Lido DAO (LDO) worth edged increased on Aug. 3, primarily on account of comparable upside strikes elsewhere within the crypto market and a rising euphoria round Ethereum’s community improve in September.

On the every day chart, LDO’s worth reached an intraday excessive of $2.40 a day after bottoming out domestically at $1.84. The sharp upside reversal amounted to almost 30% beneficial properties in a day, suggesting merchants’ strengthening bullish bias for Lido DAO.

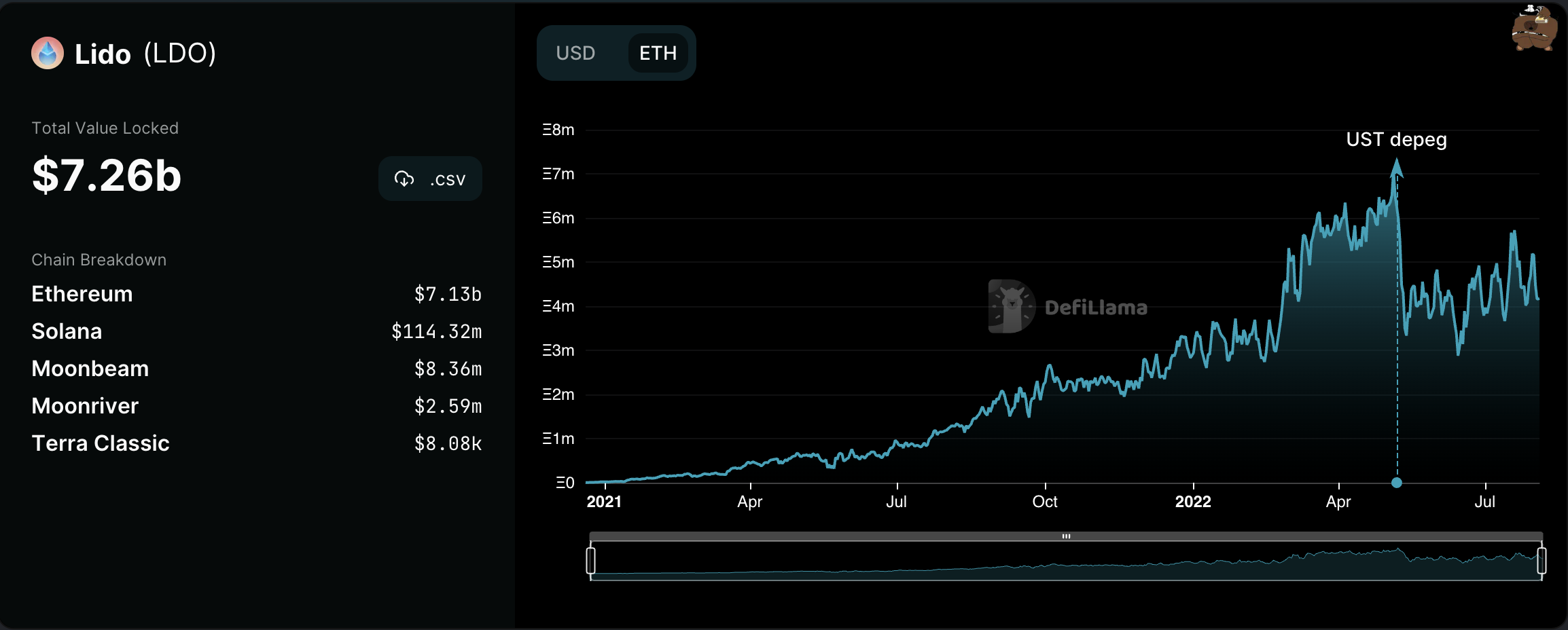

Lido DAO is a liquid staking resolution for Ethereum by complete worth deposited. In different phrases, it permits customers to take part within the operating of Ethereum’s upcoming proof-of-stake (PoS) chain in alternate for every day rewards.

Ethereum’s Ether (ETH) token has rallied by greater than 90% since mid-June partly on account of buzz round its blockchain’s PoS improve known as the Merge, anticipated in September.

Lido DAO, the most important Merge staking serve supplier, has benefited from the craze concurrently, with LDO, its governance token, rallying almost 500% in the identical interval.

Notably, the full variety of Ether staked into the Merge good contract—additionally known as ETH 2.0—by way of Lido has surged from 3.38 million on June 13 to 4.16 million on Aug. 3, in line with DeFi Llama.

Charts trace at LDO worth rally forward

Moreover, LDO’s technicals seem skewed to the upside on account of its “bull flag.” This technical pattern typically appears during an uptrend, when the price consolidates lower inside a descending channel after a strong upside move.

LDO has been forming a similar pattern. On the daily chart, the token’s price has been reversing course after undergoing a strong uptrend that topped at around $2.66 on July 28.

As a result, the Lido DAO token now eyes a break above its current descending channel range, similar to the upside move that followed its bull pennant formation in July.

As a rule, the bull flag’s profit target comes to be at length equal to the size of the previous uptrend, called “flagpole,” or $4 by September, up 65% from Aug. 3’s price.

Bull flag failure scenario

On the flip side, a bull flag’s potential to reach its upside target stands at around 67%, according to research conducted by Samurai Buying and selling Academy. Due to this fact, LDO’s bull flag might fail if its worth breaks under the sample’s decrease trendline.

Associated: ETH could consolidate as Merge pleasure wears off, says skilled

The trendline coincides with a help confluence made up of $1.91‚ which capped LDO’s upside strikes in late July, and the 20-day exponential shifting common (20-day EMA; the inexperienced wave within the chart under) at round $1.80.

Thus, a bear flag breakdown, or a break under the help confluence, might have LDO eye the 50-day EMA (the pink wave) close to $1.43 as its draw back goal.

This degree coincides with the 0.236 Fib line round $1.42, which served as a worth ground in February and Could.

The views and opinions expressed listed below are solely these of the writer and don’t essentially mirror the views of Cointelegraph.com. Each funding and buying and selling transfer includes threat, it is best to conduct your personal analysis when making a call.