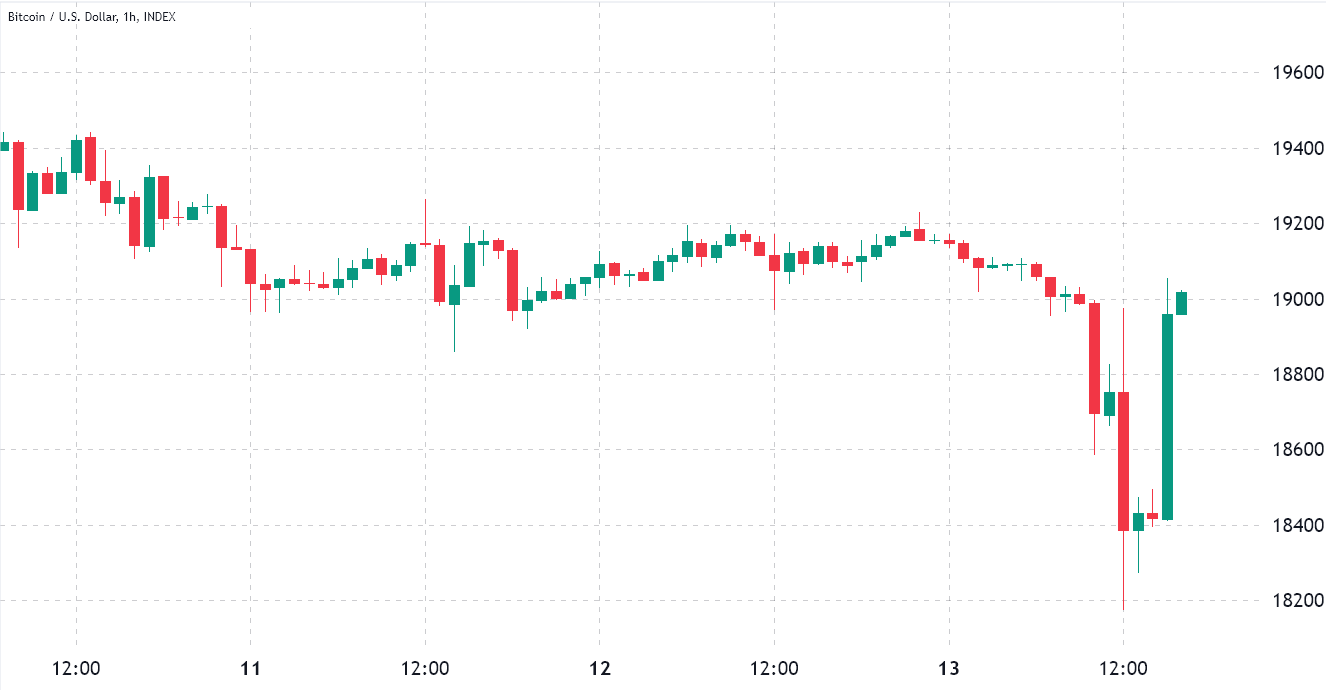

Cryptocurrency merchants had been caught without warning after the Oct. 13 Client Worth Index Report confirmed inflation in the US rising by 0.6% in September versus the earlier month. The marginally higher-than-expected quantity precipitated Bitcoin (BTC) to face a 4.4% worth correction from $19,000 to $18,175 in lower than three hours.

The abrupt motion precipitated $55 million in Bitcoin futures liquidations at derivatives exchanges, the biggest quantity in three weeks. The $18,200 degree was the bottom since Sept. 21 and marks an 8.3% weekly correction.

It’s price highlighting that the dip beneath $18,600 on Sept. 21 lasted lower than 5 hours. Bears had been doubtless dissatisfied as a 6.3% rally happened on Sept. 22, inflicting Bitcoin to check the $19,500 resistance. An identical development is going on on Oct. 13 as BTC presently trades close to $19,000.

The inventory market additionally reacted negatively because the tech-heavy Nasdaq Composite Index moved down 3% after the inflation information was launched. After the preliminary panic promoting, Nasdaq adjusted to a 2% day by day loss as analysts reaffirmed their expectations towards a 0.75% rate of interest improve by the U.S. Federal Reserve Committee in November.

Buyers turned much more bearish after BlackRock Inc (BLK) reported a 16% drop in revenue versus the earlier yr. In the meantime, monetary heavyweights JPMorgan Chase (JPM) and Morgan Stanley (MS) are set to report on Oct. .

Opposite to U.S. President Joe Biden’s attraction, Saudi Arabia’s Ministry of International Affairs put out a uncommon assertion on Oct. 13 defending the Group of the Petroleum Exporting International locations’ manufacturing reduce. The White Home wished to delay the choice till after the midterms. However, the oil producer group determined to lower the availability goal by 2 million barrels per day starting in November.

All of those developments are growing buyers’ bearish feelings. ao get a greater gauge on what is going on within the crypto sector, merchants ought to take a look at derivatives information to see if buyers had been taken without warning after the 4.4% dip under $18,200.

Futures markets had been bearish for the previous month

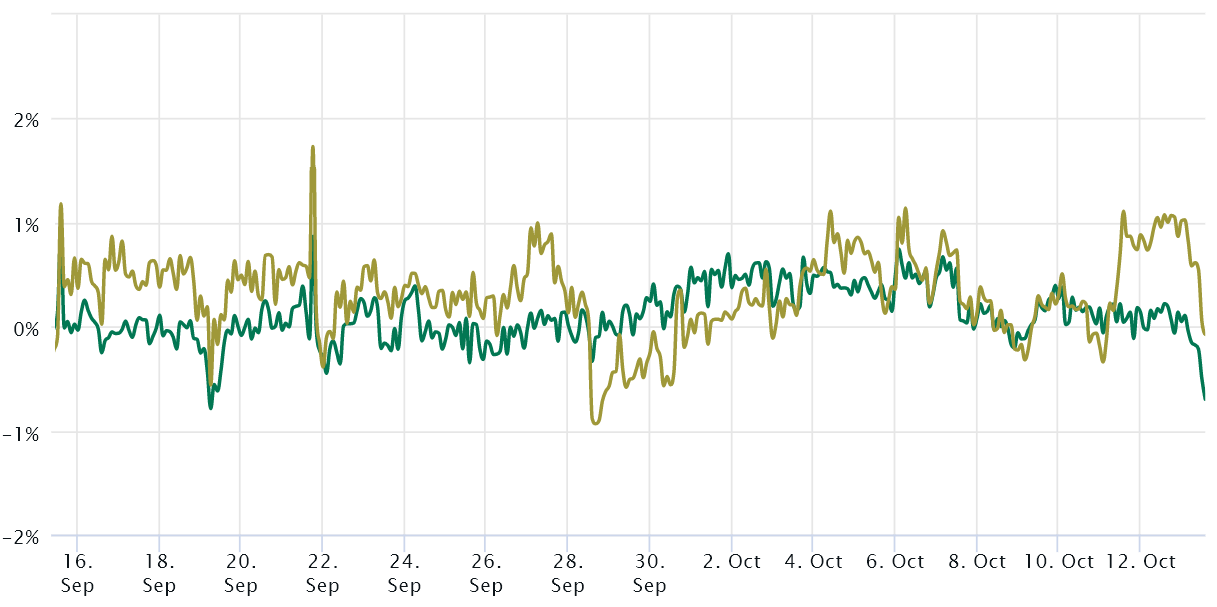

Retail merchants normally keep away from quarterly futures on account of their worth distinction from spot markets. They’re, nonetheless, skilled merchants’ most popular devices as a result of they forestall the fluctuation of funding charges that always happens in a perpetual futures contract.

The indicator ought to commerce at a 4% to eight% annualized premium in wholesome markets to cowl prices and related dangers. Derivatives merchants had been impartial to bearish for the previous month as a result of the Bitcoin futures premium remained under 1% the complete time.

This information displays skilled merchants’ unwillingness so as to add leveraged lengthy (bull) positions regardless of the low value. Nevertheless, one should additionally analyze the Bitcoin choices markets to exclude externalities particular to the futures instrument.

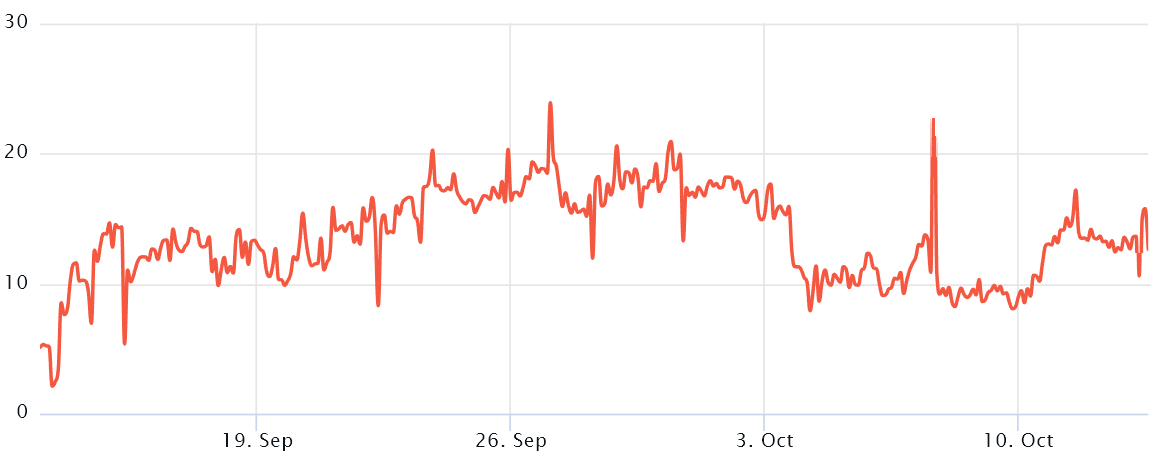

Choice merchants are unwilling to supply draw back safety

The 25% delta skew is a telling signal when market makers and arbitrage desks are overcharging for upside or draw back safety. For instance, in bear markets, choices buyers give larger odds for a worth dump, inflicting the skew indicator to rise above 12%. Then again, bullish markets are likely to drive the skew indicator under destructive 12%, which means the bearish put choices are discounted.

The 30-day delta skew had been above the 12% threshold since Oct. 10, signaling that choices merchants had been much less inclined to supply draw back safety. These two derivatives metrics counsel that the Bitcoin worth dump on Oct. 13 may need been partially anticipated, which explains the comparatively low affect on liquidations.

Extra importantly, the prevailing bearish sentiment remained after the CPI inflation was introduced. Consequently, whales and markers are much less inclined so as to add leverage longs or provide draw back safety. Contemplating the weak macroeconomic situations and international political rigidity, the percentages presently favor the bears.

The views and opinions expressed listed here are solely these of the creator and don’t essentially mirror the views of Cointelegraph.com. Each funding and buying and selling transfer includes danger, it’s best to conduct your individual analysis when making a call.