probably be ‘55% Full’ Put up-Merge

– No ‘Black and White’ Reply to the Proof-of-Work vs. Proof-of-Stake Query, Says Kraken

– The Merge’s Lengthy Time period Affect on Ethereum

– Main Bitcoin & Crypto Corporations Warn of ‘Excessive’ Danger in Proof-of-Stake Programs

– The Compromises and Advantages of Ethereum Switching to a Proof-of-Stake Community

After a big enhance within the open curiosity (OI) in ethereum (ETH) choices contracts over the course of July and the primary half of August, warnings have emerged that merchants ought to brace for elevated volatility within the nearest time period.

Elevated volatility will likely be on the horizon as choices merchants exit their positions across the time of Ethereum’s Merge, or transition from proof-of-work (PoW) to proof-of-stake (PoS).

On the time of writing, OI within the ETH choices market stood at USD 7.17bn, near its highest for the yr, and proper across the identical degree as main peaks in OI seen in Might and December of final yr, when the ETH market was unusually risky.

Complete ETH choices open curiosity:

As may be anticipated, risky costs will probably be seen this time round as effectively, and with the Merge anticipated to occur someday between September 10 and 20, a warning to merchants might be warranted.

In the meantime, volatility can also be felt within the ETH futures market, the place, on the time of writing, near USD 130m have been liquidated in 24 hours on Tuesday, per data from Coinglass. Though not large in comparison with liquidations sometimes seen throughout giant selloffs and rallies, the ETH liquidations have been nonetheless far increased than these seen within the bigger bitcoin (BTC) market, the place solely round USD 50m was liquidated.

A liquidation is the compelled closing of leveraged positions out there, and is completed by exchanges when merchants are unable or unwilling to place up the required capital to maintain the place open.

ETH whole liquidations per day:

ETH has been risky over the previous month, with a lot bigger strikes than BTC each to the upside and draw back.

Based on analysts at crypto analysis and funding agency Delphi Digital, this might must do with funding charges within the ETH futures market, which have declined to achieve a low of -0.024% on August 27. A degree that low has not been seen since June 2021, and was adopted by a “large short-squeeze” the next month, a current Delphi Digital report mentioned.

Funding charges sooner or later market is a mechanism developed to maintain the pricing of futures contracts according to spot costs. A detrimental funding fee implies that merchants who’re quick pay those that are lengthy, and vice versa. As such, a deeply detrimental funding fee implies that extra merchants need to go quick – a bearish signal for the market.

Delphi Digital’s report added that open curiosity within the ETH futures market has additionally risen because the market’s “capitulation” in June, with a peak of USD 6.8bn seen on August 13. For the month as a complete, open curiosity has remained above USD 5bn, “most of which is prone to be quick as funding charges have flipped detrimental from August 14th,” the report mentioned.

At 13:40 UTC, ETH traded at USD 1,564 within the spot market. The token was down greater than 1% in a day virtually 6% in per week.

_____

Be taught extra:

– Analysts Advise Ethereum Customers to Keep away from Transacting on Merge Day, Define Quite a few Dangers

– Finish-of-Week Ethereum: Merge Information Fails to Maintain Value Up, Merchants Talk about Merge-Associated Promote-Off, Binance Joins Exchanges Getting ready for Potential Fork

– Buterin Says Ethereum Will probably be ‘55% Full’ Put up-Merge

– No ‘Black and White’ Reply to the Proof-of-Work vs. Proof-of-Stake Query, Says Kraken

– The Merge’s Lengthy Time period Affect on Ethereum

– Main Bitcoin & Crypto Corporations Warn of ‘Excessive’ Danger in Proof-of-Stake Programs

– The Compromises and Advantages of Ethereum Switching to a Proof-of-Stake Community