The outlook throughout the cryptocurrency ecosystem continues to dim because the sharp downtrend that was initially sparked by the collapse of Terra (LUNA, now LUNC) seems to have claimed the Singapore-based crypto enterprise capital agency Three Arrows Capital (3AC) as its subsequent sufferer.

As massive crypto tasks and funding companies start to break down on a weekly foundation, the prospect of an extended, drawn out bear market is a actuality buyers are starting to just accept.

Primarily based on a latest Twitter ballot conducted by market analyst and pseudonymous Twitter person Plan C, 41.6% of respondents indicated that they thought the Bitcoin (BTC) backside will fall between the $17,000 to $20,000 vary.

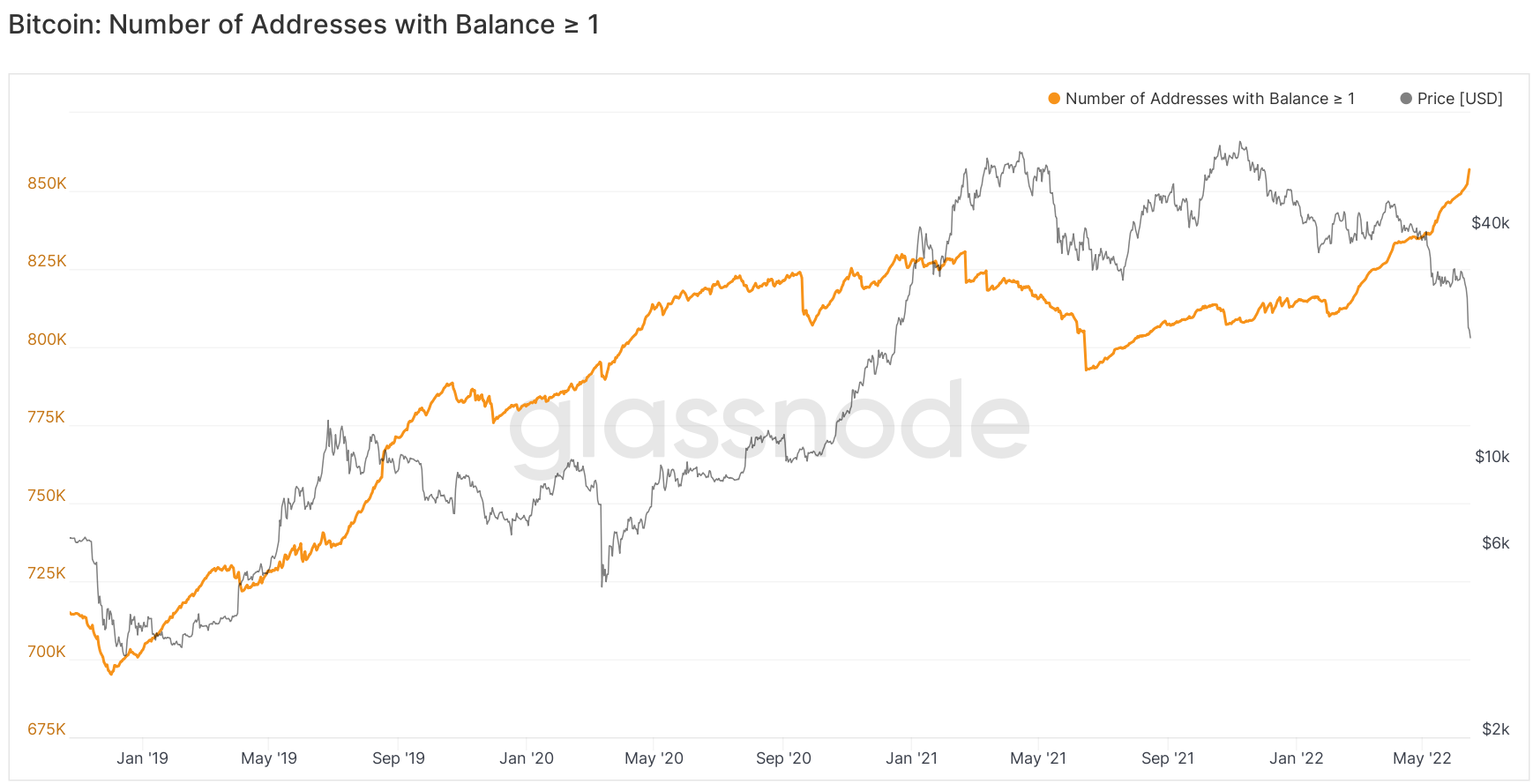

Addresses holding not less than 1 BTC hits a brand new excessive

Within the midst of the heightened volatility and speedy value decline for Bitcoin, many would anticipate to see merchants dumping their holdings and fleeing to the sidelines in a bid to take care of their buying energy.

Whereas it has certainly been the case that falling costs and liquidations have pushed many merchants out of the market, low-priced Bitcoin has additionally attracted some consumers who’ve patiently been ready for the appropriate entry level.

Knowledge reveals that the variety of Bitcoin addresses that hold at least 1BTC has now hit a new all-time high and it appears that it will increase in the near future if sub-$20,000 BTC continues to attract buyers.

Related: Is the bottom in? Raoul Pal, Scaramucci load up, Novogratz and Hayes weigh in

“BTC is cheaper than it looks”

Market tops and bottoms are usually overreactions to developments and retail traders have a tendency to FOMO when the price is rising, yet they are quick to sell when bad news starts to spread.

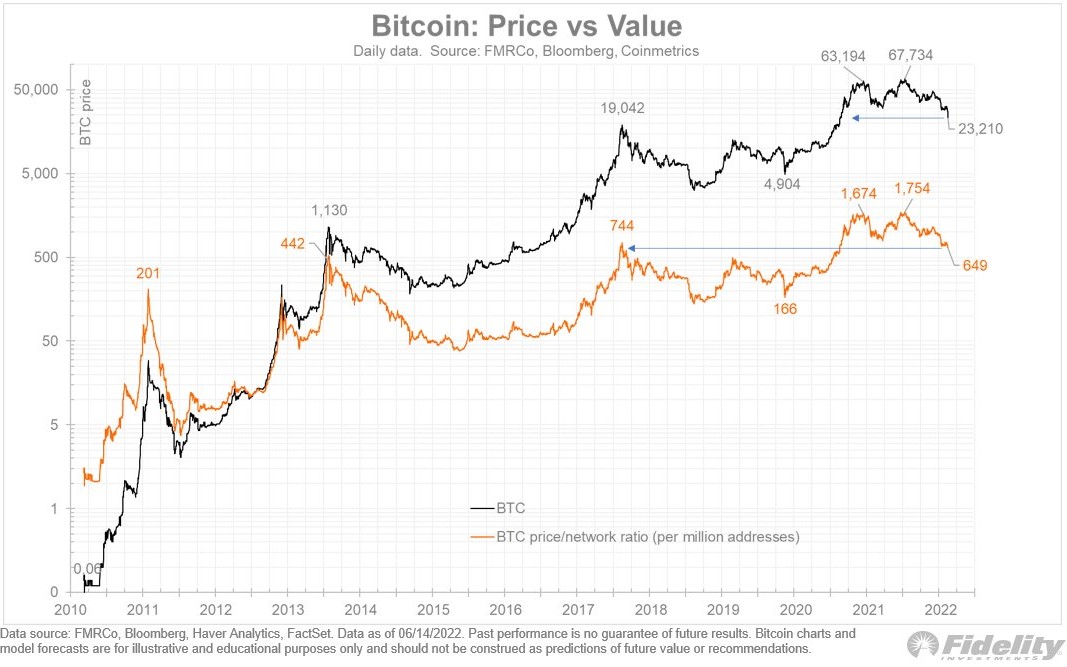

A more nuanced analysis of the current value of Bitcoin was discussed by Jurrien Timmer, director of global macro at Fidelity, who posted the next chart and questioned if “BTC is cheaper than it appears to be like?”

Timmer stated,

“If we contemplate a easy “P/E” metric for BTC to be the worth/community ratio, then that ratio is again to 2017 and 2013 ranges, though BTC, itself, is simply again to late 2020 ranges. Valuation typically is extra essential than value.”

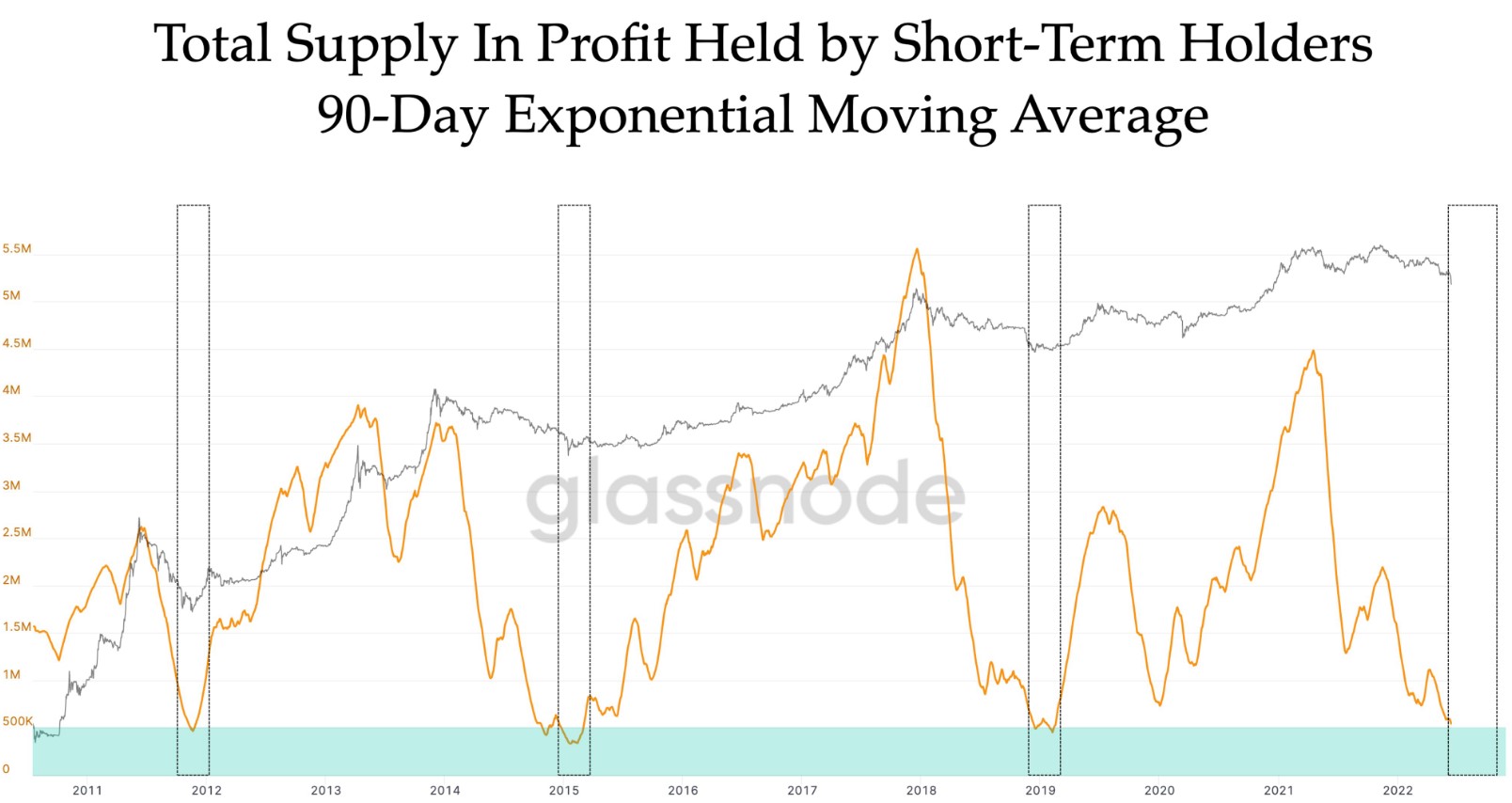

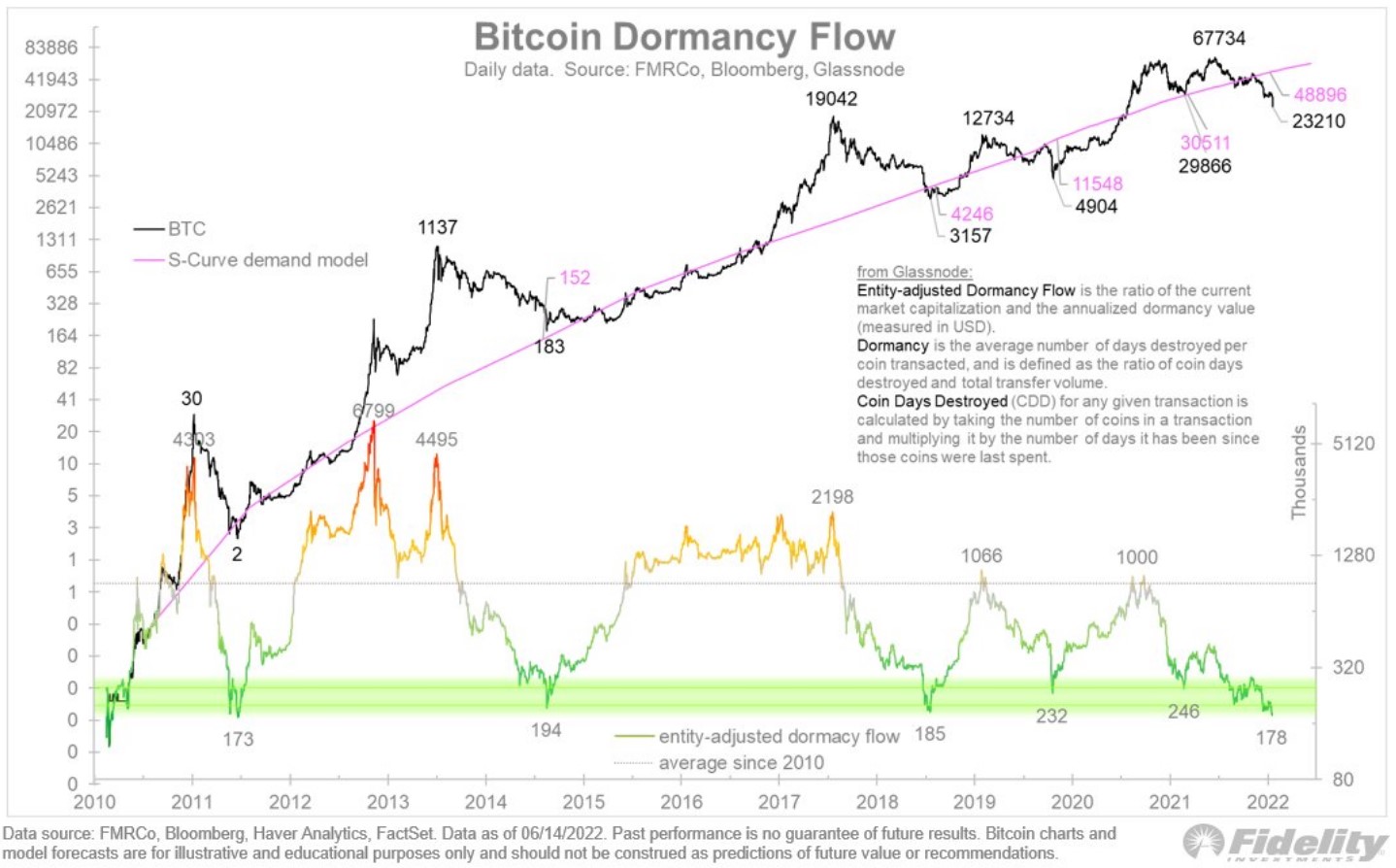

Timmer added that BTC is at present priced under its truthful market worth with the Bitcoin dormancy circulate indicator, which shows “how technically oversold [it] is.”

Timmer stated,

“Glassnode’s dormancy circulate indicator is now to ranges not seen since 2011.”

Taken collectively, the rise in Bitcoin addresses holding greater than 1 BTC mixed with the asset’s traditionally oversold value and undervalued value/community ratio means that the draw back risk is probably not as unhealthy as many merchants suppose.

The views and opinions expressed listed here are solely these of the writer and don’t essentially mirror the views of Cointelegraph.com. Each funding and buying and selling transfer includes threat, you need to conduct your individual analysis when making a choice.