Bitcoin (BTC) rose to each day resistance on the Aug. 3 Wall Road open as United States equities gained on reduction over Taiwan.

Shares achieve as U.S. greenback coils

Information from Cointelegraph Markets Professional and TradingView confirmed BTC/USD returning to the realm just under $23,500, which had figured as resistance because the begin of the month.

The pair had beforehand held the identical zone as assist and was now deciding whether or not a brand new resistance/assist flip was on the playing cards.

For in style dealer Crypto Tony, $23,500 was thus the worth to look at to lengthy BTC.

Hold it easy this morning on #Bitcoin ..

– Lengthy above resistance at $23,500

– Quick beneath assist at $22,650 pic.twitter.com/onXXRvdXx8— Crypto Tony (@CryptoTony__) August 3, 2022

To the draw back, fellow dealer Pentoshi highlighted the realm between $21,800 and $22,000 because the “line within the sand” for BTC.

Shares carried out nicely on the day, in the meantime, with the S&P 500 and Nasdaq Composite Index gaining 1.2% and a couple of%, respectively, after the open. Information that U.S. Home Speaker Nancy Pelosi had begun a go to to Taiwan with out repercussions from China buoyed the temper.

The U.S. greenback index (DXY), after stable features of its personal at the beginning of the week, consolidated after going through resistance at 106.8 on hourly timeframes. The intra-day lows matched with highs from Might, evaluation noted, with the potential for brand new two-decade highs nonetheless in play in what would signify friction for crypto and threat belongings.

“Because the greenback begins to indicate potential indicators of energy (and yields start to tear greater), will shares proceed to stay resilient? Value motion all through 2022 tells us ‘no,’” market analyst Caleb Franzen warned.

ARK faucets “rising risk-on setting”

In the meantime, in a abstract of the established order in Bitcoin and Ether (ETH), funding agency ARK Make investments painted a blended image of the place the market might go in 2022.

Associated: ARK Make investments ‘impartial to constructive’ on Bitcoin value as analysts await capitulation

Within the newest version of its analysis collection, “The Bitcoin Month-to-month,” ARK analysts, together with CEO Cathie Wooden and others, said that “all eyes” have been now on macro triggers.

“Given the constructive correlation between bitcoin and US equities since COVID, the US being the main value mover of bitcoin suggests an rising risk-on market setting,” they wrote.

The USA, ARK added, probably represented the vast majority of purchase curiosity in Bitcoin throughout July’s restoration.

”Going ahead, nevertheless, the chances of an prolonged rebound are unsure. Describing its stance as “impartial,” ARK delivered a possible “unlikely” bearish goal of slightly below $14,000.

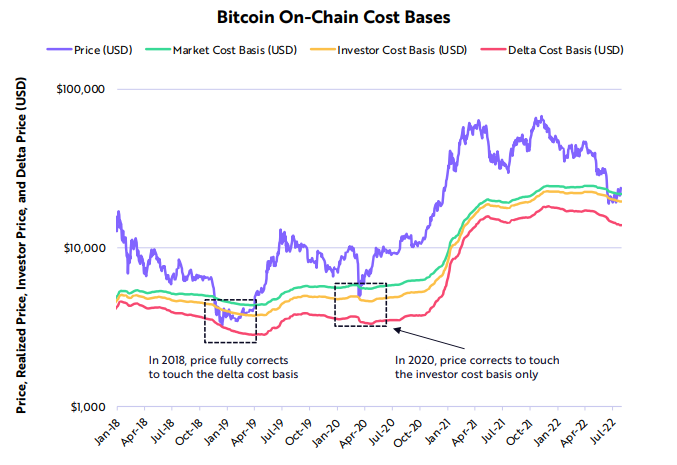

“Similar to the selloff on the peak of the COVID disaster, bitcoin’s value didn’t attain its delta value foundation, a value adjusted value foundation that subtracts the life-to date transferring common of market value from its market value foundation and serves as bitcoin’s strongest assist degree,” the report said.

“Whereas the probability of touching its delta value foundation has diminished, bitcoin’s draw back threat in a bear market technically stands at its delta value foundation, at present $13,890.”

The views and opinions expressed listed below are solely these of the writer and don’t essentially mirror the views of Cointelegraph.com. Each funding and buying and selling transfer entails threat, you must conduct your individual analysis when making a call.