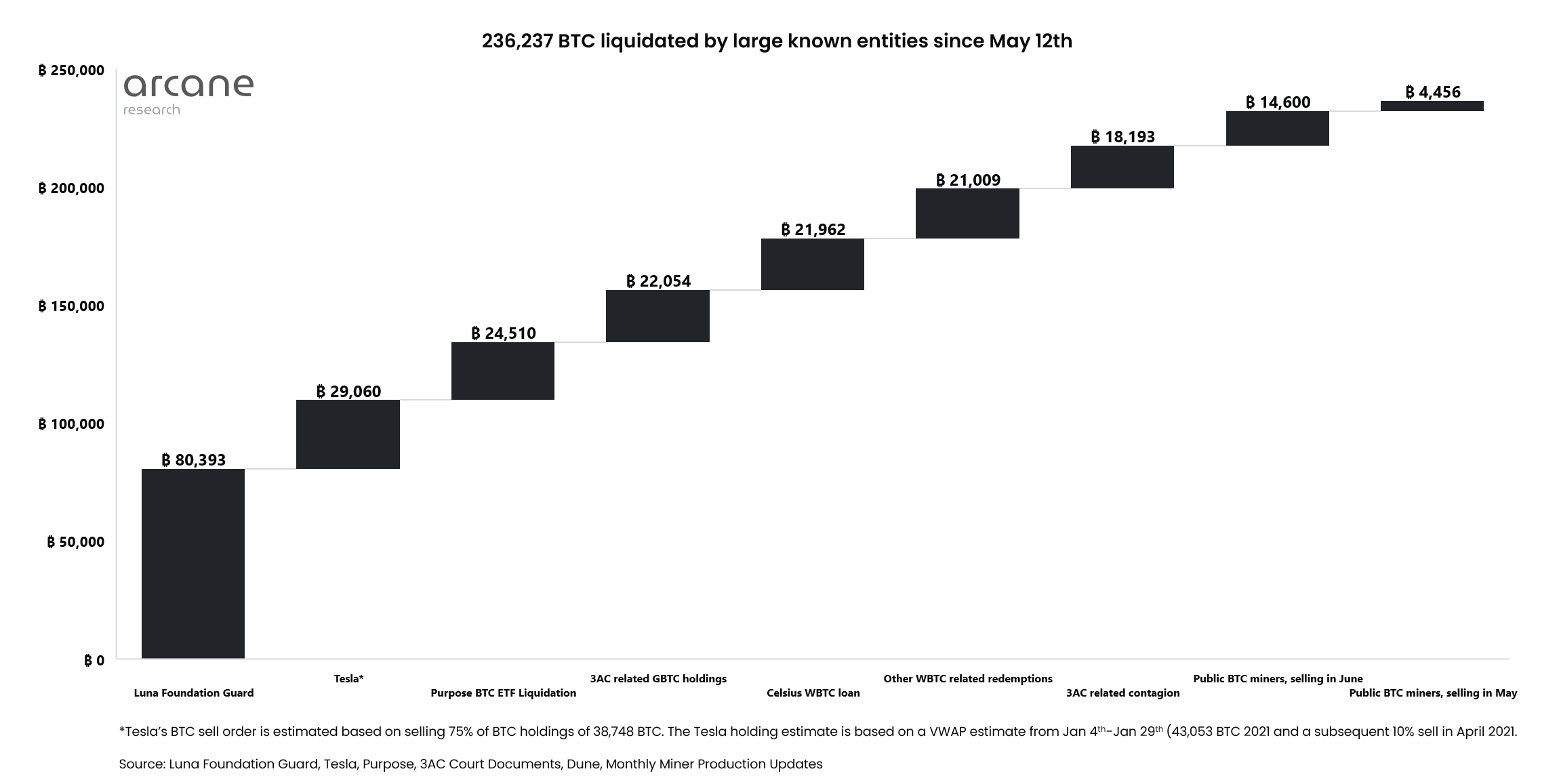

Since Might 10, as a lot as 236,237 Bitcoin (BTC), price $5.452 billion on the time of writing, has been offered by “massive establishments” — largely on account of pressured promoting.

A Twitter thread from Arcane Analysis analyst Vetle Lunde details how and when many institutional Bitcoin holders started promoting their stacks. Lunde acknowledged that “it began with Do Kwon.”

The Luna Basis Guard (LFG), which managed funds for the Terra venture, dumped 80,081 BTC in a failed effort to guard the peg of its native TerraUSD Traditional (USTC) stablecoin in Might.

Terra’s collapse seems to have put strain on some Bitcoin miners to promote. Lunde estimates that miners offered 19,056 cash between Might and June. In some instances, miners have been promoting greater than their month-to-month manufacturing, seemingly drawing from reserves.

Lunde famous that as miner promoting peaked, Elon Musk’s Tesla additionally hit the purple button and offered 29,060 BTC by the tip of Q2. On the similar time, the Three Arrows Capital (3AC) crypto funding agency was over-leveraged and owed lenders 18,193 BTC and different cash equal to 22,054 BTC.

Lunde additionally added {that a} large 24,510 BTC redemption passed off on the Canadian Objective Bitcoin exchange-traded fund (ETF) in late June, “creating additional hearth sale strain out there.” That redemption accounted for 51% of that ETF’s holdings.

BTC market progress

Regardless of the crypto markets seeing great promote strain from establishments in current months, the Bitcoin market stays remarkably resilient.

Buying and selling volumes have additionally remained larger by the 2022 market downturn in comparison with the height of the 2017 bull market. On December 17, 2017, Bitcoin’s each day buying and selling quantity reached a cycle peak of $12 billion, whereas each day quantity in July 2022 has been above $20 billion, according to CoinGecko.

CEO of Singapore-based market maker Presto Labs Yongjin Kim agreed with Lunde that liquidations from 3AC and others precipitated the numerous worth drop in June however believes the BTC worth will return to $30,000 throughout the subsequent few months.

He informed Cointelegraph on Thursday that “these liquidations pushed Bitcoin worth beneath the basic equilibrium worth,” main him to imagine that costs will return “to $30,000 within the subsequent few months.”

Associated: BTC worth battles 200-week shifting common after $930M Tesla Bitcoin sale

Kim added that it’ll take time for retail traders to regain their confidence in crypto after what they endured over the previous few months and that institutional investments will rise once more:

“I believe the retail sentiment is totally damaged, so it’s going to take a while earlier than we restore confidence out there. However there can be some reversal by the tip of this yr counteracting the liquidations.”

Lunde concluded his thread by stating:

“I are likely to lean in favor of pressured promoting and contagion-related uncertainty being achieved for now. We’ll seemingly hunch, pump, and dump in uneven circumstances within the coming interval.”