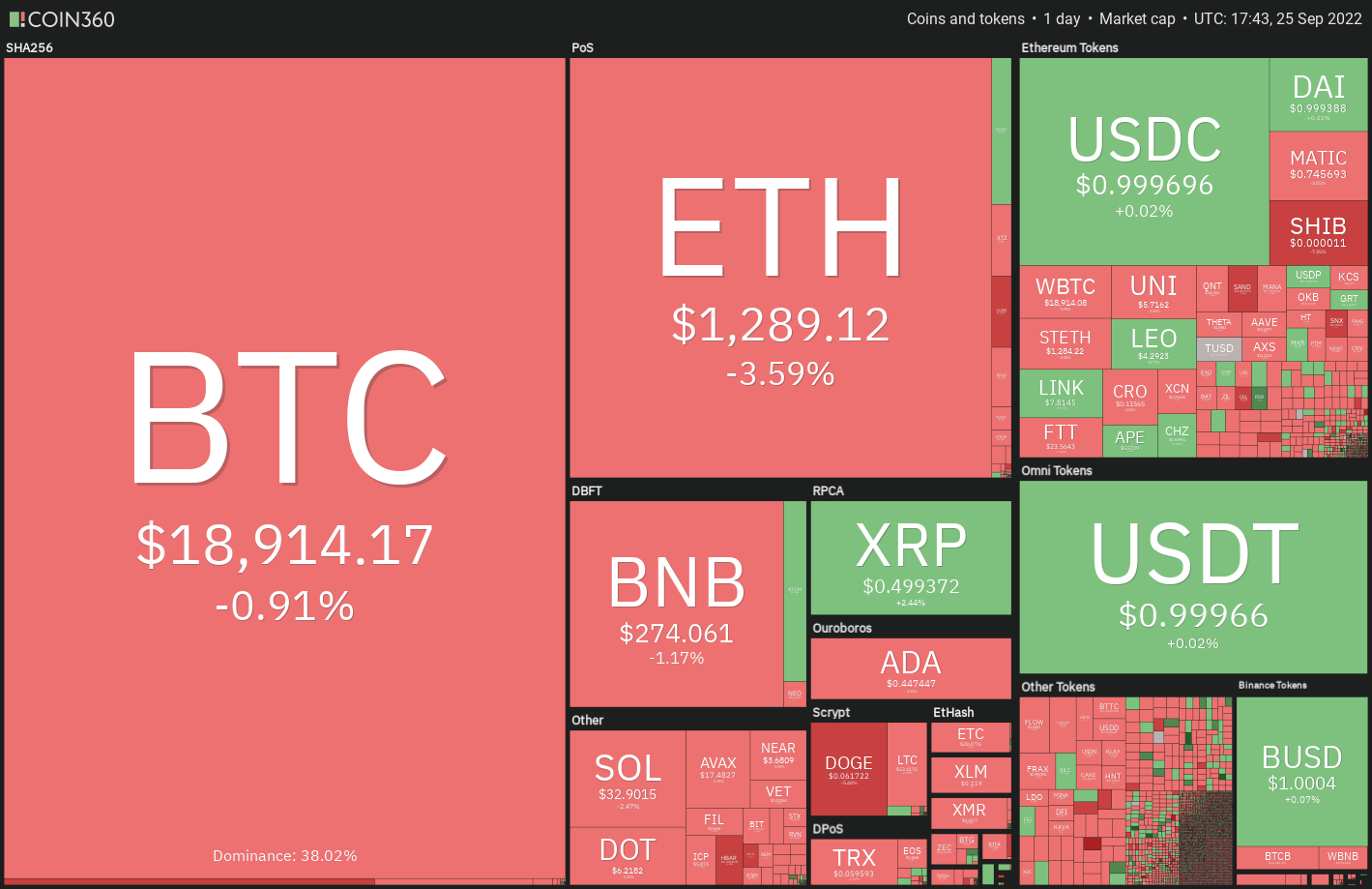

The most important United States inventory market indexes continued their decline final week as worsening macroeconomic circumstances elevated issues of a worldwide recession. The Dow Jones Industrial Common closed at its lowest stage in 2022, and main indexes recorded their fifth weekly shut previously six weeks.

Though Bitcoin (BTC) has solely declined marginally this week, it dangers closing on the lowest stage since 2020. Whereas a brand new multi-year weekly shut is a unfavourable signal, sellers must maintain the decrease ranges or else it might grow to be a bear entice. The worth motion of the following few days is more likely to witness heightened volatility as each the bulls and the bears battle it out for supremacy.

A number of traders miss alternatives to purchase throughout sharp corrections as a result of they attempt to catch the underside. Merchants ought to relatively give attention to the initiatives they like and accumulate the cash in a phased method lasting just a few weeks or months. All cash don’t backside on the similar time, therefore it’s higher to give attention to particular person cryptocurrencies that present power.

Whereas Bitcoin is nearing its yearly lows, sure altcoins are holding up properly. Let’s have a look at the charts of 5 cryptocurrencies that look fascinating within the close to time period.

BTC/USDT

The Bitcoin bulls have efficiently defended the $18,626 to $17,622 help zone previously few days however they proceed to face robust promoting on the 20-day exponential transferring common (EMA) of $19,720. This means that the bears proceed to promote on minor rallies.

The downsloping transferring averages point out that the bears have the higher hand however the optimistic divergence on the relative power index (RSI) means that the bearish momentum may very well be weakening.

A break and shut above the 20-day EMA would be the first signal that the bears could also be shedding their grip. The BTC/Tether (USDT) pair may then rise to the 50-day easy transferring common (SMA) of $21,043 and later to $22,799. Patrons must overcome this barrier to set the stage for a rally to $25,211.

Conversely, if the bears sink the worth beneath the June low of $17,622, the promoting may intensify, and the pair might resume its downtrend. The pair may then plummet to $14,500.

The bulls are shopping for the dip beneath $18,626 however the bears proceed to stall the restoration on the 50-SMA. This has squeezed the worth between these two ranges, however this tight vary buying and selling is unlikely to proceed for lengthy.

If the worth turns down and sustains beneath $18,626, the bears might pull the pair to the important help at $17,622. This stage might once more witness a powerful battle between the bulls and the bears. On the upside, if the bulls thrust the worth above the 50-SMA, the pair may rise to $20,400.

ATOM/USDT

Cosmos (ATOM) has been buying and selling above the breakout stage of $13.46 for the previous a number of days, indicating that the sentiment stays optimistic and merchants are shopping for on dips.

The 20-day EMA of $14.22 has flattened out and the RSI is close to the midpoint, indicating a steadiness between provide and demand. If the worth breaks above $15.26, the short-term benefit may tilt in favor of the patrons. The ATOM/USDT pair may then rise to $17.20.

This stage might once more act as a resistance but when patrons thrust the worth above it, the pair may choose up momentum and rise to $20.34 and later to $25.

Opposite to this assumption, if the worth turns down and breaks beneath the 50-day SMA of $12.90, the benefit may tilt in favor of the bears. The pair may then decline to $10.

The pair has been caught between $13.45 and $17 for a while. Patrons aggressively defended the help at $13.45 and try to push the worth above the 50-SMA. In the event that they do this, the chance of a rally to $16 and thereafter to $17 will increase.

Conversely, if the worth turns down from the present stage and breaks beneath the 20-EMA, it’s going to recommend that bears proceed to promote on rallies. That might pull the worth to the robust help at $13.45. The sellers must sink the pair beneath $13 to clear the trail for a potential drop to $11.50.

ALGO/USDT

The uncertainty of the range-bound motion between $0.27 and $0.38 resolved to the upside on Sept. 23, indicating the beginning of a brand new up-move. If that occurs, Algorand (ALGO) may nonetheless be in its first leg of the uptrend.

The necessary stage to observe on the draw back is $0.38. If the bulls flip this stage into help, it may improve the chance of the beginning of a brand new uptrend. The ALGO/USDT pair may then rally to $0.45 and later to $0.50.

This bullish view may invalidate within the close to time period if the worth slips beneath $0.38 and re-enters the vary. That might sink the worth to the 20-day EMA of $0.33. If the worth rebounds off this stage, the bulls will once more attempt to clear the overhead resistance.

The worth rose above the overhead resistance at $0.38, however the bulls couldn’t construct upon this momentum. This reveals that the bears haven’t but given up and so they proceed to promote on rallies close to $0.41.

If thebears pull the worth beneath the 20-EMA, the pair may drop to $0.36. This is a vital stage for the bulls to defend as a result of a break beneath it may open the doorways for a potential drop to the 50-SMA.

On the upside, the bulls must push the worth above $0.41 to sign the resumption of the up-move.

Associated: What’s scalping in crypto, and the way does scalp buying and selling work?

CHZ/USDT

Chiliz (CHZ) recovered sharply from its June lows and the bulls cleared the overhead resistance at $0.26 on Sept. 22, signaling the resumption of the up-move. When a coin strikes towards the market sentiment, it warrants an in depth look.

The bears have been attempting to sink the worth beneath the breakout stage of $0.26 for the previous three days however the bulls have held their floor. This reveals that the bulls are viewing the dips as a shopping for alternative. The rising transferring averages and the RSI within the optimistic territory point out that patrons are in command.

If the worth turns up and breaks above $0.28, the CHZ/USDT pair may rally to the following stiff resistance at $0.33.

Conversely, if the worth turns down and breaks beneath $0.26, it’s going to recommend that merchants could also be speeding to the exit. The pair may first drop to the 20-day EMA of $0.23 and later to the 50-day SMA of $0.21.

Each transferring averages are sloping up indicating a bonus to patrons however the unfavourable divergence on the RSI reveals that the bullish momentum could also be weakening. If the bears sink the worth beneath $0.26, the pair may drop to the 50-SMA. It is a key stage for the bulls to defend as a result of if it offers approach, the pair may drop to $0.22.

Then again, if the worth rebounds off $0.26 and rises above $0.28, the up-move may resume. The pair may then rally to $0.32.

QNT/USDT

Quant (QNT) is exhibiting power as it’s buying and selling above each transferring averages. Even when the sentiment throughout the cryptocurrency sector has been unfavourable, it has managed to cost increased.

The bears had been defending the $112 stage for the previous many days however the bulls pierced by means of the resistance on Sept. 24 and pushed the worth to the downtrend line. The lengthy wick on the day’s candlestick reveals that the bears are attempting to stall the up-move at this stage.

A minor optimistic is that the bulls purchased the dip to $112 on Sept. 25, suggesting that patrons are attempting to flip this stage into help. The QNT/USDT pair may as soon as once more rise to the downtrend line. If this hurdle is cleared, the pair may soar to $133 and later to $154.

Alternatively, if the worth turns down and breaks beneath $112, the following cease may very well be the 20-day EMA of $106. A break beneath this help may pull the pair to $95.

The pair picked up momentum after breaking above $112 and reached close to the downtrend line. This pushed the RSI into the overbought territory, which can have tempted the short-term merchants to ebook income.

The worth rebounded off $112, indicating that the sentiment stays optimistic and merchants are shopping for on dips. The pair may rise to $121 and thereafter to the downtrend line. On the draw back, a break beneath $112 may sink the pair to the 50-SMA and thereafter to $95.

The views and opinions expressed listed below are solely these of the writer and don’t essentially replicate the views of Cointelegraph. Each funding and buying and selling transfer includes danger, it’s best to conduct your personal analysis when making a choice.