The value of Ethereum’s native token ETH might drop to a low of USD 675 – and rise to a excessive of USD 2,673 – earlier than ending the yr at USD 1,711, in accordance with a panel of crypto trade professionals surveyed by comparability web site Finder.com.

In line with a median of the responses given by the panelists, ETH is dealing with 5 months of outstanding volatility, with each a 57% drop and 68% acquire from the present worth prone to occur, earlier than the value ends the yr at USD 1,711 – round 7% larger than the present worth.

On the time of writing (14:25 UTC), ETH traded at USD 1,604. The token is up 4% in a day and practically 54% in per week.

Many panelists pointed to the Merge – Ethereum’s transition from the proof-of-work (PoW) to the proof-of-stake (PoS) consensus mechanism – as vital for the asset’s worth going ahead.

Ben Ritchie, managing director of Digital Capital Administration, stated that,

“Since Ethereum’s correlation to bitcoin continues to be excessive, we will speculate that if Merge occurs earlier than the year-end, its worth could decouple [from the rest of crypto]. Nevertheless, the surface financial issue is important, bringing hurdles to the short-term worth motion.”

The same sentiment was shared by Kevin He, chief working officer of fintech agency CloudTech Group.

“If Ethereum efficiently completes the merger this yr, we count on the value to rise as a result of PoS and quicker [transactions per second] result in larger demand for ETH from miners, traders and Dapp customers, and if the market woes are alleviated within the second half of the yr, it’s attainable for ETH worth to rise to the earlier excessive or break the earlier excessive as a result of rising demand,” he stated.

Others additionally concurred, with Joseph Raczynski, a technologist and futurist for Thomson Reuters, saying the Merge “isn’t priced into [ETH]” but.

“[Ethereum] nonetheless helps a whole lot of billions of {dollars} in transactions and worth, with 1000’s of tokens. At this stage, Ethereum continues to be the blue blood of the crypto world,” Raczynski opined.

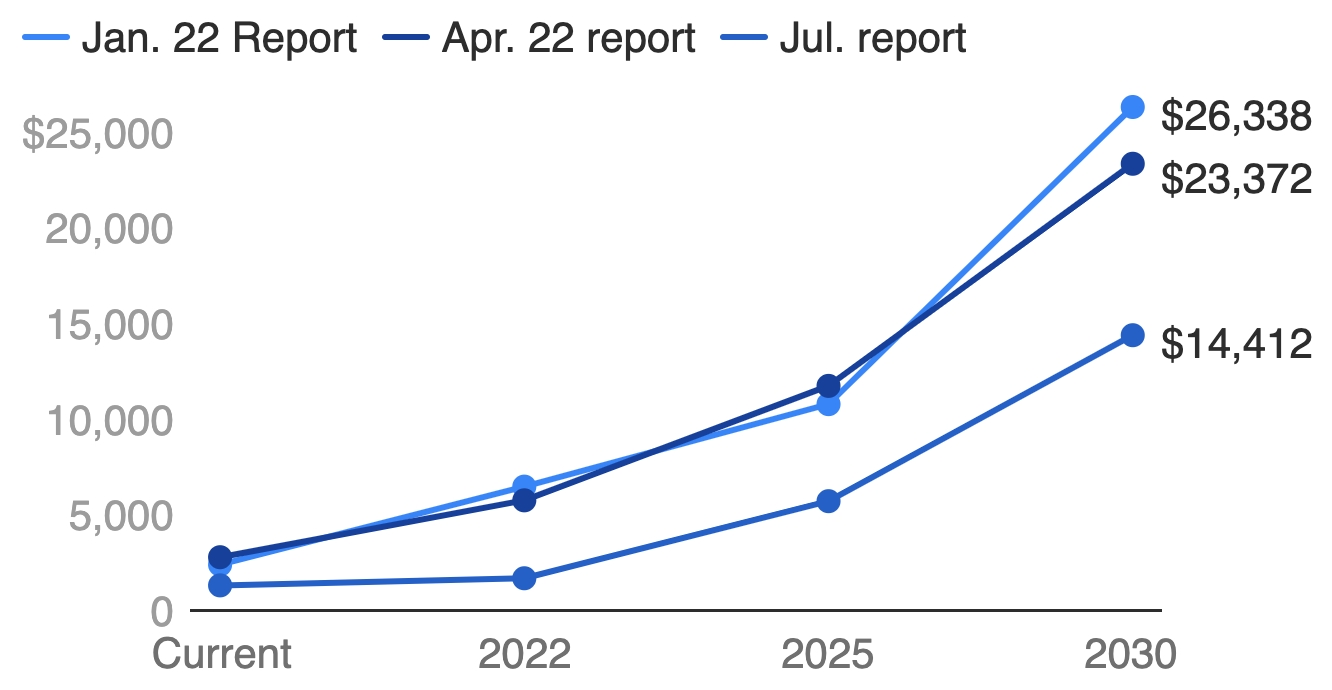

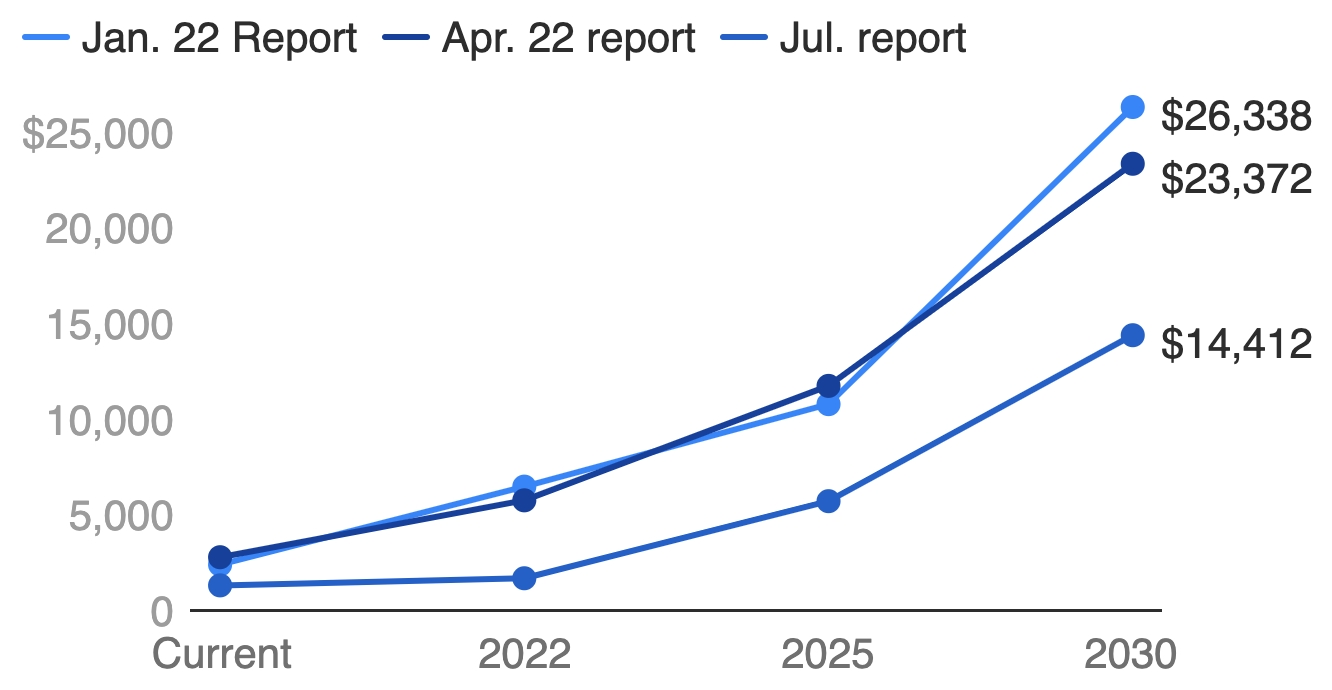

Wanting additional out, the typical of the panelists’ responses indicated a worth for year-end 2025 of USD 5,739, and for 2030 of USD 14,412.

And though which will sound bullish, it nonetheless marks a big downgrade within the worth predictions in comparison with earlier surveys by the panel from January and April this yr.

In April, the panel predicted ETH would attain USD 11,764 by the top of 2025 and USD 23,372 by the top of 2030. In January, panelists have been additionally bullish, predicting a year-end worth for 2025 of USD 10,810 and for 2030 of USD 26,338.

As beforehand reported by Cryptonews.com, comparable downgrades have additionally been seen in Finder.com’s bitcoin worth predictions. As not too long ago as April, Finder.com’s panel predicted BTC would finish the yr at USD 65,185. Then, in July, the panel downgraded this prediction, saying {that a} year-end worth of USD 25,500 is extra probably.

Finder.com’s panel is made up of assorted crypto trade gamers, together with analysts, founders, CEOs, and lecturers within the subject.

____

Study extra:

– Large Liquidations Push Ethereum Greater because the Nearing Merge Boosts Sentiment

– Ethereum Merge Date Proposed for September

– Bitcoin and Arduous Property Will Win as Inflation Rises, Novogratz Says and Sees BTC at USD 500K

– Bitcoin May Fall to USD 13.6K This 12 months, Panel Says After Adjusting Predictions As soon as Once more

– Cardano Value to Finish 12 months at USD 0.63, More and more Bearish Panel Predicts

– Crypto Winter Will Finish Earlier than 2022 Is Out – Korbit

The value of Ethereum’s native token ETH might drop to a low of USD 675 – and rise to a excessive of USD 2,673 – earlier than ending the yr at USD 1,711, in accordance with a panel of crypto trade professionals surveyed by comparability web site Finder.com.

In line with a median of the responses given by the panelists, ETH is dealing with 5 months of outstanding volatility, with each a 57% drop and 68% acquire from the present worth prone to occur, earlier than the value ends the yr at USD 1,711 – round 7% larger than the present worth.

On the time of writing (14:25 UTC), ETH traded at USD 1,604. The token is up 4% in a day and practically 54% in per week.

Many panelists pointed to the Merge – Ethereum’s transition from the proof-of-work (PoW) to the proof-of-stake (PoS) consensus mechanism – as vital for the asset’s worth going ahead.

Ben Ritchie, managing director of Digital Capital Administration, stated that,

“Since Ethereum’s correlation to bitcoin continues to be excessive, we will speculate that if Merge occurs earlier than the year-end, its worth could decouple [from the rest of crypto]. Nevertheless, the surface financial issue is important, bringing hurdles to the short-term worth motion.”

The same sentiment was shared by Kevin He, chief working officer of fintech agency CloudTech Group.

“If Ethereum efficiently completes the merger this yr, we count on the value to rise as a result of PoS and quicker [transactions per second] result in larger demand for ETH from miners, traders and Dapp customers, and if the market woes are alleviated within the second half of the yr, it’s attainable for ETH worth to rise to the earlier excessive or break the earlier excessive as a result of rising demand,” he stated.

Others additionally concurred, with Joseph Raczynski, a technologist and futurist for Thomson Reuters, saying the Merge “isn’t priced into [ETH]” but.

“[Ethereum] nonetheless helps a whole lot of billions of {dollars} in transactions and worth, with 1000’s of tokens. At this stage, Ethereum continues to be the blue blood of the crypto world,” Raczynski opined.

Wanting additional out, the typical of the panelists’ responses indicated a worth for year-end 2025 of USD 5,739, and for 2030 of USD 14,412.

And though which will sound bullish, it nonetheless marks a big downgrade within the worth predictions in comparison with earlier surveys by the panel from January and April this yr.

In April, the panel predicted ETH would attain USD 11,764 by the top of 2025 and USD 23,372 by the top of 2030. In January, panelists have been additionally bullish, predicting a year-end worth for 2025 of USD 10,810 and for 2030 of USD 26,338.

As beforehand reported by Cryptonews.com, comparable downgrades have additionally been seen in Finder.com’s bitcoin worth predictions. As not too long ago as April, Finder.com’s panel predicted BTC would finish the yr at USD 65,185. Then, in July, the panel downgraded this prediction, saying {that a} year-end worth of USD 25,500 is extra probably.

Finder.com’s panel is made up of assorted crypto trade gamers, together with analysts, founders, CEOs, and lecturers within the subject.

____

Study extra:

– Large Liquidations Push Ethereum Greater because the Nearing Merge Boosts Sentiment

– Ethereum Merge Date Proposed for September

– Bitcoin and Arduous Property Will Win as Inflation Rises, Novogratz Says and Sees BTC at USD 500K

– Bitcoin May Fall to USD 13.6K This 12 months, Panel Says After Adjusting Predictions As soon as Once more

– Cardano Value to Finish 12 months at USD 0.63, More and more Bearish Panel Predicts

– Crypto Winter Will Finish Earlier than 2022 Is Out – Korbit