Bitcoin (BTC) briefly broke above $25,000 on Aug. 15, however the pleasure lasted lower than an hour and was adopted by a 5% retrace within the subsequent 5 hours. The resistance degree proved to be more durable than anticipated however could have given bulls false hope for the upcoming $335 million weekly choices expiry.

Buyers’ fleeting optimism reverted to a sellers’ market on Aug. 17 after BTC dumped and examined the $23,300 assist. The detrimental transfer happened hours earlier than the discharge of the Federal Open Markets Committee (FOMC) minutes from its July assembly. Buyers anticipate some insights on whether or not the Federal Reserve will proceed elevating rates of interest.

The detrimental newsflow accelerated on Aug. 16 after a federal court docket in the US approved the U.S. Inside Income Service (IRS) to pressure cryptocurrency dealer SFOX to disclose the transactions and identities of shoppers who’re U.S. taxpayers. The identical technique was used to acquire info from Circle, Coinbase and Kraken between 2018 and 2021.

This motion explains why betting on Bitcoin worth above $25,000 on Aug. 19 appeared like a positive factor a few days in the past, and this is able to have incentivized bullish bets.

Bears did not anticipate BTC to maneuver above $24,000

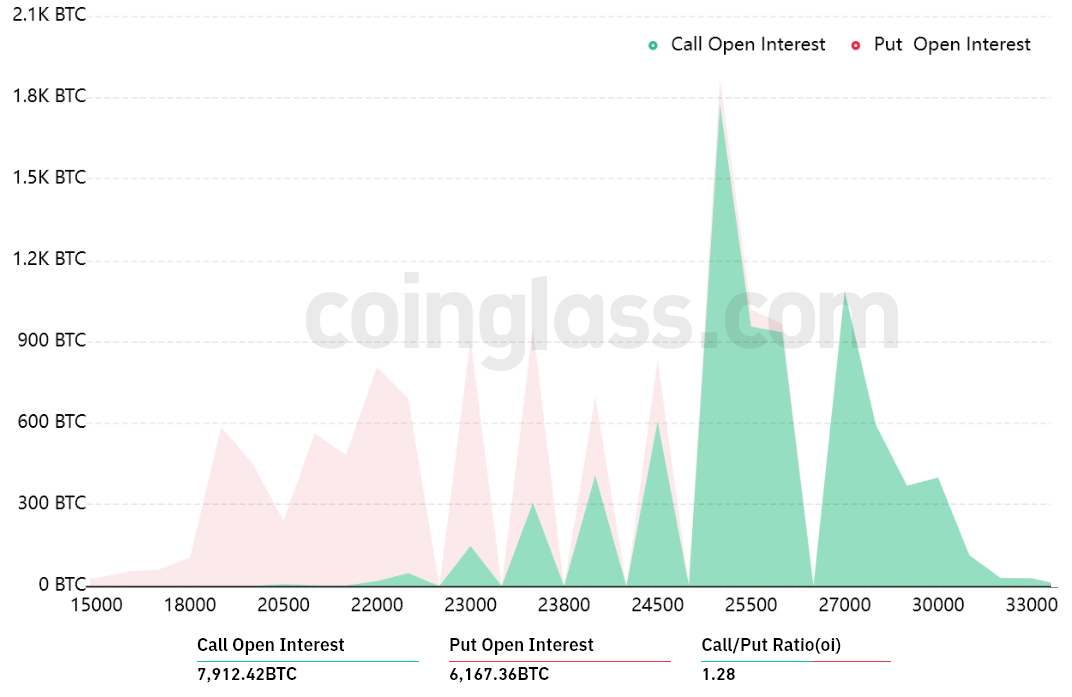

The open curiosity for the Aug. 19 choices expiry is $335 million, however the precise determine will probably be decrease since bears have been overly-optimistic. These merchants may need been fooled by the short-lived dump to $22,700 on Aug. 10 as a result of their bets for Aug’s choices expiry lengthen all the way down to $15,000.

The 1.29 call-to-put ratio reveals the distinction between the $188 million name (purchase) open curiosity and the $147 million put (promote) choices. Presently, Bitcoin stands close to $23,300, that means most bullish bets are prone to grow to be nugatory.

If Bitcoin’s worth strikes beneath $23,000 at 8:00 am UTC on Aug. 19, solely $1 million price of those name (purchase) choices will probably be accessible. This distinction occurs as a result of a proper to purchase Bitcoin at $23,000 is ineffective if BTC trades beneath that degree on expiry.

There’s nonetheless hope for bulls, however $25,000 appears distant

Beneath are the three almost definitely eventualities based mostly on the present worth motion. The variety of choices contracts accessible on Aug. 19 for name (bull) and put (bear) devices varies, relying on the expiry worth. The imbalance favoring both sides constitutes the theoretical revenue:

- Between $21,000 and $23,000: 30 calls vs. 2,770 places. The web outcome favors the put (bear) devices by $60 million.

- Between $23,000 and $25,000: 940 calls vs. 1,360 places. The web result’s balanced between bulls and bears.

- Between $25,000 and $26,000: 3,330 calls vs. 100 places. The web outcome favors the decision (bull) devices by $80 million.

This crude estimate considers the put choices utilized in bearish bets and the decision choices solely in neutral-to-bullish trades. Even so, this oversimplification disregards extra advanced funding methods.

For instance, a dealer might have bought a put possibility, successfully gaining constructive publicity to Bitcoin above a particular worth, however sadly, there is not any straightforward option to estimate this impact.

Associated: Former Goldman Sachs banker explains why Wall Street gets Bitcoin wrong

Bears will try to pin Bitcoin below $23,000

Bitcoin bulls need to push the price above $25,000 on Aug. 19 to profit $80 million. On the other hand, the bears’ best case scenario requires pressure below $23,000 to maximize their gains.

Bitcoin bulls just had $144 million in leveraged futures long positions liquidated on Aug. 16, so they need to have much less margin to drive the value increased. With this mentioned, bears have the higher hand to suppress BTC beneath $23,000 forward of the Aug. 19 choices expiry.

The views and opinions expressed listed here are solely these of the author and don’t essentially replicate the views of Cointelegraph. Each funding and buying and selling transfer includes danger. It’s best to conduct your individual analysis when making a choice.