After a formidable 73% rally between July 13 and Aug. 13, Avalanche (AVAX) has confronted a 16% rejection from the $30.30 resistance degree. Some analysts will attempt to pin the correction as a “technical adjustment,” however the community’s deposits and decentralized purposes replicate worsening situations.

So far, Avalanche stays 83% beneath its November 2021 all-time excessive at $148. Extra knowledge than technical evaluation may be analyzed to clarify the 16% worth drop, so let’s check out the community’s use by way of deposits and customers.

The decentralized software (DApp) platform continues to be a top-15 contender with a $7.2 billion market capitalization. In the meantime, Solana (SOL), one other proof-of-work (PoW) layer-1 platform, holds a $14.2 billion market cap, which is almost twice as giant as Avalanche’s.

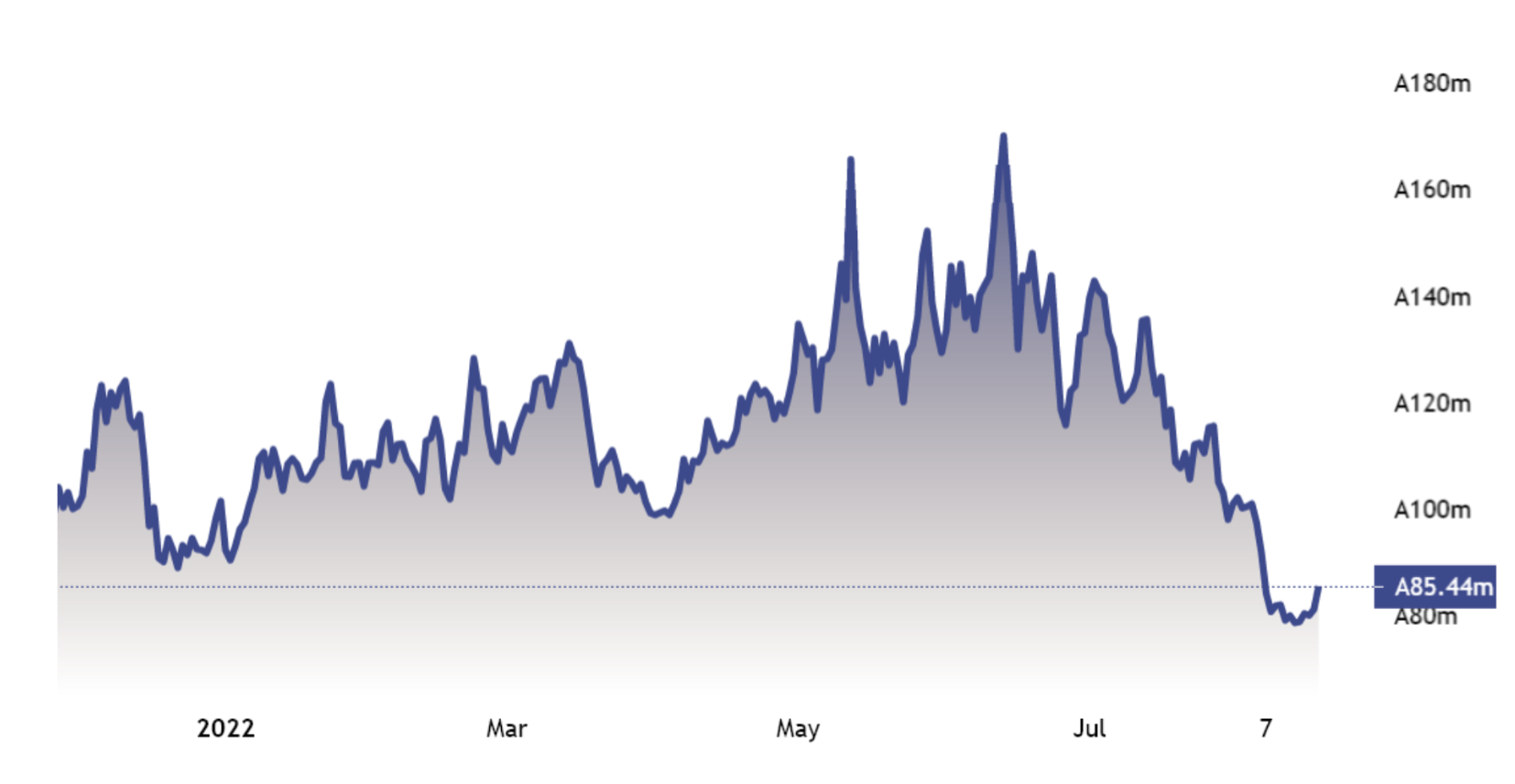

Avalanche’s TVL dropped 40% in two months

Some analysts have a tendency to present an excessive amount of weight to the overall worth locked (TVL) metic and though this may maintain relevance for the decentralized finance (DeFi) trade, it’s seldom required for nonfungible token (NFT) minting, digital merchandise marketplaces, crypto video games, playing and social purposes.

Utilizing the layer-2 answer Polygon (MATIC) as a proxy, it presently holds a $2.2 billion TVL whereas MATIC’s market cap stands at $7.2 billion; thus, a 3.3x MCap/TVL ratio. Curiously, the identical ratio applies to Avalanche, which presently holds an analogous $2.2 billion TVL and $7.2 billion capitalization.

Avalanche’s main DApp metric started to show weak point in late July after the TVL dropped beneath 110 million AVAX. In two months, the present 85.4 million is a pointy 40% minimize and indicators that buyers have been withdrawing cash from the community’s sensible contract purposes.

The chart above exhibits how Avalanche’s sensible contracts deposits peaked at 175 million AVAX on June 13, adopted by a relentless decline. In greenback phrases, the present $2.2 billion TVL is the bottom quantity since September 2021. This quantity represents 8.2% of the combination TVL (excluding Ethereum), according to knowledge from DefiLlama.

Initially, the info appears disappointing, particularly contemplating Solana’s community TVL lowered by 27% in the identical interval in SOL phrases, and Ethereum’s TVL declined by 33% in ETH deposits.

DApp use has additionally underperformed competing chains

To substantiate whether or not the TVL drop in Avalanche is troublesome, one ought to analyze a number of DApp utilization metrics.

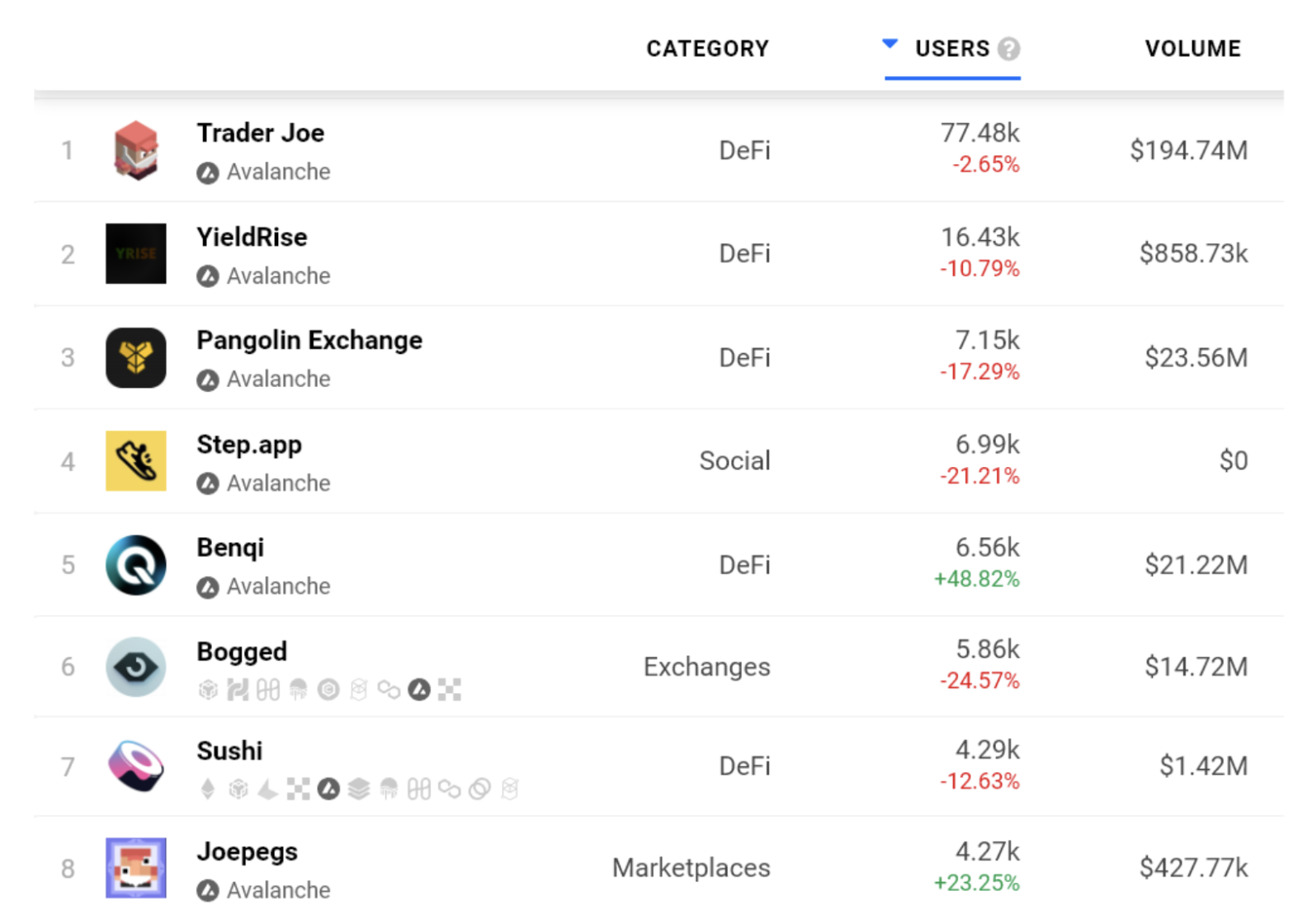

As proven by DappRadar, on Aug. 18, the variety of Avalanche community addresses interacting with decentralized purposes declined by 5% versus the earlier month. Compared, Ethereum posted a 4% improve and Polygon customers gained 10%.

Avalanche’s TVL has been hit the toughest in comparison with related sensible contract platforms and the variety of lively addresses interacting with most DApps solely surpassed 20,000 in a single case. This knowledge ought to be a warning sign for buyers betting on this automated blockchain execution answer.

Polygon, however, racked up 12 decentralized purposes with 20,000 or mo lively addresses in the identical time interval. The findings above counsel that Avalanche is dropping floor versus competing chains and this provides additional motive for the current 16% sell-off.

The views and opinions expressed listed here are solely these of the author and don’t essentially replicate the views of Cointelegraph. Each funding and buying and selling transfer includes danger. You must conduct your individual analysis when making a choice.