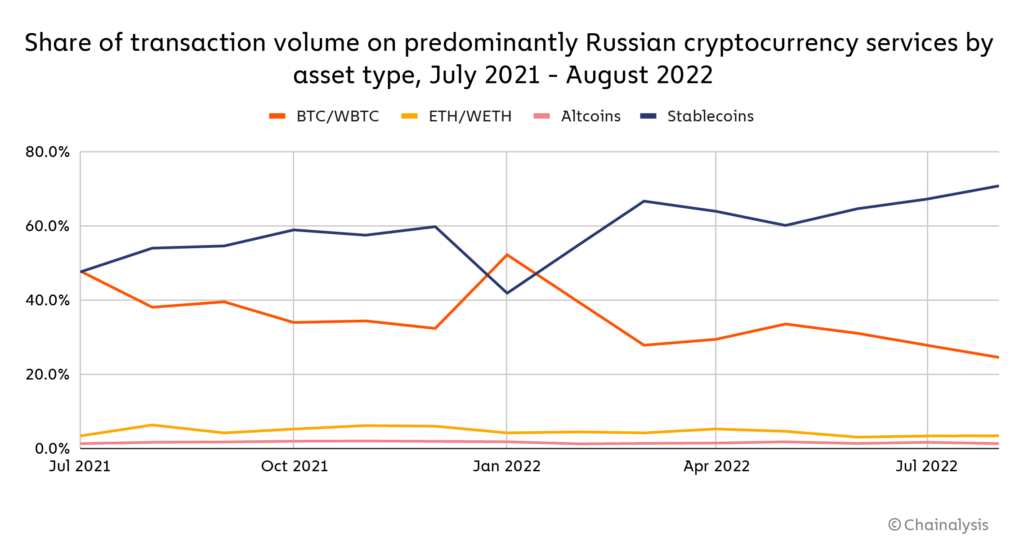

A brand new report from blockchain analytics agency Chainalysis has proven a surge in stablecoin utilization in Russia following the Russian invasion of Ukraine, which has since seen sanctions and inflation impacting the nation.

Released on Oct. 12, the report revealed that the share of stablecoin’s transaction quantity on primarily Russian providers elevated from 42% in January to 67% in March following the invasion and has continued to extend since.

An nameless professional on regional cash laundering chatting with Chainalysis urged that Russia’s removing from the cross-border system SWIFT is more likely to see crypto being utilized for cross-border transactions, with stablecoins more likely to be the popular medium of trade because of their value stability.

The report additionally means that a number of the surge in stablecoin utilization is probably going because of extraordinary Russian residents buying and selling the Ruble for stablecoins with a view to defend the worth of their property, amid excessive ranges of inflation for the reason that warfare started.

“Whereas a few of which may be because of companies embracing cryptocurrency for worldwide transactions, it’s additionally probably that a number of the enhance is because of extraordinary Russian residents buying and selling for stablecoins with a view to defend their property’ worth, as we mentioned beforehand,” the report famous.

Associated: Dapper Labs suspends Russian accounts after new EU sanctions

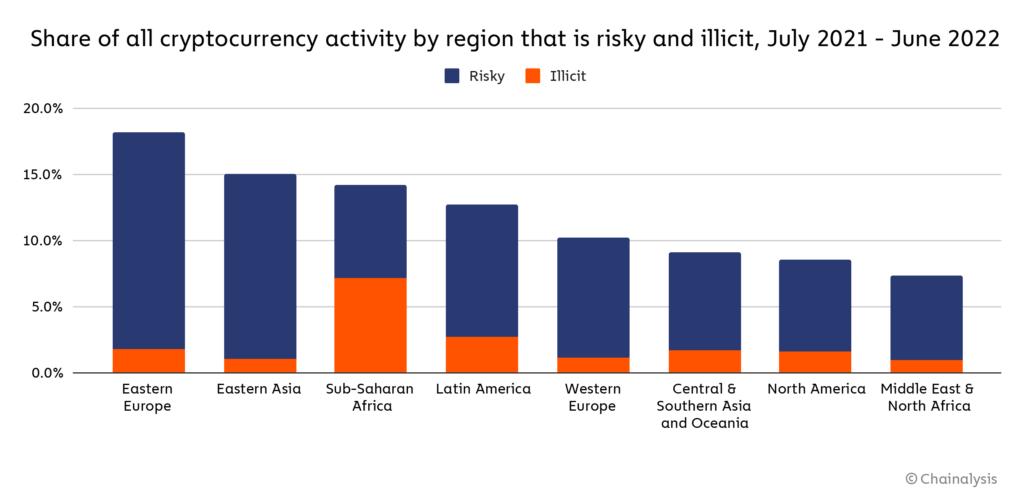

In the meantime, Chainalysis additionally famous in its discovering that Japanese Europe had the best share of dangerous crypto exercise in comparison with every other area worldwide over the past yr.

18.2% of cryptocurrency exercise within the area is both “dangerous” or “illicit,” with Japanese Asia the following highest at 15% and Sub-Saharan Africa coming in third, although the latter had by far the most important share of illicit exercise involving cryptocurrency.

The agency outlined dangerous exercise as any transaction that includes an handle related to a dangerous entity, resembling exchanges with low or no Know-Your-Buyer (KYC) necessities. In the meantime, illicit exercise is outlined as transactions related to a identified prison entity.

Latest developments referring to crypto may additional enhance this quantity. The European Union just lately banned crypto funds from Russians to European pockets suppliers, which may drive extra cryptocurrency customers to make use of lesser-known exchanges with no KYC necessities with a view to get across the sanctions.

The report famous that crypto getting used to work round sanctions means there must be extra dialogue on enhancing the effectiveness of sanctions but additionally highlighted the constructive position crypto has had in facilitating donations to the Ukrainian trigger, inserting the present determine at over $65 million.

In prior analysis, Chainalysis famous that the prevalence of Russian cybercriminals was driving vital ransomware and cryptocurrency-based cash laundering exercise, noting:

“Specifically, we’ve traditionally seen an outsized quantity of ransomware and crypto-based cash laundering in Japanese Europe, with the latter supported by a big ecosystem of dangerous cryptocurrency companies.”