Funding charges available in the market for bitcoin (BTC) and ethereum (ETH) perpetual futures contracts reveal that the majority crypto derivatives merchants proceed to lean bullish, regardless of falling spot costs over the previous 24 hours.

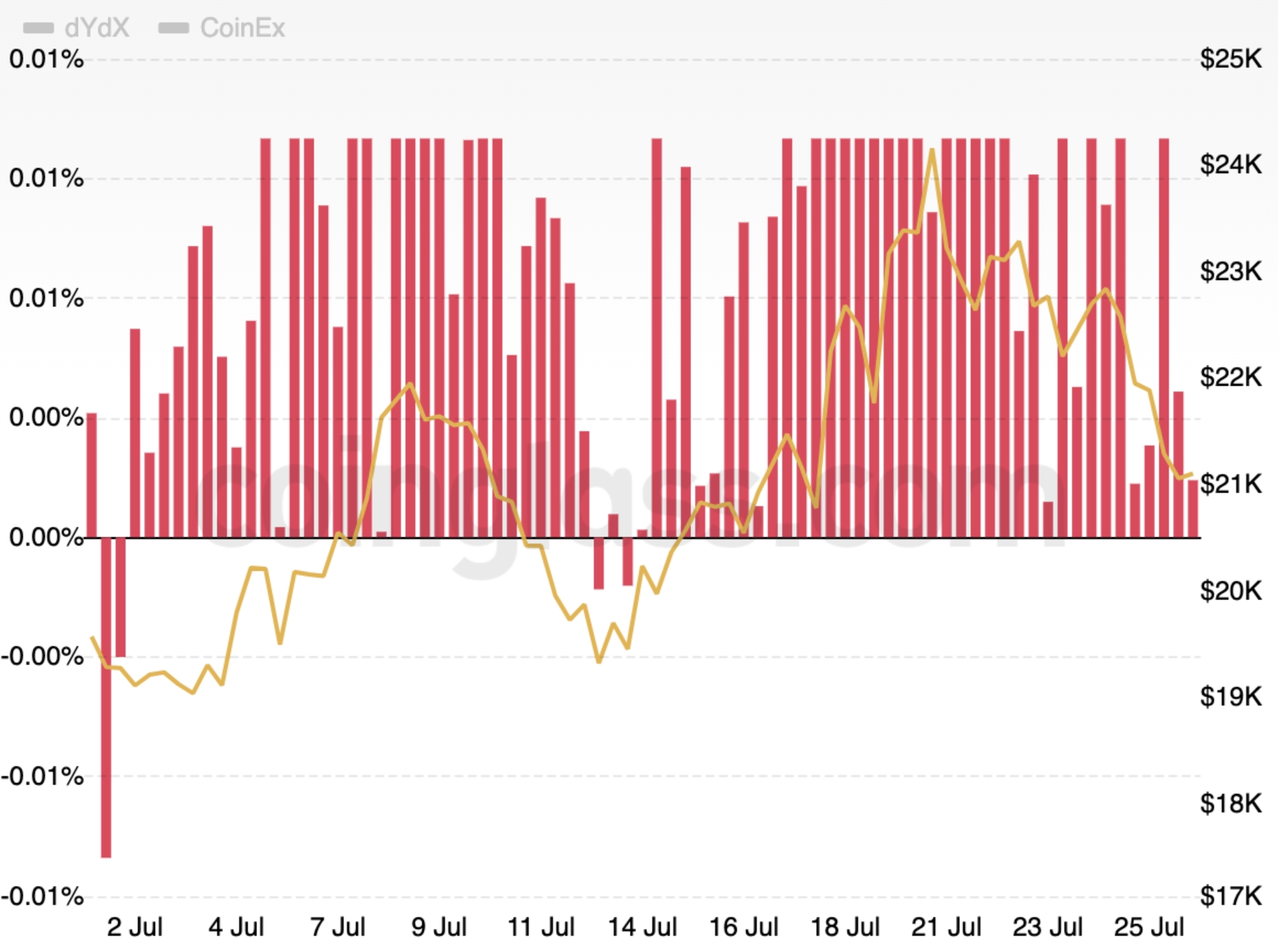

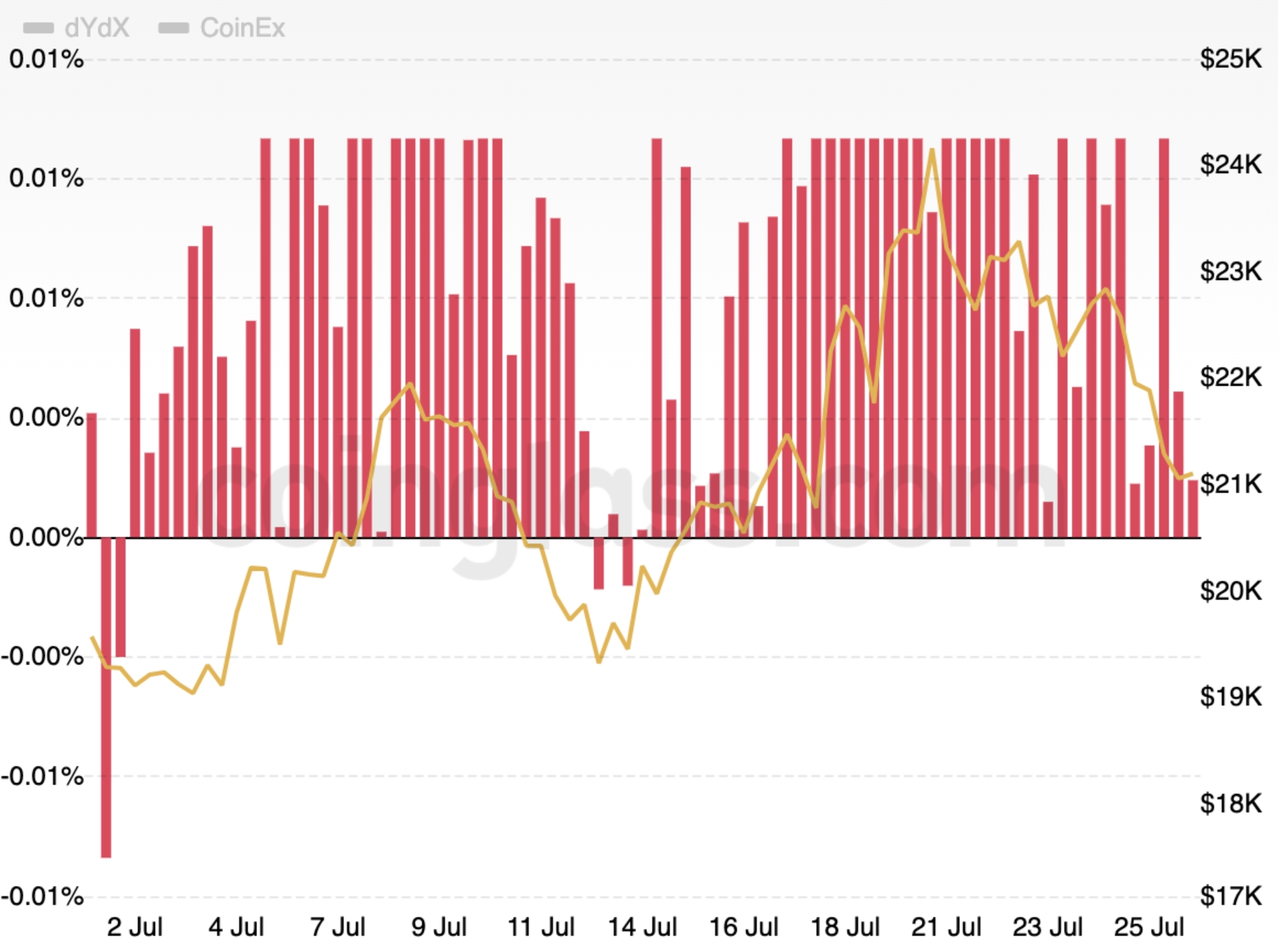

Judging from knowledge by Coinglass, funding charges on the BTC/USDT perpetual contract on the most important crypto change Binance have largely remained constructive all through July, regardless of stagnating and falling costs seen since July 19.

Binance BTC/USDT funding charges in July:

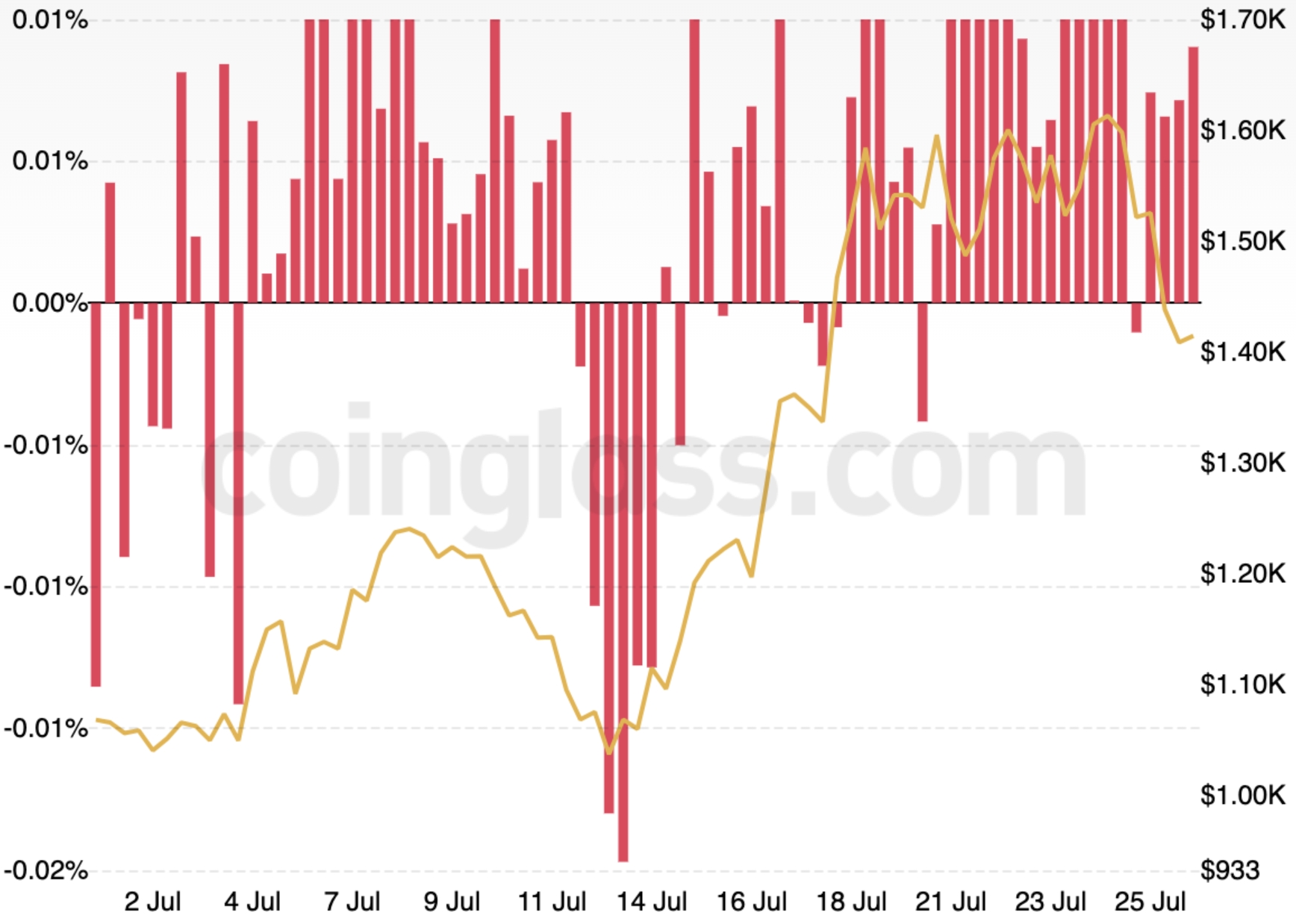

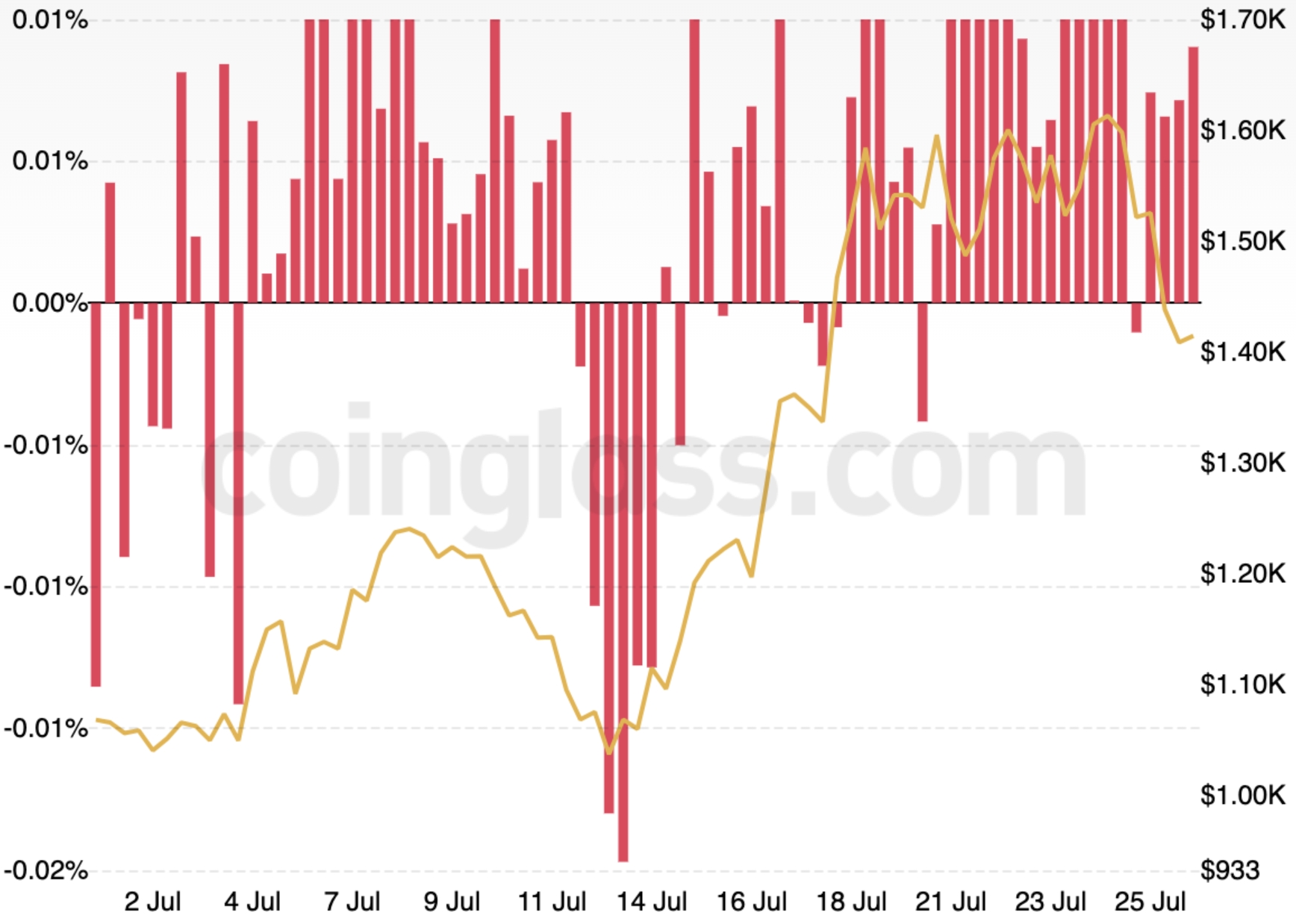

The identical has principally additionally been the case for the ETH/USDT perpetual contract. The funding price has remained constructive at the same time as ETH fell sharply on Monday this week, dropping from USD 1,600 to effectively beneath the important thing USD 1,500 stage.

Binance ETH/USDT funding charges in July:

A constructive funding price signifies that merchants who’re lengthy have to pay a funding charge to those that are quick, whereas a unfavourable funding price ends in the other state of affairs. Funding charges on perpetual futures are usually constructive throughout bullish market circumstances and unfavourable throughout bearish circumstances.

Binance normally ranks as the biggest change by open curiosity in bitcoin perpetual futures. The change updates its perpetual funding charges each 8 hours.

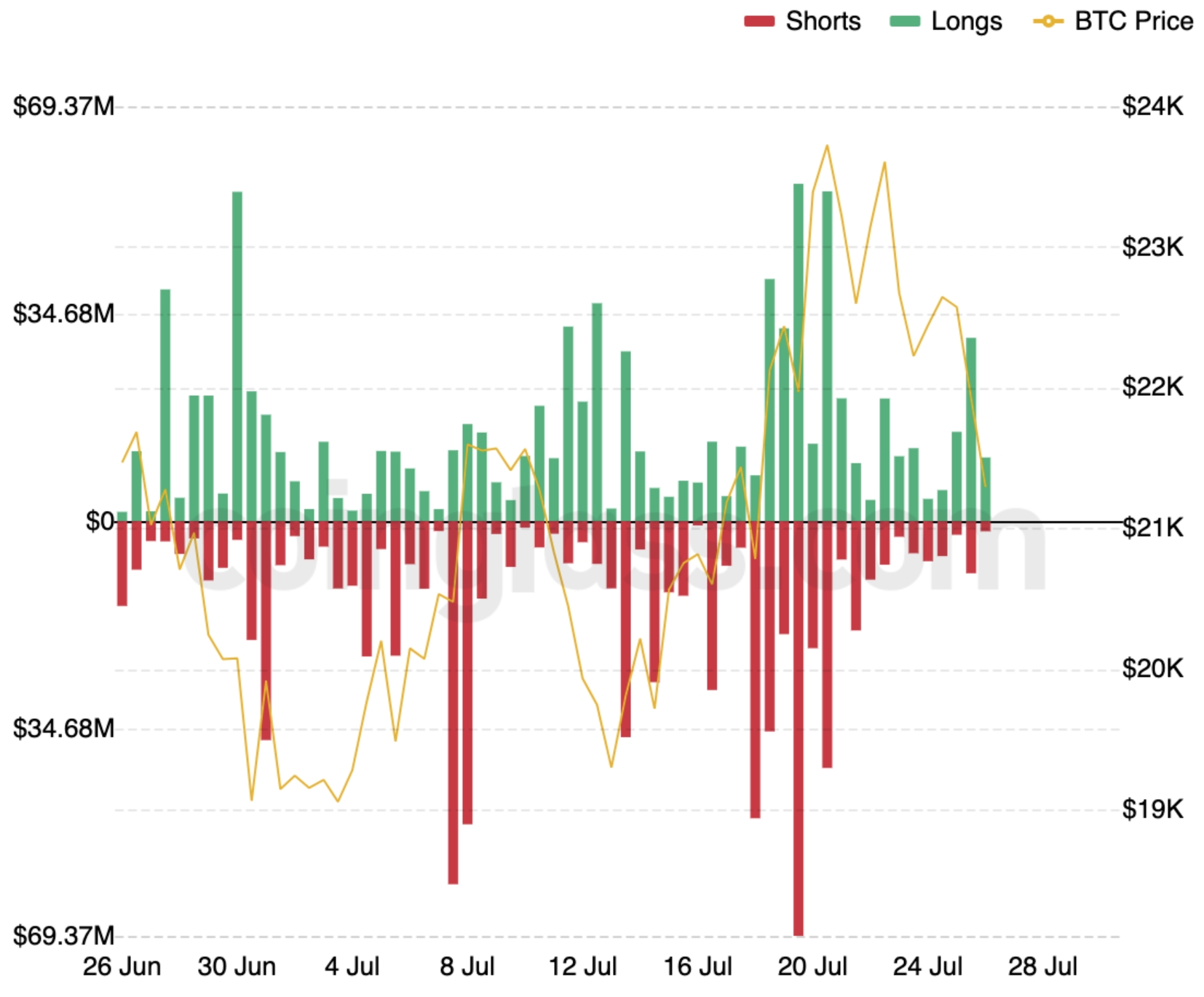

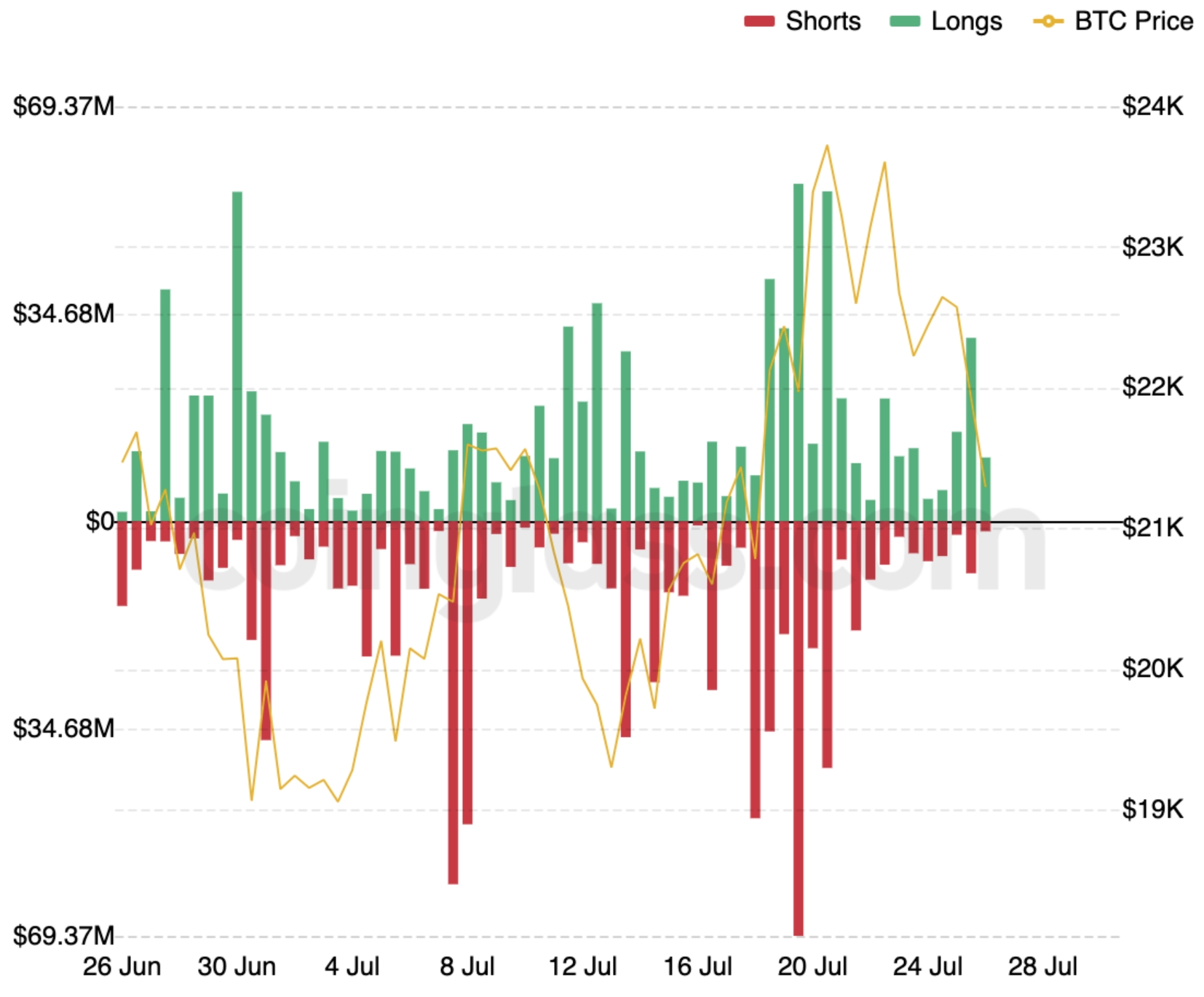

In the meantime, liquidations of leveraged bitcoin lengthy positions reached USD 30.6m within the 12 hours from midday to midnight UTC on Monday. The occasion marked the very best stage of liquidations since July 20, when over USD 55m of bitcoin longs have been liquidated as bitcoin crashed from the USD 24,000 stage.

BTC liquidations:

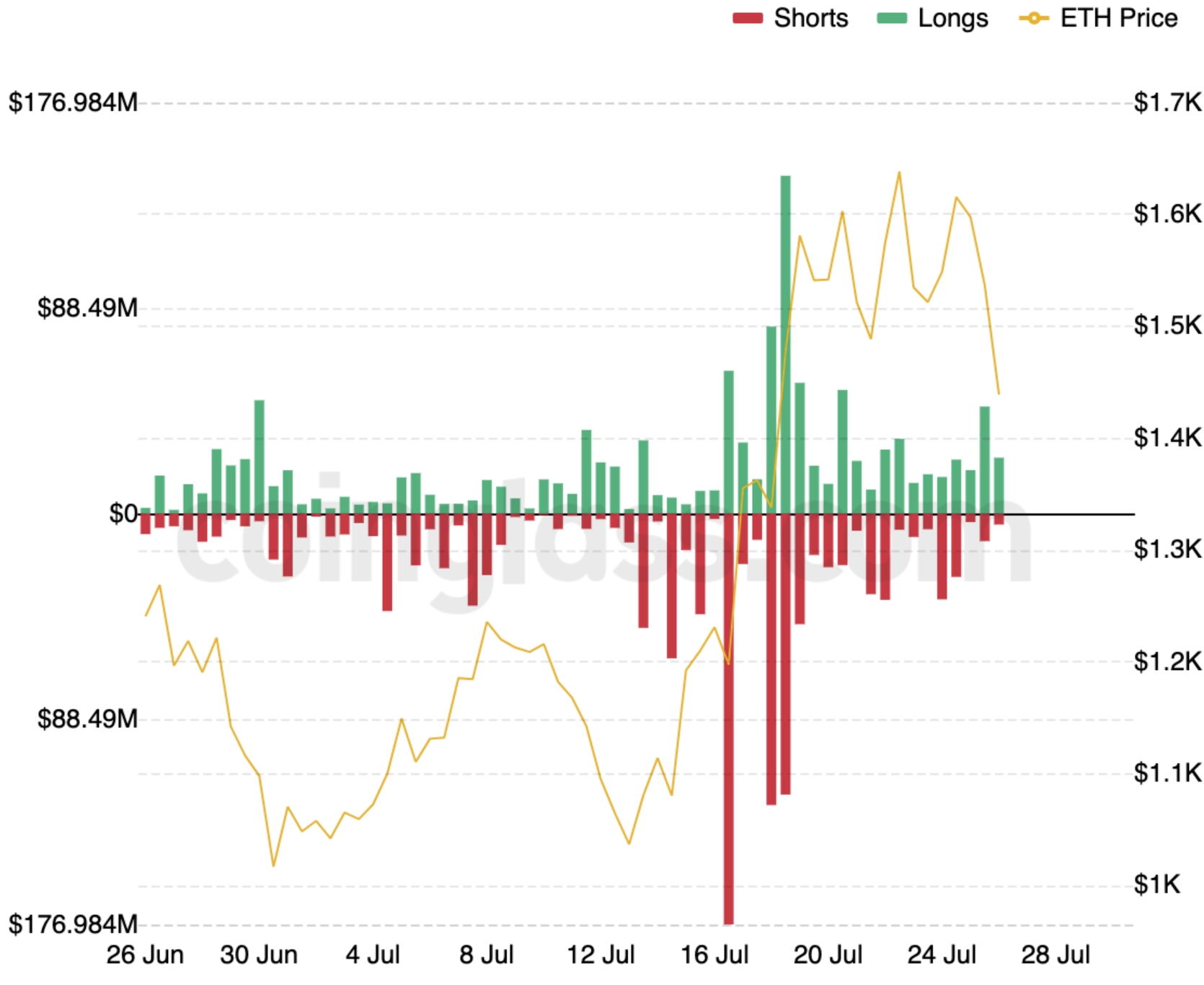

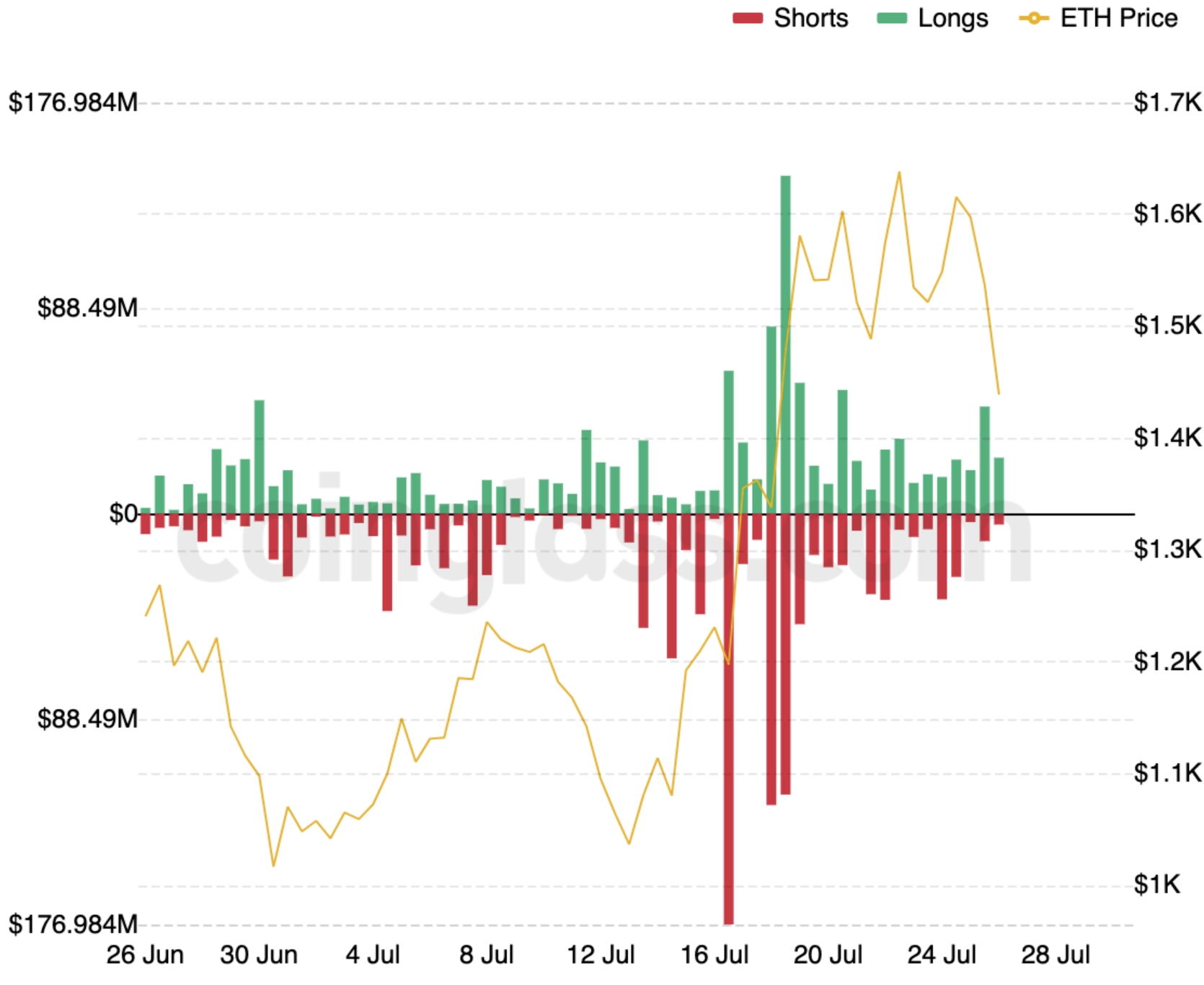

Equally, ETH additionally noticed a comparatively excessive stage of liquidations on Monday, with USD 46m in ETH longs liquidated within the 12 hours from midday to midnight. As with bitcoin, the liquidations on Monday marked the very best stage of ETH liquidations for the reason that crypto sell-off on July 20.

ETH liquidations:

The lengthy liquidations within the ETH market got here regardless of elevated bullishness on the asset in latest days, fueled partly by a way that the Merge – Ethereum’s transition from the proof-of-work (PoW) to the proof-of-stake (PoS) consensus mechanism – is nearing. Ethereum developer Tim Beiko earlier in July proposed September 19 because the tentative date for the Merge.

The information is regarded as at the least partly accountable for a surge within the value of ETH from the USD 1,200 stage to shut to USD 1,600 between July 16 and July 18 as a large quantity of leveraged shorts have been liquidated.

Commenting on the surging value on the time, a weblog post printed by the crypto derivatives change Deribit mentioned that it “appears to be brought on by a gamma squeeze,” or large-scale shopping for of short-dated name choices. Nonetheless, the submit additionally warned that the value enhance “lacks enough help.”

Certain sufficient, ETH fell sharply on Monday this week, with the sell-off persevering with on Tuesday, seen by many different cryptoassets as effectively.

At 12:34 UTC on Tuesday, BTC was down 3.7% for the previous 24 hours and 5.7% for the week to a value of USD 21,113. On the identical time, ETH stood at USD 1,402, down 8.3% for the day and 10.6% for the week.

____

Study extra:

– Bitcoin & Crypto Slip Amid ‘Indicators of Exhaustion,’ BTC & ETH See Funding Inflows Once more

– Bitcoin Mining Problem Sees Its Greatest Fall in 12 Months

– Risky Months Forward for Ethereum & USD 1,711 Probably for Yr-Finish, Says Crypto Business Panel

– Crypto Winter Will Finish Earlier than 2022 Is Out – Korbit

– US Fed Set for New Fee Hike This Week, However How Aggressive Will It Be?

– Tesla Reveals Its Bitcoin Holdings and BTC Sale Revenue

Funding charges available in the market for bitcoin (BTC) and ethereum (ETH) perpetual futures contracts reveal that the majority crypto derivatives merchants proceed to lean bullish, regardless of falling spot costs over the previous 24 hours.

Judging from knowledge by Coinglass, funding charges on the BTC/USDT perpetual contract on the most important crypto change Binance have largely remained constructive all through July, regardless of stagnating and falling costs seen since July 19.

Binance BTC/USDT funding charges in July:

The identical has principally additionally been the case for the ETH/USDT perpetual contract. The funding price has remained constructive at the same time as ETH fell sharply on Monday this week, dropping from USD 1,600 to effectively beneath the important thing USD 1,500 stage.

Binance ETH/USDT funding charges in July:

A constructive funding price signifies that merchants who’re lengthy have to pay a funding charge to those that are quick, whereas a unfavourable funding price ends in the other state of affairs. Funding charges on perpetual futures are usually constructive throughout bullish market circumstances and unfavourable throughout bearish circumstances.

Binance normally ranks as the biggest change by open curiosity in bitcoin perpetual futures. The change updates its perpetual funding charges each 8 hours.

In the meantime, liquidations of leveraged bitcoin lengthy positions reached USD 30.6m within the 12 hours from midday to midnight UTC on Monday. The occasion marked the very best stage of liquidations since July 20, when over USD 55m of bitcoin longs have been liquidated as bitcoin crashed from the USD 24,000 stage.

BTC liquidations:

Equally, ETH additionally noticed a comparatively excessive stage of liquidations on Monday, with USD 46m in ETH longs liquidated within the 12 hours from midday to midnight. As with bitcoin, the liquidations on Monday marked the very best stage of ETH liquidations for the reason that crypto sell-off on July 20.

ETH liquidations:

The lengthy liquidations within the ETH market got here regardless of elevated bullishness on the asset in latest days, fueled partly by a way that the Merge – Ethereum’s transition from the proof-of-work (PoW) to the proof-of-stake (PoS) consensus mechanism – is nearing. Ethereum developer Tim Beiko earlier in July proposed September 19 because the tentative date for the Merge.

The information is regarded as at the least partly accountable for a surge within the value of ETH from the USD 1,200 stage to shut to USD 1,600 between July 16 and July 18 as a large quantity of leveraged shorts have been liquidated.

Commenting on the surging value on the time, a weblog post printed by the crypto derivatives change Deribit mentioned that it “appears to be brought on by a gamma squeeze,” or large-scale shopping for of short-dated name choices. Nonetheless, the submit additionally warned that the value enhance “lacks enough help.”

Certain sufficient, ETH fell sharply on Monday this week, with the sell-off persevering with on Tuesday, seen by many different cryptoassets as effectively.

At 12:34 UTC on Tuesday, BTC was down 3.7% for the previous 24 hours and 5.7% for the week to a value of USD 21,113. On the identical time, ETH stood at USD 1,402, down 8.3% for the day and 10.6% for the week.

____

Study extra:

– Bitcoin & Crypto Slip Amid ‘Indicators of Exhaustion,’ BTC & ETH See Funding Inflows Once more

– Bitcoin Mining Problem Sees Its Greatest Fall in 12 Months

– Risky Months Forward for Ethereum & USD 1,711 Probably for Yr-Finish, Says Crypto Business Panel

– Crypto Winter Will Finish Earlier than 2022 Is Out – Korbit

– US Fed Set for New Fee Hike This Week, However How Aggressive Will It Be?

– Tesla Reveals Its Bitcoin Holdings and BTC Sale Revenue